A cool tool can be any book, gadget, software, video, map, hardware, material, or website that is tried and true. All reviews on this site are written by readers who have actually used the tool and others like it. Items can be either old or new as long as they are wonderful. We post things we like and ignore the rest. Suggestions for tools much better than what is recommended here are always wanted.

Tell us what you love.Categories

- Announcements

- Aural

- Autonomous Motion

- Backpacking

- Big Systems

- Clothing

- Communications

- Community

- Computers

- Consumptivity

- Craft

- Culture

- Dead Tools

- Deals

- Design

- Destinations

- Dwelling

- Edibles

- Every Day Carry

- Family

- Gardens

- Gareth's Tips

- General Purpose Tools

- Health

- Homestead

- Inner Space

- Just 1 Question

- Kitchen

- Learning

- Life on Earth

- Livelihood

- Living on the Road

- Maker Tools

- Maker Update

- Materials

- Media Tools

- Multiple Product Reviews

- No Stream

- Nomadico

- Paper World

- Photography

- Play

- Podcast

- Prove Us Wrong

- Readers' Gifts

- Recomendo

- Related Stuff

- Science Method

- Somatics

- Source Wanted

- Tips

- Tool Chest

- Tools for Possibilities

- Uncategorized

- Vehicles

- Videos

- Visual Media

- What's in My Bag

- Workplace

- Workshop

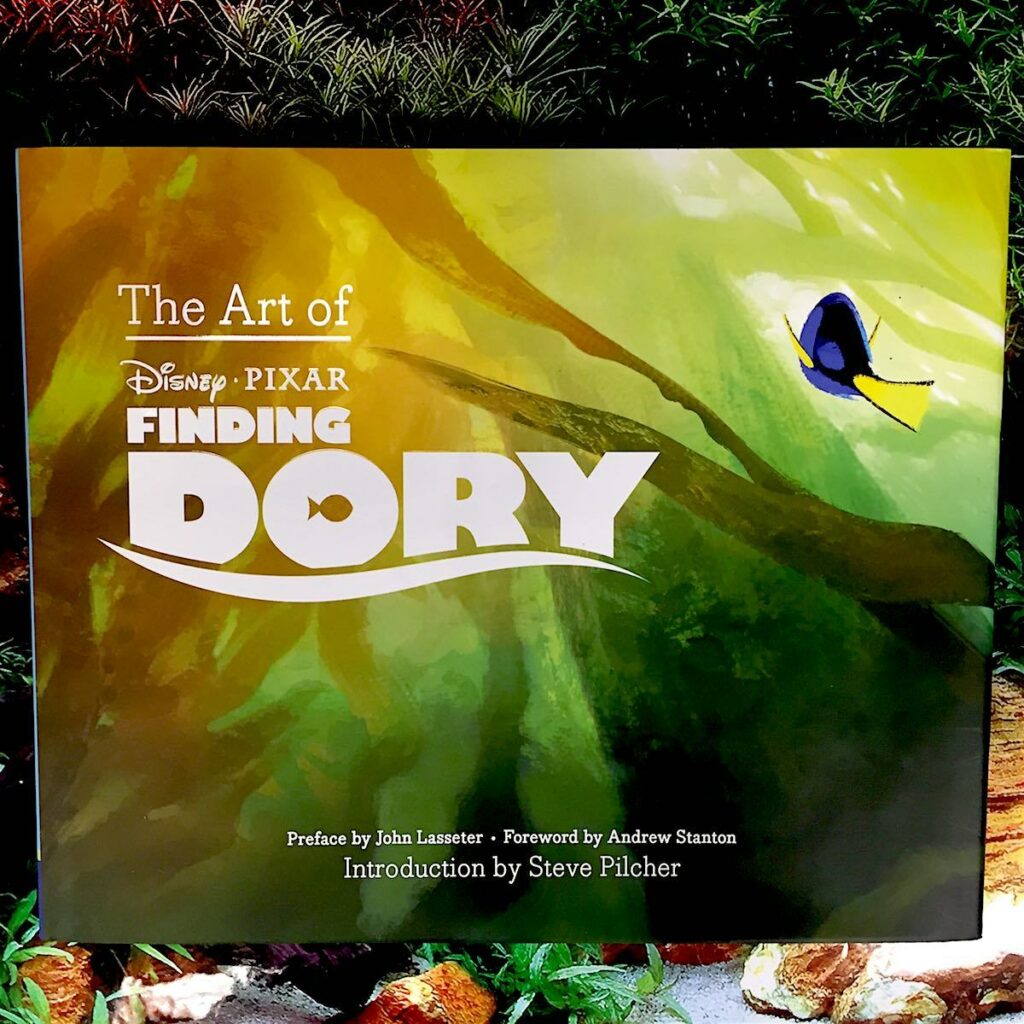

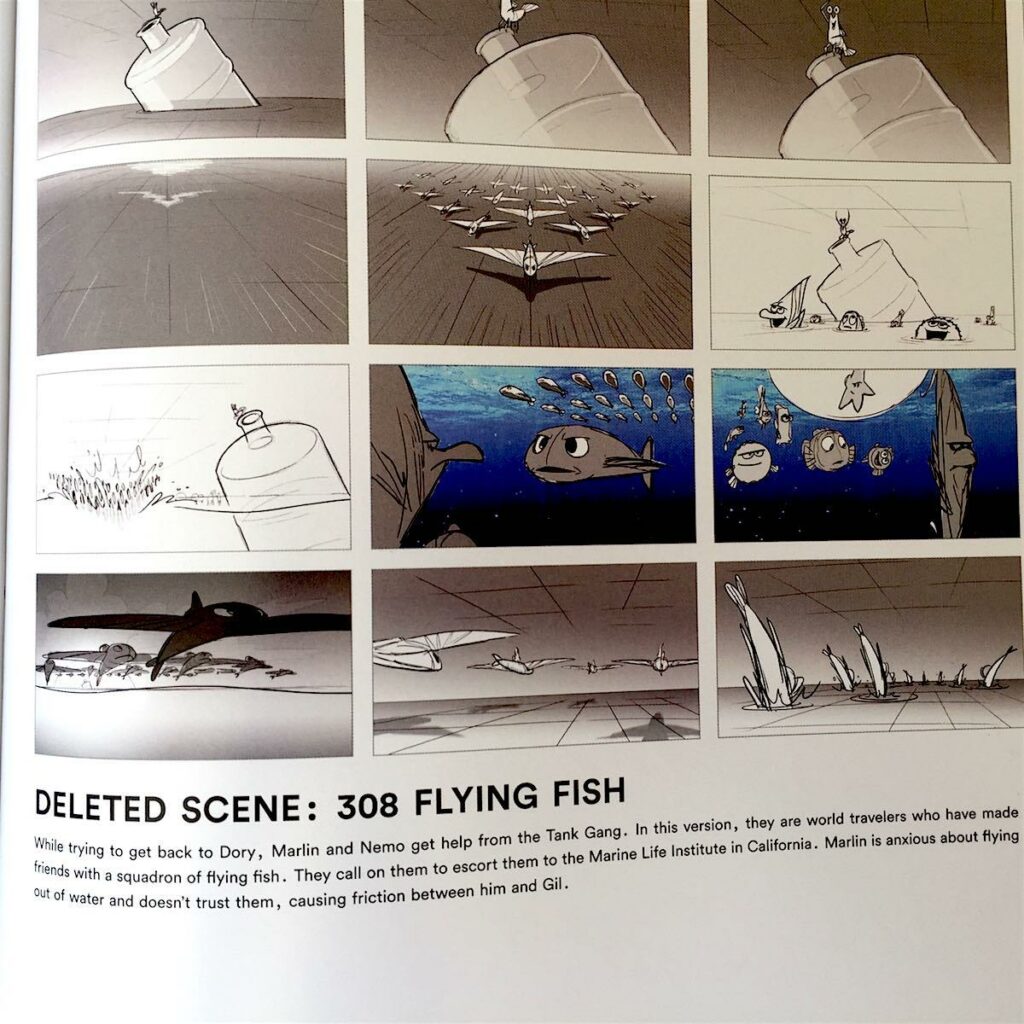

THE ART OF FINDING DORY – BENEATH THE SURFACE OF DISNEY’S AMAZING AQUATIC ADVENTURE

The Art of Finding Dory

by Disney and Pixar Studios (preface by John Lasseter)

