|

Why the Net Rewards Generosity

The very best gets cheaper each year. This principle is so

ingrained in our lifestyle that we bank on it without marveling at it.

But marvel we should, because this paradox is a major engine of the new

economy.

Before the industrial age, consumers could expect only

slight improvements in quality for slight increases in price. Over the

years the improved cost more. But with the arrival of automation and

cheap energy in the industrial age, manufacturers could invert the

equation: They offered lower costs and increased quality. Between 1906,

when autos were first being made, and 1910, only four years later, the

cost of the average car had dropped 24%, while its quality rose by 31%.

By 1918, the average car was 53% cheaper than its 1906 counterpart, and

100% better in performance quality. The better-gets-cheaper magic had

begun.

The arrival of the microprocessor accelerated this wizardry.

In the information age, consumers quickly have come to count on

drastically superior quality for drastically reduced price over time. A

sensible recommendation to anyone asking for shopping advice today is

that they should delay buying a consumer good until about 60 seconds

before they actually need it. Indeed, a transportation specialist told

me that almost nothing in the information industry is shipped by sea

anymore; it all goes by air, so the price won’t have a chance to

drop while the product is in transit.

So certain is the plummet of prices that economists have

mapped the curve of their fall. The cost of making

something—whether it is steel, light bulbs, airplanes, flower pots,

insurance policies, or bread—will drop over time as a function of

the cumulative number of units produced. The more an industry makes, the

better it learns how to make them, the more the cost drops. The downward

price curve, propelled by organizational learning, is sometimes called

the learning curve. Although it varies slightly in each industry,

generally doubling the total output of something will reduce the unit

cost on average by 20%.

Smart companies will anticipate this learning curve. Very

smart companies will accelerate it by increasing volumes, one way or

another. Since increasing returns can exponentially expand the demand of

items—doubling their totals in months—network effects speed

the steep fall of prices.

Computer chips further compound the learning curve. Better

chips lower the cost of all manufactured goods, including new chips.

Engineers use the virtues of computers to directly and indirectly create

the next improved version of computers, quickening the rate at which

chips are made, and their prices drop, which speed the rate at which all

goods become cheaper. Around a circle the virtues go.

Feedback loops saturate networks. Since so many people and

machines are interlinked in overlapping feedback loops, virtuous circles

form. One, two, three, four, it all adds up to more.

- Expanding knowledge makes computers smarter.

- As computers get smarter we transfer some of that

intelligence to the production line, lowering costs of goods and raising

their perfection—including chips.

- Cheaper chips lower the cost of setting up a competing

enterprise, so competition and spreading knowledge lowers the prices yet

more.

- The know-how of cheapness spreads throughout industry

quickly and makes its way back to the creation of better/cheaper chip

and communication tools.

That virtuous circle feeds itself voraciously. So potent is

compounding chip power that everything it touches—cars, clothes,

food—falls under its spell. Prices dip and quality rises in all

goods; not mildly, but precipitously. For example, between 1971 and 1989

a standard 17-cubic foot refrigerator declined in price by a third (in

real dollars) while becoming 27% more energy efficient and sporting more

features, such as ice-making. In 1988 Radio Shack listed a cellular

phone for $1,500. Ten years later they list a better one for $200.

Most of the increase in value we’ve seen in products

comes from the power of the chip. But in the network economy, shrinking

chip meets exploding net to create wealth. Just as we leveraged

compounded learning in creating the microprocessor revolution, we are

leveraging the same amplifying loops in creating the global

communications revolution. We can now harness the virtues of networked

communications to directly and indirectly create better versions of

networked communications. When quality feeds on itself in such a manner,

we witness discontinuous change: in this case, a new economy.

Almost from their birth in 1971, microprocessors experienced

steep inverted pricing. The chip’s pricing plunge is called

Moore’s Law, after Gordon Moore, the Intel engineer who first

observed the amazing, steady increase in computer power per dollar.

Moore’s Law states that computer chips are halving in price, or

doubling in power every 18 months. Now, telecommunications is about to

experience the kind of plunge that microprocessor chips have

taken—but even more drastically. The net’s curve is called

Gilder’s Law, for George Gilder, a radical technotheorist, who

forecasts that for the foreseeable future (the next 10 years), the total

bandwidth of communication systems will triple every 12 months.

