A cool tool can be any book, gadget, software, video, map, hardware, material, or website that is tried and true. All reviews on this site are written by readers who have actually used the tool and others like it. Items can be either old or new as long as they are wonderful. We post things we like and ignore the rest. Suggestions for tools much better than what is recommended here are always wanted.

Tell us what you love.Categories

- Announcements

- Aural

- Autonomous Motion

- Backpacking

- Big Systems

- Clothing

- Communications

- Community

- Computers

- Consumptivity

- Craft

- Culture

- Dead Tools

- Deals

- Design

- Destinations

- Dwelling

- Edibles

- Every Day Carry

- Family

- Gardens

- Gareth's Tips

- General Purpose Tools

- Health

- Homestead

- Inner Space

- Just 1 Question

- Kitchen

- Learning

- Life on Earth

- Livelihood

- Living on the Road

- Maker Tools

- Maker Update

- Materials

- Media Tools

- Multiple Product Reviews

- No Stream

- Nomadico

- Paper World

- Photography

- Play

- Podcast

- Prove Us Wrong

- Readers' Gifts

- Recomendo

- Related Stuff

- Science Method

- Somatics

- Source Wanted

- Tips

- Tool Chest

- Tools for Possibilities

- Uncategorized

- Vehicles

- Videos

- Visual Media

- What's in My Bag

- Workplace

- Workshop

Complete house building know-how

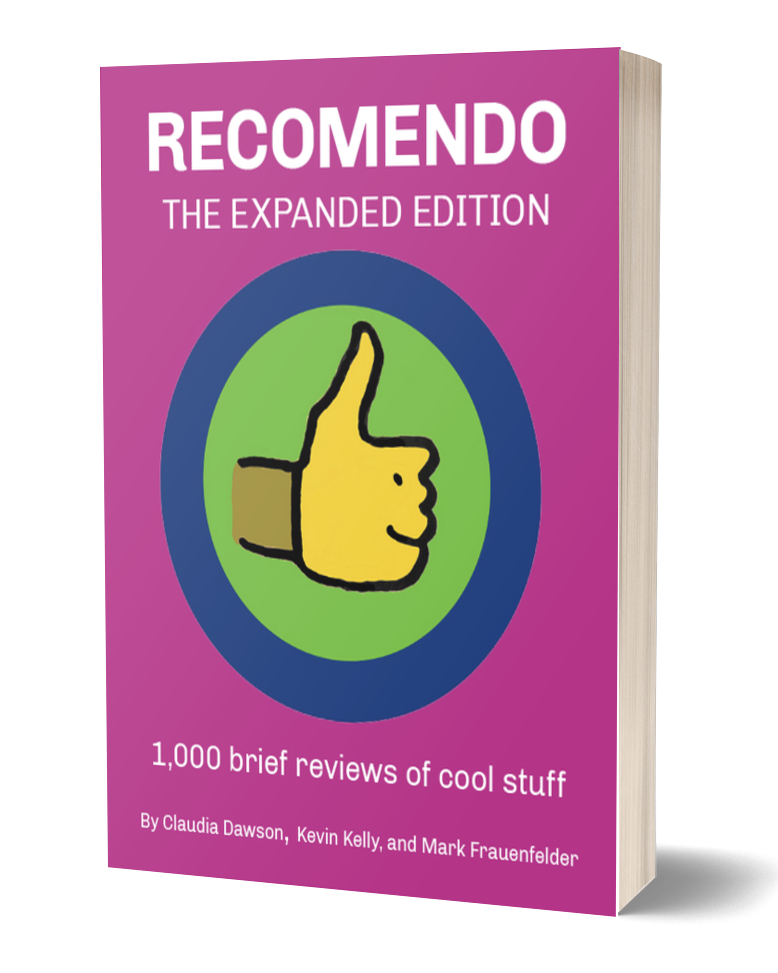

This is a book I wished I’d had when I started building, but it is also one that’s extraordinarily useful to more experienced builders. Mike Litchfield was the original editor of Fine Homebuilding; in 1982 he published the first version of Renovation, and it’s been updated periodically, this being the latest and 4th edition. Popular Science called it “The most comprehensive single volume on renovation ever” — which is totally true.

What differentiates this book from others of its ilk is that the author has gathered all this information in the field, interviewing carpenters, electricians, plumbers, and contractors, finding out what’s important, what works, what’s new. These guys love to talk about what they do well, and in this sense, the book is one of collective wisdom. It’s at the same time highly useful to professionals, but also one that’s invaluable for homeowners and people of the fixer-upper persuasion.

The chapter “Planning Your Renovation” is completely new, reflecting the current interest in smaller projects, spending wisely, and energy efficiency. The chapter on wiring covers code changes, and tells you things like how to fish wire, install wireless switches, or replace old incandescent ceiling lights with energy-efficient LEDs.

