|

Value Flows from Abundance

Plentitude, not scarcity, governs the network economy. Duplication,

replication, and copies run in excess. Whatever can be made, can be made

in abundance. This plentitude:

- drives value

- works

to open up closed systems

- spins off immense numbers of opportunities

Consider the

first modern fax machine that rolled off the conveyor belt around 1965.

Despite millions of dollars spent on its R&D, it was worth nothing.

Zero. The second fax machine to be made immediately made the first one

worth something. There was someone to fax to. Because fax machines are

linked into a network, each additional fax machine that is shipped

increases the value of all the fax machines operating before it.

This is called the fax effect. The fax effect dictates that

plentitude generates value.

So strong is this power of

plentitude that anyone purchasing a fax machine becomes an evangelist

for the fax network. "Do you have a fax?" fax owners ask you.

"You should get one." Why? Because your purchase increases the

worth of their machine. And once you join the network, you’ll begin

to ask others, "Do you have a fax (or email, or Acrobat software,

etc.)?" Each additional account you can persuade to join the

network substantially increases the value of your account.

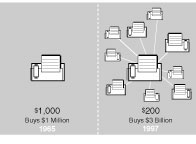

When you buy a fax machine, you are not merely buying a $200 box. Your

$200 purchases the entire network of all other fax machines in the world

and the connections among them—a value far greater than the cost of

all the separate machines. Indeed, the first fax machines cost several

thousands of dollars and connected to only a few other machines, and

thus were not worth much. Today $200 will buy you a fax network worth $3

billion.

|

The low price of a fax machine today buys you an entire network,

consisting of eighteen million machines. Each additional unit sold

increases the value of your machine. |

In the network economy, the more plentiful things become, the

more valuable they become.

This notion directly

contradicts two of the most fundamental axioms we inherited from the

industrial age.

First hoary axiom: Value comes from

scarcity. Take the icons of wealth in the industrial age—diamonds,

gold, oil, and college degrees. These were deemed precious because they

were scarce.

Second hoary axiom: When things are made

plentiful, they become devalued. For instance, carpets. They were once

rare handmade items found only in houses of the rich. They ceased to be

status symbols when they could be woven by the thousands on machines.

The traditional law was fulfilled: commonness reduces value.

The logic of the network flips this industrial lesson upside down.

In a network economy, value is derived from plentitude, just as a fax

machine’s value increases as fax machines become ubiquitous. Power

comes from abundance. Copies are cheap. Let them proliferate.

Ever since Gutenberg made the first commodity—cheaply

duplicated words—we have realized that intangible things can easily

be copied. This lowers the value per copy. What becomes valuable is the

relationships—sparked by the copies—that tangle up in the

network itself. The relationships rocket upward in value as the parts

increase in number even slightly.

Windows NT, fax machines,

TCP/IP, GIF images, RealAudio—all born deep in the network

economy—adhere to this logic. But so do metric wrenches, triple-A

batteries, and other devices that rely on universal standards. The more

common they are, the more it pays you to stick to that standard. We have

an even older example in the English language. Wherever the expense of

churning out another copy becomes trivial (and this is happening in

more than software), the value of standards and the network booms.

In the future, cotton shirts, bottles of vitamins, chain saws,

and the rest of the industrial objects in the world will also obey the

law of plentitude as the cost of producing an additional copy of them

falls steeply.

Proprietary, or "closed," systems

were once rare because industrial systems were relatively uncomplicated.

Proprietary systems rose in popularity as advancing technology made it

difficult to replicate a system without assistance or encroaching on

patents. The creators of a closed system made a nice living. When the

information economy was first launched several decades ago, the dream

was to own and operate a proprietary system—one that no one else

could copy—and then let the money roll in. To a degree that can

still be done, at least for short period, if the system is significantly

superior. Bloomberg terminals in Wall Street traders’ offices is

one current example. But the network economy rewards the plentitude of

open systems more than the scarcity of closed systems. It is a bit of a

cliche now to blame Apple’s misfortunes on its insistence that its

operating systems be treated as a scarce resource but it’s true.

Apple had more than one opportunity to license its particularly

wonderful interface—the now familiar desktop and windows

design—but backed off each time, thereby guaranteeing its eventual

eclipse by the relatively more open DOS and Windows systems.

There is a place for isolation in the infancy of systems, but

openness is needed for growth because it taps into a larger wealth.

Citibank pioneered the use of 24-hour instant cash at ATMs in the 1970s.