The conjunction of escalating communication power with

shrinking size of jelly bean nodes at collapsing prices leads Gilder to

speak of bandwidth becoming free. What he means is that the price per

bit transmitted drops down toward the free. What he does not mean is

that telecom bills drop to zero. Telecom payments are likely to remain

steady per month in real dollars as we consume more bits, just as those

bits sink in cost.

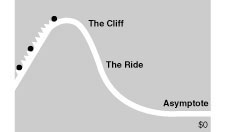

The cost per bit sinks so low, however, that the per unit

cost to the consumer closes in on the free. The cost follows what is

called an asymptotic curve. In an asymptotic curve the price point

forever nears zero without ever reaching it. It is like Zeno’s

tortoise: with each step forward, the tortoise gets halfway closer to

the limit but never actually crosses it. The trajectory of an asymptotic

curve is similar. It so closely parallels the bottom limit of free that

it behaves as if it is free.

Because prices move inexorably toward the free, the best

move in the network economy is to anticipate this cheapness.

So reliable is the arrival of cheapness in the new economy

that a person can make a fortune anticipating it. One of the classic

tales of counting on the cheap comes from the information era’s Big

Bang—when the semiconductor transistor was born.

In the early 1960s Robert Noyce and his partner Jerry

Sanders—founders of Fairchild Semiconductor—were selling an

early transistor, called the 1211, to the military. Each transistor cost

Noyce $100 to make. Fairchild wanted to sell the transistor to RCA for

use in their UHF tuner. At the time RCA was using fancy vacuum tubes,

which cost only $1.05 each. Noyce and Sanders put their faith in the

inverted pricing of the learning curve. They knew that as the volume of

production increased, the cost of the transistor would go down, even a

hundredfold. But to make their first commercial sale they need to get

the price down immediately, with zero volume. So they boldly anticipated

the cheap by cutting the price of the 1211 to $1.05, right from the

start, before they knew how to do it. "We were going to make the

chips in a factory we hadn’t built, using a process we hadn’t

yet developed, but the bottom line: We were out there the next week

quoting $1.05," Sanders later recalled. "We were selling into

the future." And they succeeded. By anticipating the cheap, they

made their goal of $1.05, took 90% of the UHF market share, and then

within two years cut the price of the 1211 to 50 cents, and still made a

profit.

In the network economy, chips and bandwidth are not the only

things headed toward the asymptotic free. Calculation is too. The cost

of computation—as measured by the millions of calculations per

second per dollar—is headed toward the free. Transaction costs also

dive toward the free. Information itself—headlines and stock

quotes—plunges toward the free, too. Real-time stock quotes, for

instance, were once high-priced insider information. Lately they have

become so widely available that they must conform to a stock quote

"spec" so that generic web browsers can read them

uniformly.

Indeed, all items that can be copied, both tangible and

intangible, adhere to the law of inverted pricing and become cheaper as

they improve.

While it is true that automobiles will never be free, the

cost per mile of driving will dip toward the free. It is the function

(moving the body) per dollar that continues to drop. This distinction is

important. Because while the function costs head toward zero, the

expenditure share can remain steady, or even balloon. With cheaper costs

we travel more, way more. With cheaper computation we consume billions

of more calculations. Yet for vendors to make a profit, they must

anticipate this cheapening per unit.

|

Gilder's Law says that the cost per communication bit will begin to

sink farther than it has fallen previously. Eventually the cost of a

telephone call, or of a bit transmitted, will be

"free." |

Let’s take communications. All-you-can-use plain old

telephone service with no frills will soon be essentially free. But as

customers use more of this nearly free service, they quickly add options

and deluxe services. First, every room gets a phone line. Then your car

gets a line, or two. Then you get a mobile line. Then everyone in the

family gets a mobile. Then answering service. Then call forwarding, call

waiting, caller ID. Then fax and modem lines. Then all appliances and

objects get a line. Then continuous open lines to cash registers, and

credit card readers. Then security lines. Then ISDN and ADSL lines. Then

caller ID blocking. Then junk call blocking. Then vanity phone numbers.

Then portable personal numbers. Then voice mail sorting.

The outer boundaries of telephony keep expanding. When the

phone was first invented, there was much confusion about what in the

world it was good for commercially. Some thought it would be used to

transmit music into homes. But even the most ambitious booster

didn’t envision having five phones lines in their home (as I do).

The desire to have a phone in a car and to have caller ID was

manufactured, indirectly, by the technology itself.

Technology creates an opportunity for a demand, and

then fills it.