Chronicle Books

2016, 176 pages, 9.5 x 11.5 x 1 inches

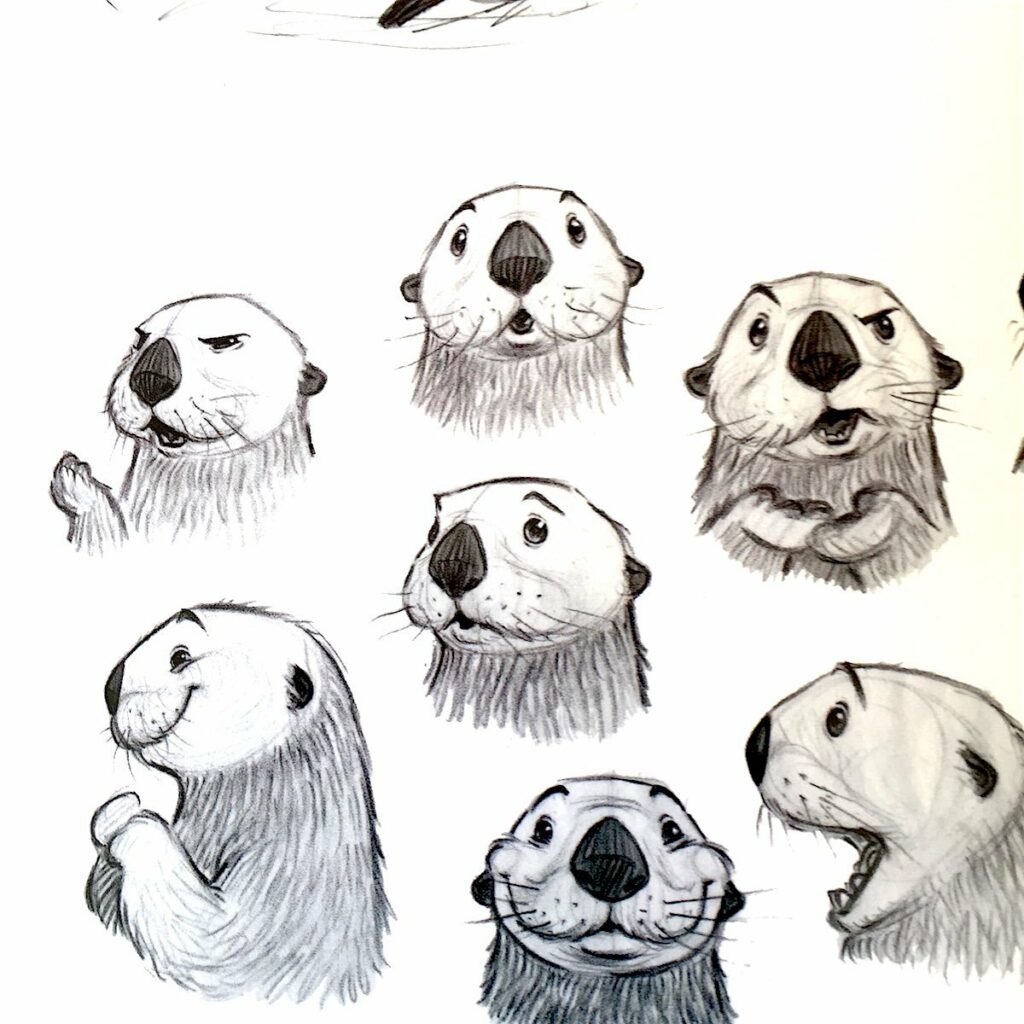

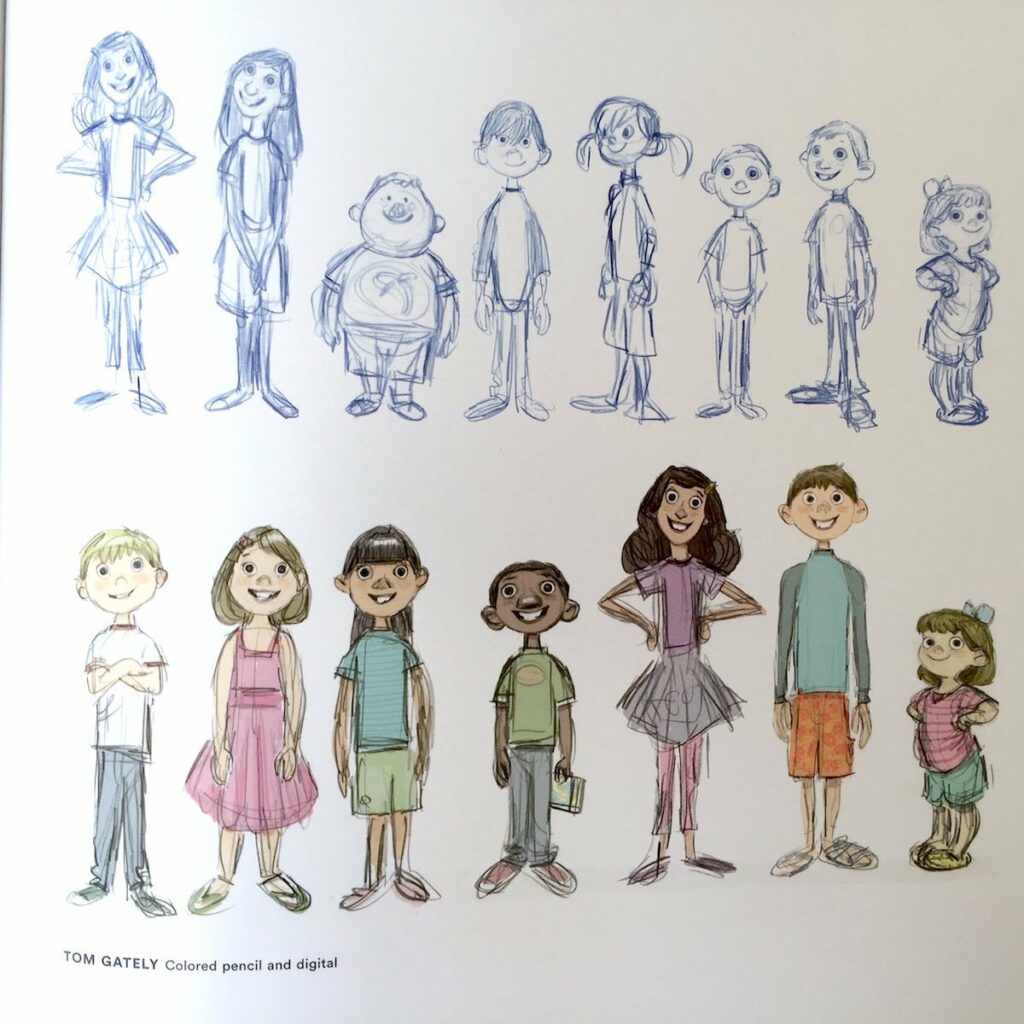

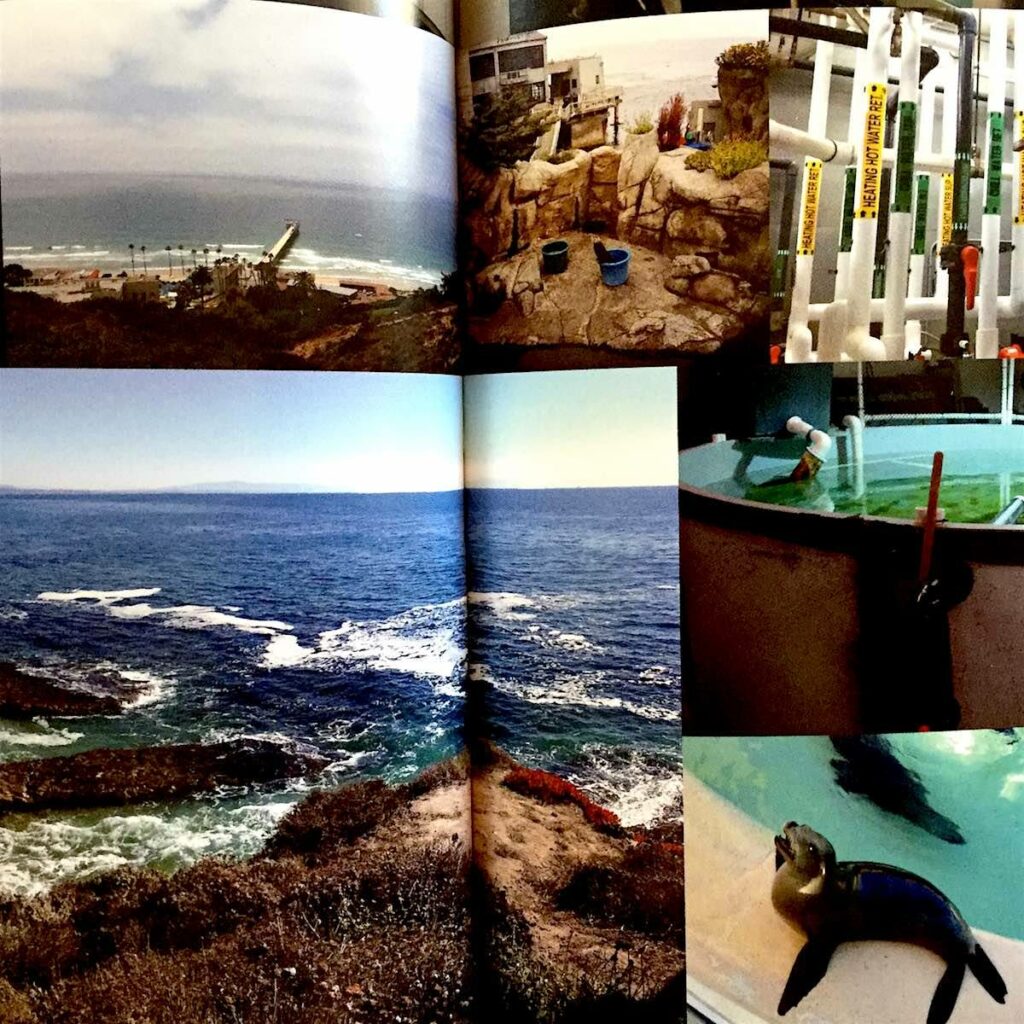

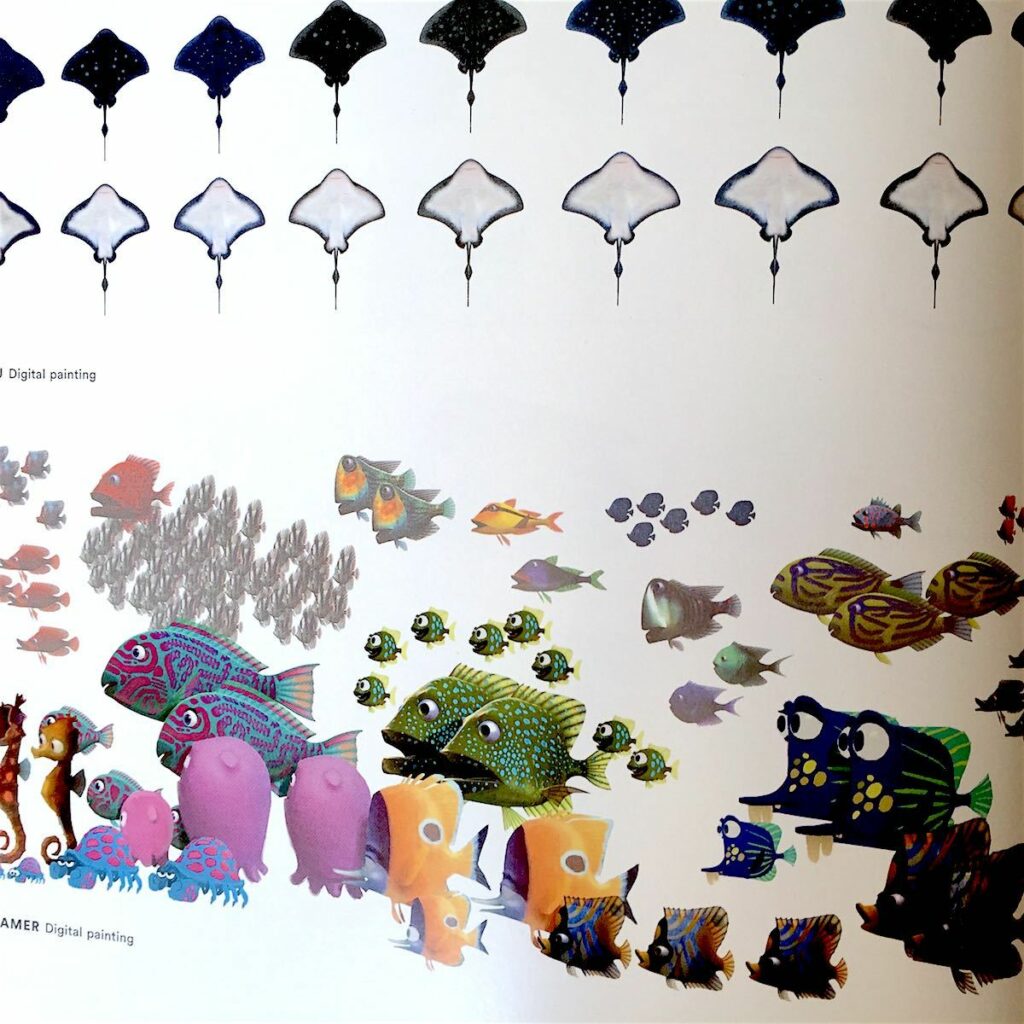

The Art of Finding Dory is more than a companion book to the new Disney Pixar movie – it’s an in-depth look at all aspects of the development and production process for an animated film. Finding Dory the movie explores the life of the forgetful little blue fish known as Dory, while the book not only delves into Dory’s background, but also lets the reader experience the imagination (and magic) of Pixar and Disney. The team behind the movie spent countless hours at beaches, aquariums, marine rehabilitation centers, and along the California coastline to create the most realistic world possible under the sea. They researched how light filters through the ocean, how sea life travels in deep water, and how to make authentic-looking coral reefs out of clay. The Art of Finding Dory chronicles their creative process through photos, hand drawings, computer generated images, story boards, and detailed color palettes. It took four years to bring Finding Dory to the big screen. Once you read The Art of Finding Dory you will understand what a true labor of love the journey was. – Carole Rosner