They blanketed New York City with their proprietary machines, and at

first this strategy was highly successful. Smaller competing banks

started their own tiny and proprietary ATM networks, but they

couldn’t compete against the high penetration of Citibank machines.

Then, led by Chemical Bank, these smaller banks banded together to form

an open ATM network called Plus. The power of n2 kicked in.

Suddenly any ATM was your ATM. Citibank was invited to join the open

Plus network but declined. Following the principle of increasing

returns, the handy Plus system attracted more and more customers, and

soon overwhelmed the once dominant Citibank. Eventually the open factor

forced Citibank to forgo their proprietary ways and join.

Every time a closed system opens, it begins to interact more

directly with other existing systems, and therefore acquires all the

value of those systems.

In the mid 1980s I was

associated with a pioneering online community called the Well. You

dialed the Well’s special modem, and once logged on you could chat,

post, and email anyone you wanted—within the Well. All 2,000

members. Within a short time after start-up the Well made a big jump and

opened its mail service to the then-obscure internet. The value of the

Well suddenly skyrocketed in the view of its 2,000 or so members because

now they could email thousands of academic professors or corporate

nerds. A few years later, the Well further opened up its system to a

capability called ftp, which allowed Well users to grab files on other

internet servers and allowed others to grab files on the Well server.

Again, the value of the Well exploded; with only a small effort it

gained the tremendous value of the entire ftp network. Eventually the

Well opened up even further, allowing users to join the conversation via

the web, thereby acquiring all the value of the web.

There

was a cost in each step. With every inclusion there was less control of

the environment, more noise, more danger of disruption by accident or

hacker, and more worry that the business model would collapse. At the

same time it was obvious that a totally closed Well would have died.

The idea of plentitude is to create something that has as many

systems and standards flowing through it as possible. The more networks

a thing touches, the more valuable it becomes.

The value

of an invention, company, or technology increases exponentially as the

number of systems it participates with increases linearly.

The law of plentitude is not about dominance. The self-interest of

ordinary business guarantees that every company in the world will strive

to get its product or service into every home, or into every store.

Popularity is an ancient goal. But that is not what network plentitude

strives for.

The abundance upon which the network economy

is built is one of opportunity.

While it is true that

every additional email address in the world increases the value of all

previous email addresses (that’s the primary effect of plentitude)

the increase in value happens because each email address is a node of

opportunity, not just an artifact. An email address is more than a way

to exchange memos. Because email is rooted in a network, opportunity

runs in several directions at once. For instance, once it was realized

that mail addresses could be archived easily (opportunity number one),

it occurred to someone that they could be collected automatically

(opportunity two). They could also be mailed to in bulk (opportunity

three). The domain part of the address could be analyzed and used to

detect patterns of usage (opportunity four). Addresses in a Rolodex

could be updated automatically by the addressee (opportunity five). The

address artifact itself could contain more than just a name; it could

also hold other facets of interests that the owner was willing to

exchange in certain circumstances (opportunity six).

|

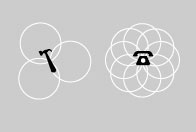

A hammer is part of only a few networks, but a telephone is a

part of many. The more networks a product or service can join, the more

powerful it becomes. | Contrast this cascading

abundance of opportunities with almost any product of the industrial

age—say an electric rotary saw, or a color-fast dye, or a maplewood

chair. While some of these objects have a few dual uses (the chair could

be used as a step stool or to wedge a door open, and the saw motor could

be used to drive a drill), they are pretty much limited to their

designed intentions. There is no river of opportunities flowing from

them. So that even if chairs, dye, and saws were to become universally

abundant, their physical plentitude would not change the world much.

The power of the fax effect—more fax machines increasing

the value of all previous machines—does not rely on the

proliferation of Panasonic brand fax machines, or of any particular

machine. Since many faxes are sent from laptop computers, or from a

server somewhere, the power of plenty derives from opportunities rather

than lumps of matter.

As opportunities proliferate,

unintended uses take off. In the late 1970s, the Shah of Iran exiled his

rival, the Ayatollah Khomeini, to Paris. Since the Shah controlled his

country’s media he assumed Khomeini would not be able to reach the

Iranian people from France to stir up trouble. But sympathetic Iranian

clergy exploited an unsuspected technological opportunity: the cassette

tape. Every week in Paris Khomeini’s friends recorded his

inflammatory speeches on cheap recorders and smuggled copies (easily

disguised as music tapes) into Iran, to be multiplied on $200

duplication machines and passed out to every mosque. On Fridays,

Khomeini’s sermons were played throughout Iran on boomboxes. The

clerics turned the common tape deck into a broadcast network. I’m

sure that not a single engineer who developed cassette tape technology

ever envisioned it being used for broadcasting. Electronic media,

because it is animated by electrons, is highly susceptible to being

subverted by new uses.