This is a very different notion of supply and demand from

the one diagrammed in the introductory chapters of any economics

textbook. The traditional supply and demand curve conveys a simple

lesson: As a resource is consumed, it becomes more expensive to produce.

For instance, as gold is mined, the easy (cheap) nuggets are found

first; but to mine little particles of gold out of 25 tons of rock

requires a higher gold price to make the effort worthwhile. Therefore,

the supply curve slopes up, with the potential supply increasing as the

price goes up. In contrast, the traditional understanding of demand says

that demand slacks off the more supply there is. If you have lobster on

Monday, Tuesday, and Wednesday, you’ll be less interested in having

it again and more inclined to pay less for lobster on Thursday.

Therefore, the demand curve slopes down, with prices dropping as a

product becomes abundant.

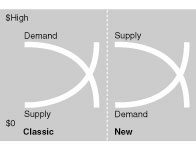

|

In textbook economics the supply of products would only increase if

their price went up; in the new economics the supply increases as price

goes down. |

In the new order, as the law of plentitude kicks in and the

nearly free take over, both of these curves are turned upside down. Paul

Krugman, an economist at MIT, says that you can reduce the entire idea

of the network economy down to the observation that "in the Network

Economy, supply curves slope down instead of up and demand curves slope

up instead of down." The more a resource is used, the more demand

there is for it. A similar inversion happens on the supply side. Because

of compounded learning, the more we create something, the easier it

becomes to create more of it. The classic textbook graph is

inverted.

As the supply curve rockets upward exponentially and the

demand curve plunges further, the new Supply/Demand Flip suggests the

two curves will cross each other at lower and lower price points. We see

this already as the prices of goods and services keep heading toward the

free. But hidden between the curves is a momentous surprise. Supply and

demand are no longer driven by resource scarcity and human desire. Now

both are driven by one, single exploding force: technology.

The accelerating expansion of knowledge and technology

simultaneously pushes up the demand curve while pushing down the supply

curve. One very potent force shifts both sides.

The effectiveness of technology in driving down prices is

easy to appreciate. As stated at the beginning of this chapter, price

drops have been going on for a while, although now it is accelerating.

We know the outcome of this trend: lower prices everywhere. Consumers

rejoice. But how are companies to make a profit in a world of constantly

sinking prices? In the supply. Technology and knowledge are driving up

demand faster than it is driving down prices. And demand, unlike prices,

has no asymptote to limit it. The extent of human needs and desires is

limited only by human imagination, which means, in practical terms,

there is no limit.

|

Anything that can be replicated will have a price that will tend

toward zero, or free. While the cost may never reach free, it approaches

the free in a curve called an asymptote. |

The quicker the price of transportation drops, the more

quality and services and innovation are embedded into cars, planes, and

trains, lifting the quality of the "wants" they satisfy.

Over time, any product is on a one-way trip over the cliff

of inverted pricing and down the curve toward the free. As the network

economy catches up to all manufactured items—from cell phones to

sofas—they will all slide down this slope of decreasing price more

rapidly than ever.

The task, then, is to create new things to send down the

slide—in short, to invent items and services faster than they are

commoditized.

This is easier to do in a network-based economy because the

crisscrossing of ideas, the hyperlinking of relationships, the agility

of alliances, and the nimble quickness with which new nodes are created

all support the constant generation of new goods and services.

We will create artifacts and services rapidly, as if they

were short-lived bubbles. Since we can’t hold back a bubble’s

drift toward popping, we can only learn to make more bubbles,

faster.

If goods and services become more valuable as they become

more plentiful, and if they become cheaper as they become valuable, then

the natural extension of this logic says that the most valuable things

of all should be those that are ubiquitous and free.

Ubiquity drives increasing returns in the network economy.

The question becomes, What is the most cost-effective way to achieve

ubiquity? And the answer is: give things away. Make them free.

Indeed, we see many innovative companies in the new economy

following the free. Microsoft gives away its Internet Explorer web

browser. Netscape also gives away its browser, as well as its valuable

source code. Qualcomm, which produces Eudora, the popular email program,

is given away as freeware in order to sell upgraded versions. Thomson,

the $8 billion-a-year publisher, is giving away its precious high-priced

financial data to investors on the web. Some one million copies of

McAfee’s antivirus software are distributed free each month. And,

of course, Sun passed Java out gratis, sending its stock up and

launching a mini-industry of Java application developers.