There’s a section on installing IKEA cabinets, tips and instructions on energy retrofits, working with paperless drywall (in wet areas), soundproofing, cutting into a concrete floor, working with PEX plumbing tubing, and installing engineered flooring. I found myself flipping through the book at random, and learning a lot. —Lloyd Kahn

Trim on older buildings is rarely level or parallel. Thus new trim maybe look better if it’s installed slightly out of level so that it aligns with what’s already there. For example, when stretching a chalkline to indicate the bottom of the water table, start level and then raise or lower the line until it looks right in relation to nearby windowsills and the like. Once the chalkline looks more or less parallel to existing trim, snap it on the building paper, and extend it to corner boards.

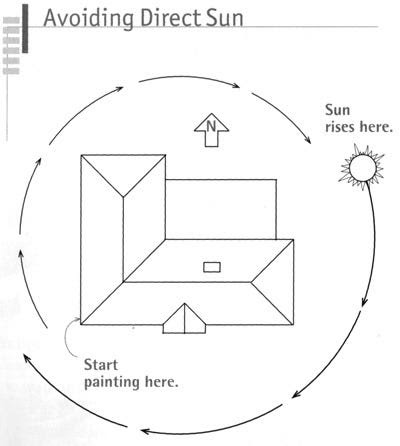

Avoid the sun around the house as you paint so that you apply paint in the shade if possible. Paint applied in full sunlight is more likely to blister later.

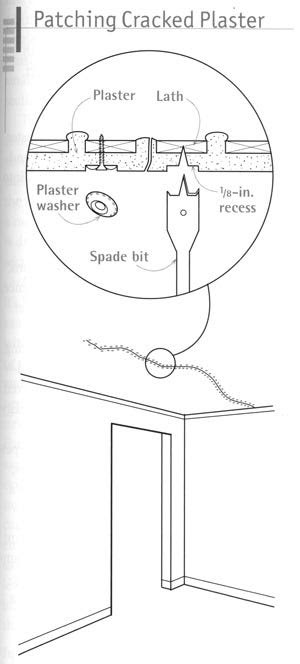

Cracked plaster often means that it has pulled free from its lath. Use screws and plaster washers to reattach it, countersinking them so they’ll be easier to patch.

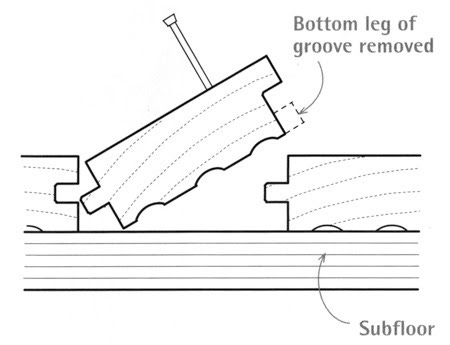

To insert a replacement board into an existing tongue-and-groove floor, use a tablesaw to remove the bottom of the groove. Slightly back-cut the ends of the new board so it will slide in easier.

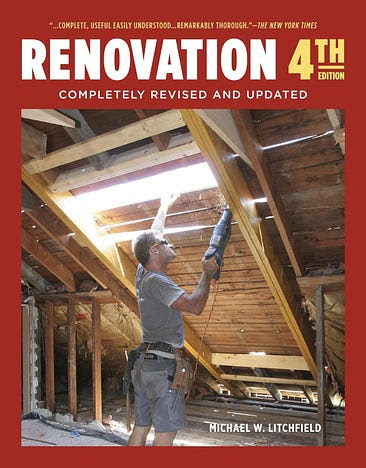

PEX Advantages

It installs quickly. Because lengths of flexible tubing easily turn corners and snake through walls, PEX systems require far fewer connections and fittings than do rigid materials. For that reason, it’s particularly well suited to renovation work.

Fewer leaks. PEX tubing runs to fixtures from hot- and cold-water manifolds with multiple takeoffs. Most of the fitting is simple, consisting of crimping steel or copper rings onto tubing ends. Because most leaks occur at joints, fewer fittings also mean fewer leaks.

It’s quiet. The tubind expands slightly, minimizing air hammer--the banging that takes place in rigid piping when taps are turned off suddenly and running water stops abruptly. That ability to expand also means less-pronounced pressure drops (fewer scalding or freezing showers), and PEX tubing is less likely to rupture if water freezes in it.

The beauty of working with PEX is that is required relatively few specialized tools. Here, an inexpensive PEX-cutting tool with a replaceable blade produces a clean, squared-off end.

Making adaptable shelter

Every building that endures will be modified. Yet few structures are built to be easily modified. The more stylized a building is now, the harder it is to change. Stewart Brand (who invented the ancestor of Cool Tools) teases out design principles for making buildings that can adapt — or “learn” — to new needs, new uses. While his examples are architectural, showing how the greatest buildings evolve, his advice is aimed at any kind of hard-to-change organization. Software programmers think this book is talking to them since they are often asked to adapt skyscrapers of code built with no concern about adapting it later. This book will be useful to anyone trying to build complicated things that will outlive them. — KK

Once a week we’ll send out a page from Cool Tools: A Catalog of Possibilities. The tools might be outdated or obsolete, and the links to them may or may not work. We present these vintage recommendations as is because the possibilities they inspire are new. Sign up here to get Tools for Possibilities a week early in your inbox.