Recently Sprint, the

telecommunications company, pioneered flat cellular phone

pricing—you could make all the cell phone calls you want for a

fixed monthly fee. Within days of the pricing, the startled marketing

experts at Sprint heard reports that people were using the cell phones

as baby monitors. Parents would go into baby’s bedroom with a cell

phone, dial the kitchen, and then leave the line open. Voilà!

The more interconnected a technology is, the more

opportunities it spawns for both use and misuse.

Some of

the best video games of all time were elegant little programs that ran

on early computers such as the Commodore 64. Millions of C-64s were

sold during the early 1980s; most of them lie at the bottom of landfills

today. Their flealike memories and lack of disk space have been replaced

by Powerbooks and Pentiums. The few still working are sold at

collector’s prices. But out on the web, filling niches no one could

have predicted, are a flock of emulators. You can download a Commodore

64 emulator onto your Powerbook. At the click of a button it will turn

your state-of-the-art workstation into a moronic C-64 (or one of 25

other golden oldies) so you can play an ancient version of Moondust, or

PacMan. This is equivalent to having a switch on the dashboard of your

Ferrari to make it run like a VW Bug.

These refreshing

street uses for technology stem from the plentitude of interactions.

Artifacts of the industrial economy yield limited potential for such

weird, tangential uses. The network economy, on the other hand, is a

cornucopia of products and innovations that cry out to be subverted in

new ways. Indeed, in a network, new opportunities arise primarily when

existing opportunities are seized. A business that successfully occupies

a niche immediately creates at least two new niches for other

businesses. There is, for example, no end to the number of companies

that will find a niche in email; the more wild ideas that are created,

the more wild ideas can be created. The arms race between spammers and

readers is only in its infancy.

The law of plentitude is

most accurately rendered thus: In a network, the more opportunities

that are taken, the faster new opportunities arise.

Furthermore, the number of new opportunities increases exponentially

as existing opportunities are seized. Networks spew fecundity because

by connecting everything to everything, they increase the number of

potential relationships, and out of relationships come products,

services, and intangibles.

A standalone object, no matter

how well designed, has limited potential for new weirdness. A connected

object, one that is a node in a network that interacts in some way with

other nodes, can give birth to a hundred unique relationships that it

never could do while unconnected. Out of this tangle of possible links

come myriad new niches for innovations and interactions.

A network is a possibility factory.

So tremendous

is the fount of plentitude in the network economy that having to deal

with nearly infinite choices and mushrooming possibilities may be the

limiting factor in the future. Navigating sanely through an expanding

ocean of options is already difficult. The typical supermarket in

America offers 30,000 to 40,000 products. The average shopper will zoom

through the store in 21 minutes, and select out of those 40,000 choices

about 18 items. This is an amazing feat of decision making. But it is

nothing compared to what happens on the web. There are one million

indexed web sites, containing 250 million pages. To be able to find the

right page out of that universe is astounding, and the number of pages

doubles every year. Dealing with this plentitude is critical because the

totals of everything we manufacture in the world are only compounding.

The total amount of information stored in the entire

world—that’s counting all the libraries, film vaults, and data

archives—is estimated to be about 2,000 petabytes. (A petabyte is a

billion megabytes, or about a quadrillion books the size of this one.)

That’s a lot of bits.

Plentitude will soon reach the

level of zillionics. We know from mathematics that systems containing

very, very large numbers of parts behave significantly different from

systems with fewer than a million parts. Zillionics is the state of

supreme abundance, of parts in the many millions. The network economy

promises zillions of parts, zillions of artifacts, zillions of

documents, zillions of bots, zillions of network nodes, zillions of

connections, and zillions of combinations. Zillionics is a realm much

more at home in biology—where there have been zillions of genes and

organisms for a long time—than in our recent manufactured world.

Living systems know how to handle zillionics. Our own methods of dealing

with zillionic plentitude will mimic biology.

The network

economy runs with plentitude. It vastly expands the numbers of things,

increases the numbers of intangibles with ease, multiplies the numbers

of connections exponentially, and creates new opportunities without

number.