Can you imagine a young executive in the 1940s telling the

board that his latest idea is to give away the first 40 million copies

of his only product? (Fifty years later that’s what Netscape did.)

He would not have lasted a New York minute.

But now, giving away a product is a tested, level-headed

strategy that banks on the network’s new rules. Because compounding

network knowledge inverts prices, the marginal cost of an additional

copy (intangible or tangible) is near zero. It cost Netscape $30 million

to ship the first copy of Navigator out the door, but it cost them only

$1 to ship the second one. Yet because each additional copy of Navigator

sold increases the value of all the previous copies, and because the

more value the copies accrue, the more desirable they become, it makes a

weird kind of economic sense to give them away at first. Once the

product’s worth and indispensability is established, the company

sells auxiliary services or upgrades, continuing its generosity to

involve more customers in a virtuous circle.

One might argue that this frightening dynamic works only

with software, since the marginal cost of an additional copy is already

near zero (now that software can be distributed online). But

"following the free" is a universal law. Hardware, when

networked, also follows this mandate. Cellular phones are given away in

order to sell cell phone services. We can expect DirecTV dishes to be

given away for the same reasons. This principle applies to any object

whose diminishing cost of replication is exceeded by the advantages of

being plugged in.

As crackpot as it sounds, in the distant future nearly

everything we make will (at least for a short while) be given away

free—refrigerators, skis, laser projectors, clothes, you name it.

This will only make sense when these items are pumped full of chips and

network nodes, and thus capable of delivering network value.

The natural question is how companies are to survive in a

world of such generosity? Three points will help.

First, think of "free" as a design goal for

pricing. There is a drive toward the free—the asymptotic

free—that, even if not reached, makes the system behave as if it

has been reached. A very cheap rate can have an effect equivalent to

being outright free.

Second, pricing a core product as free positions other

services to be expensive. Thus, Sun gives Java away to help sell

servers, and Netscape hands out consumer browsers to help sell

commercial server software.

Third, and most important, following the free is a way to

rehearse a service’s or a good’s eventual fall to free. You

structure your business as if the thing that you are creating is free in

anticipation of where its price is going. Thus, while Sega game consoles

are not free to consumers, they are sold as loss leaders to accelerate

their journey toward their eventual destiny—to be given away in a

network economy.

Another way to view this effect is in terms of

attention:

The only factor becoming scarce in a world of abundance is

human attention.

As Nobel-winning economist Herbert Simon puts it: "What

information consumes is rather obvious: It consumes the attention of its

recipients. Hence a wealth of information creates a poverty of

attention." Each human has an absolute limit of 24 hours per day to

provide attention to the millions of innovations and opportunities

thrown up by the economy. Giving stuff away captures human attention, or

mind share, which then leads to market share.

Following the free also works in the other direction. If one

way to increase product value is to make products free, then many things

now free may contain potential value not yet perceived. We can

anticipate the eruption of new wealth on the frontier by tracking down

the free.

In the web’s early days, the first indexes to this

uncharted territory were written by students and given away. The indexes

helped people focus their attention on a few sites out of the thousands

available. Webmasters, hoping to draw attention to their sites, aided

the indexers’ efforts. Because they were free, indexes became

ubiquitous. Their ubiquity quickly made them valuable (and their

stockholders rich) and enabled many other web services to flourish.

What is free now that may later lead to extreme value? Where

today is generosity preceding wealth? A short list of online candidates

would be digesters, guides, catalogers, FAQs, remote live cameras, front

page web splashes, and numerous bots. Free for now, each of these will

someday have profitable companies built around them selling auxiliary

services. Digesting, guiding and cataloging are not fringe functions,

either. In the industrial age, a digest, Reader’s Digest,

was the world’s most widely read magazine; a guide, TV

Guide, was more profitable than the three major networks it guided

viewers to; and a catalog of answers, the Encyclopaedia

Britannica, began as a compendium of articles written by

amateurs—something like online FAQs (Frequently Asked

Questions).

But the migration from ad hoc use to commercialization

cannot be rushed. To reach ubiquity you need to pass through

sharing.

Increasingly we see technologies pass through a

protocommercial stage. Huge numbers of people, exerting millions of

hours of collective effort, will jointly craft hundreds of thousands of

creations, but without the exchange of money. An entire society

following the free! Author Lewis Hyde long ago called this arrangement a

gift economy. The central task in a gift economy is to keep the gifts

moving. By social debt, barter, and pure charity, gifts circulate and

generate happiness and wealth.

The early internet and the early web sported amazingly

robust gift economies. Text and expertise (FAQs, for example) and

services (page designs) were swapped, shared generously, or donated

outright. Information was bartered, content was given away, code was

exchanged. For a long while the gift economy was the only way to

acquire things online. In the first 1,000 days of the web’s life,

several hundred thousand webmasters created over 450,000 web sites,

thousands of virtual communities, and 150 million pages of intellectual

property, primarily for free. And these protocommercial sites were

visited by 30 million people around the world, with 50% of them visiting

daily, staying for an average of 10 minutes per day. This is a raging

success by almost any measure you’d want to use. No other emerging

media in the past experienced such glory so early in its growth.

Talk of generosity, of information that wants to be free,

and of virtual communities is often dismissed by businesspeople as

youthful new age idealism. It may be idealistic but it is also the only

sane way to launch a commercial economy in the emerging space. "The

web’s lack of an obvious business model right now is actually its

main event," says Stewart Brand, of the Global Business

Network.

When a sector of the new economy passes through the

protocommercial phase, it is the opposite of the "tragedy of the

commons." The tragedy of the commons was that nobody took

responsibility for maintaining the communal pastures that were the

livelihood for the entire community. In the follow-the-free economy that

seems to precede commercial activity on the net, everyone keeps

the commons up because nobody is able to make a living from it on their

own. Sophisticated software, as good as anything you can purchase, is

written, debugged, supported, and revised for free in this "triumph

of the commons."

The most popular software used to run web sites is called

Apache. It is not sold by Netscape, or Microsoft, or anyone. Apache,

which has 47% of the server market (Microsoft has 22% and Netscape 10%),

was written (and is maintained) by a network of volunteers. It is given

away free. Apache, which is used by the developers of such commercial

sites as McDonald’s, keeps getting better because the triumph of

the commons rewards a completely open product: Anyone has access to

Apache’s software source code and can improve it. "If you give

everyone source code, everyone becomes your engineer," says John

Gage, chief scientist at Sun Microsystems.

The most popular operating system for web server

workstations is not sold by anyone. It is a product called Linux, a

Unix-compatible program that was originally written by Linus Torvalds,

and given away for free. In the manner of building medieval cathedrals,

hundreds of software engineers volunteer their time and expertise to

refine and improve Linux, and to keep it free. Beside Apache and Linux,

there are many other free software suites, such as Perl and X-Windows,

maintained by a network of programmers. The engineers don’t get

paid in money; rather they get better tools than they can buy, tools

that can be easily tweaked by them for maximum performance, tools

superior to what they can make alone, and tools that increase in network

value, since they are given away.

Tens of thousands of software programs written for almost

every imaginable use are available on the net for free. Called

shareware, the model is simple. Download whatever software you want for

free, try it out, and if you like it, send some money to the author.

Dozens of entrepreneurs have made their million dollars selling goods by

this protocommercial method. More and more, the triumph of the commons

overrides orthodox business models.

As Stewart Brand says, the main event of the emerging

World Wide Web is its current absence of a business model in the midst

of astounding abundance. The gift economy is one way players in the net

rehearse for a life of following the free and anticipating the cheap.

This is also a way for entirely new business models to shake out.

Furthermore the protocommercial stage is a way for innovation to

fast-forward into hyperdrive. Temporarily unhinged from the constraints

of having to make a profit by next quarter, the greater network can

explore a universe of never-before-tried ideas. Some ideas will even

survive the transplantation to a working business.

It’s a rare (and foolish) software outfit these days

that does not introduce its wares into the free economy as a beta

version in some fashion. Fifty years ago the notion of releasing a

product unfinished—with the intention that the users would help

complete it—would have been considered either cowardly, cheap, or

inept. But in the new regime, this precommercial stage is brave,

prudent, and vital.

Releasing incomplete "buggy" products is not

cost-cutting desperation; it is the shrewdest way to complete a product

when your customers are smarter than you are.

The protocommercial state and the triumph of the commons is

in ascendance. It is no coincidence that increasing numbers of internet

companies take themselves public before they are profitable. Investors

are purchasing shares in a firm with protocommercial value. The old

guard reads this as a signal of greed, speculation, and hype. But it

also signals that many of the components of the gift

economy—attention, community, standards, and shared

intelligence—have to be in place before cold-cash commercialization

can kick in. The gift economy is a rehearsal for the radical dynamics of

the network economy.