Strategies Touch as many nets as you

can. Because the value of an action in the network economy

multiplies exponentially by the number of networks that action flows

through, you want to touch as many other networks as you can reach. This

is plentitude. You want to maximize the number of relations flowing to

and from you, or your service or product. Imagine your creation as being

born inert, like a door nail off a factory conveyor belt. The job in the

network economy is to link the nail to as many other systems as

possible. You want to adapt it to the contractor system by making it a

standard contractor size so that it fits into standard air-powered

hammers. You want to give it a SKU designation so it can be handled by

the retail sales network. It may want a bar code so it can be read by a

laser-read checkout system. Eventually, you want it to incorporate a

little bit of interacting silicon, so it can warn the door of breakage,

and take part in the smart house network. For every additional system

the nail is a part of, it gains in value. Best of all, the systems and

all their members also gain in value from every nail that joins.

And that’s just for a stick of iron. More complex objects

and services are capable of permeating far more systems and networks,

thus greatly boosting their own value and the plentiful value of all the

systems they touch.

Maximize the opportunities of others.

In every aspect of your business (and personal life) try to allow

others to build their success around your own success. If you run a

hotel, what can you do to permit others—airlines, luggage

retailers, tour guides—to be part of your network? Rather than

viewing their dependency on your success as a form of parasitism, or

worse, as a rip-off, understand this tight coupling as sustenance. You

want to entice others to create services centered around the customer

attention you have won, or to supply add-ons to your product, or even,

if it is a new-fangled idea, to create legal imitations. This is a

counter-intuitive stance at first, but it plays right into the logic of

the net. A small piece of an expanding pie is the biggest piece of all.

Software is especially primed to work this way. The programmers who

created the hit game Doom deliberately made it easy to modify.

The results: Hundreds of other gamers issued versions of Doom

that were vastly better than the original, but that ran on the

Doom system. Doom boomed and so did some of the

derivatives. The software economy is full of such examples. Third-party

templates for spreadsheets, word processors, and browsers make profits

for both the third-party vendor and the host system. It takes only a bit

of imagination to see how the leveraging of opportunities also works in

domains outside of software. When confronted with a fork in the road, if

all things are equal, go down the path that makes the opportunities of

others plentiful.

Don’t pamper commodities; let them

flow. The cost of replicating anything will continue to go down. As

it does, the primary cost will be developing the first copy, and then

getting attention to it. No longer will it be necessary to coddle most

products. Instead they should be liberated to flow everywhere.

Let’s take pharmaceuticals, especially genetically bio-engineered

pharmaceuticals. The cost of little pills in the drug store can be

hundreds of times greater than what they cost to produce in quantity,

yet many drugs are priced expensively in order to recoup their

astronomical development costs. Pharmaceutical companies treat and

price their drugs as scarcities. One can expect, however, that in the

future, as drug design becomes more networked, more data-driven, more

computer mediated, and as drugs themselves become smarter, more

adaptive, more animated, the competitive advantage will go to those

companies that let "copies" of the drug flow in plentitude.

For example, a highly evolved bioengineered headache relief drug may be

sold for a few dollars on a "take as much as you need" basis.

The company makes its profits when you pay it handsomely for tailoring

that drug specifically for your DNA and your body. Once designed, you

pay almost nothing for additional refills. Indeed there are already a

few start-up biotech companies headed this way. The field is called

parmacogenomics. They are heeding the call of plentitude.

Avoid proprietary systems. Sooner or later closed systems have

to open up, or die. If an online service requires dialing a special

phone number to reach it, it’s moribund. If it needs a special

gizmo to read it, it’s kaput. If it can’t share what it knows

with competing goods, it’s a loser. Closed systems close off

opportunities for others, making leverage points scarce. This is why the

network economy—which is biased toward plenty—routes around

closed systems. One could safely bet that America Online, WebTV, and

Microsoft Network (MSN)—three somewhat closed systems—will

eventually go entirely onto the open web, or disappear. The key issue in

closed-versus-open isn’t private versus public, or who owns a

system; often private ownership can encourage innovation. The issue is

whether it is easy or difficult for others to invent something that

plays off your invention. The strategic question is simple: How easy is

it for someone outside of the host company to contribute an advance to

their system or product or service? Are the opportunities for

participating in your own network scarce or plentiful?

Don’t seek refuge in scarcity. Every era is marked by the

wealth of those who figure out what the new scarcity is. There will

certainly be scarcities in the network economy. But far greater wealth

will be made by exploiting the plentitude. To make sure you are not

seeking refuge in scarcity, ask yourself this question: Will your

creation thrive if it becomes ubiquitous? If its value depends on only a

few using it, you should reconsider it in light of the new rules.

continue...

|