Strategies

What can you give away? This is the most powerful

question in this book. You can approach this question in two ways: What

is the closest you can come to making something free, without actually

pricing it at zero? Or, in a true gesture of enlightened generosity, you

can figure out how to part with something very valuable for no monetary

return at all. If either strategy is pursued with intelligence, the

result will be the same. The network will magnify the value of the gift.

But giving something away is not usually easy. It must be the right

gift, given in the proper context. To figure out what to give away,

consider these questions:

- Is the freebie more than a silly premium, like the toy

in a cereal box? There is no power in the gift unless it is crucial to

your business.

- What virtuous circle will this freebie circulate in? Is

it the loop you most need to amplify?

- In the long run, the unbounded support of a customer is

more valuable than a fixed amount of their money. How will you

eventually capture the support of customers if there is initially no

flow of money?

Every organization harbors at least one creation—or

potential creation—that can be liberated into

"freedom." This is often an idea with problems, particularly

with its price: Should it be $69.50 per minute or $6.50 per box? The

answer sometimes is: It should be free. Even if the idea is never

actualized, my experience is that the very act of contemplating the free

will inevitably illuminate all kinds of beneficial attributes that were

never visible before. "Free" has long been a taboo price

point. Perhaps because it has been forbidden, many low-hanging fruit are

waiting to be plucked by giving the free serious consideration.

Act as if your product or service is free.

Magazine publishers do this. The cover price on a magazine barely covers

the cost of printing it, so publishers act as if they were giving it

away (and some actually do). They make their money instead on

advertising. Says pundit Esther Dyson, "The creator who immediately

writes off the costs of developing content—as if it were

valueless—is always going to win over the creator who can’t

figure out how to cover those costs." Memberships in serious

discounters such as Cendant are also "as if free." Cendant

"gives away" the merchandise very near the cost of

manufacturing, as if the stuff were free. They make the bulk of their

profits not from selling goods to its members—who get fantastic

retail prices—but from selling $40 per year membership fees.

Invest in the first copy. That is the only one that

will hurt. The second copy and all thereafter will head toward the

free, but the first will become increasingly more expensive and capital

intensive. Gordon Moore, of Moore’s Law fame, posed a second law:

that the costs of inventing chips (that are halving in cost every 18

months) is doubling every three to four years. The up-front investment

for research, design, and process invention for all complex endeavors

are commanding a larger share of the budget, while the capital costs of

subsequent copies diminishes.

Anticipate the cheap. What would you do if your

current offerings cost only one third what they cost today? They

will someday soon, so create models that recognize this

trend.

Turn off the meter, charge for joining. Flat or

monthly fixed pricing is one way of pricing "as if free." Fees

are paid, but there is no meter running. This tactic can be abused by

the company (a la cable TV) or can be abused by the consumer (a la AOL).

A flat fee is one type of subscription. Subscriptions are well-honed

tools used by the soft world of magazines and theater, among others.

Could subscriptions really apply to old order physical products, like

say, food? The idea of subscribing to food is not so outlandish. Forty

years ago subscriptions to milk were quite common. There were also

subscriptions to bread and beer and other staples. Subscriptions tend to

emphasize and charge for intangible values: regularity, reliability,

first to be served, and authenticity, and work well in the arena of

"as if free."

The ancillary market is the market. The software is

free, but the manual is $10,000. That’s no joke. Cygnus Solutions,

based in Sunnyvale, California, rakes in $20 million per year in

revenues selling support for free Unix-like software. Apache is free but

you can buy support and upgrades from C2Net. Although Novell, the

network provider, does sell network software, that’s not what they

are really selling, says Esther Dyson: "What Novell Inc. really is

selling is its certified NetWare engineers, instructors, and

administrators, and the next release of NetWare." One educational

software exec admitted that his company’s help line was actually an

important profit center. Their main market was the ancillary products

they sold for their flagship software, which they had a chance to do

while helping customers.

Pinpoint where value is being given out for free now, and

then follow up. The next netscape, the next yahoo, the next

microsoft is already up and running, and they are giving their stuff

away for free. Find them, and hitch your wagon to their star. Look for

the following tricks: charges only for ancillaries, as-if-free behavior,

memberships, and outright generosity. If they are using the free to play

off network effects, they are the real mccoys.

continue...

|