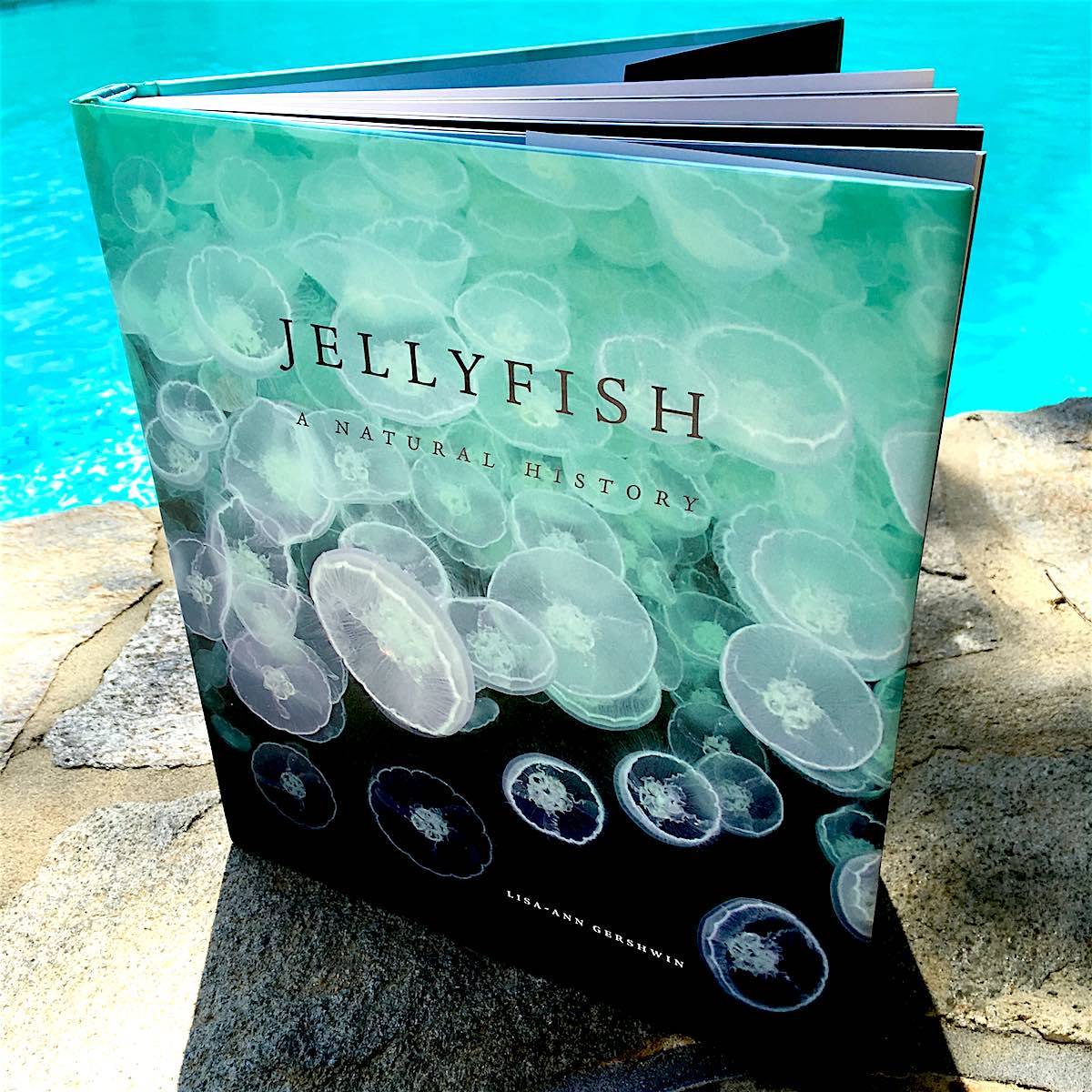

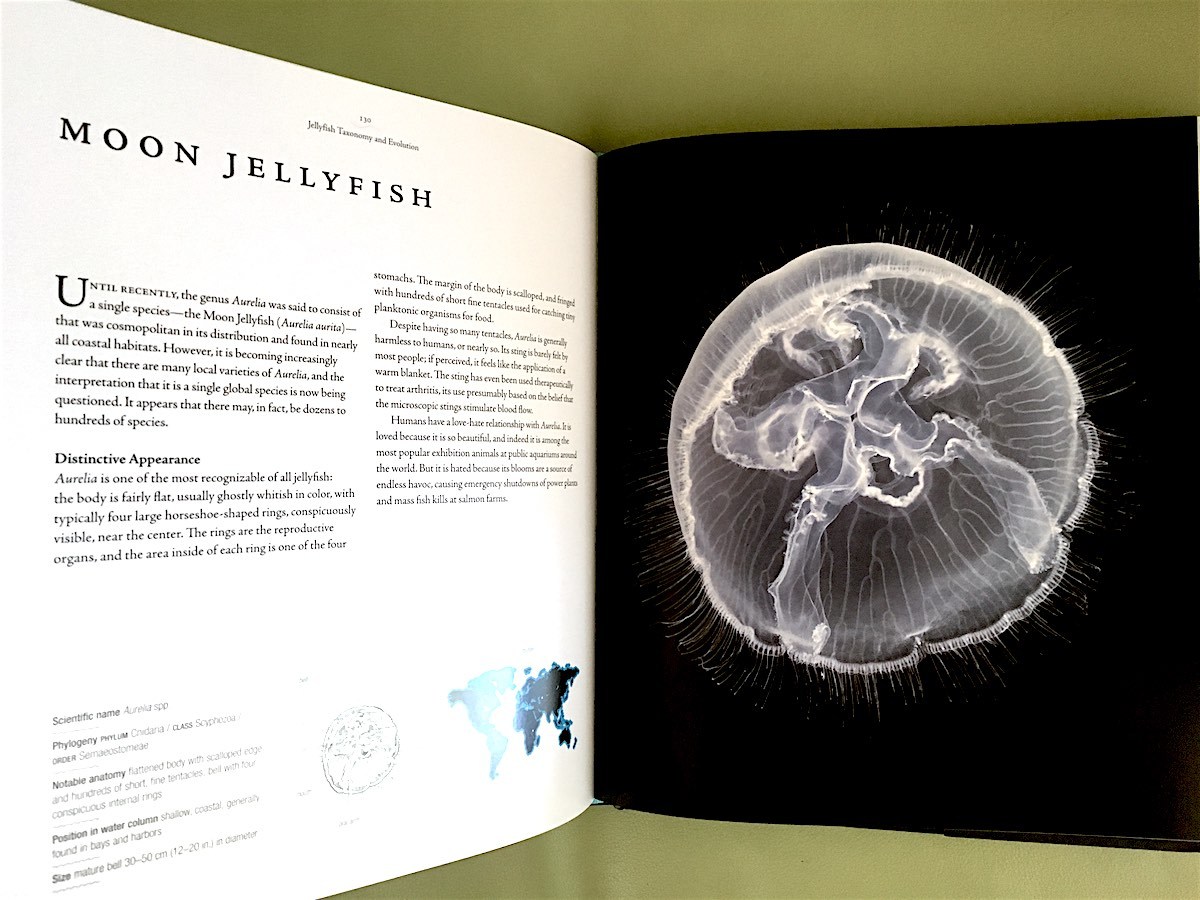

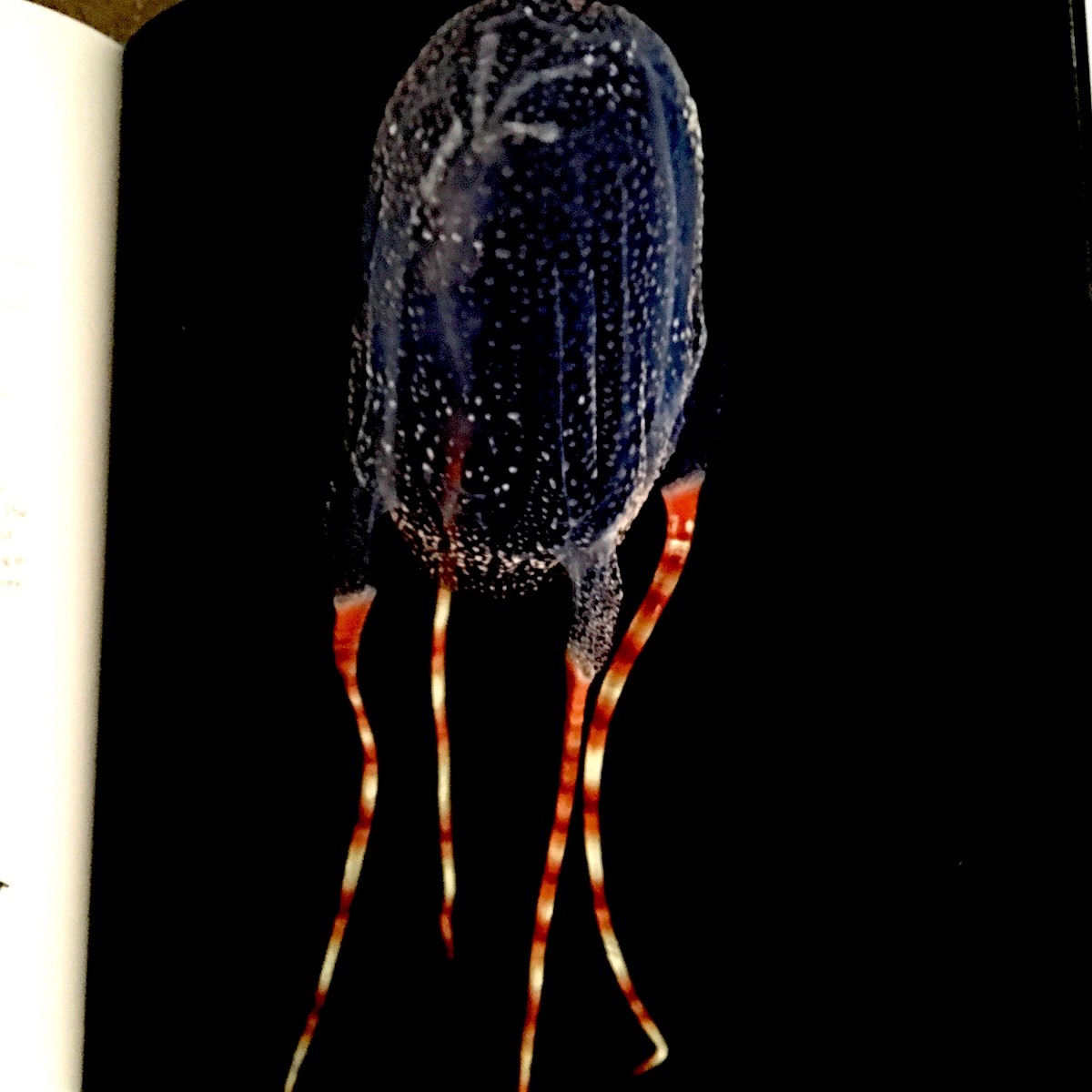

JELLYFISH: A NATURAL HISTORY – A LUSCIOUS BOOK ABOUT OUR OCEAN’S BRAINLESS, HEARTLESS CREATURES

Jellyfish: A Natural History

by Lisa-ann Gershwin

University of Chicago Press

2016, 224 pages, 8.2 x 9.5 x 1 inches

Five interesting facts I read in the just-released Jellyfish: A Natural History:

1. The deadly box jellyfish is the world’s most venomous animal, and its sting feels like “a splash of boiling oil, searingly hot and indescribably painful.”

2. The immortal jellyfish is just what it sounds like – its cells keep regenerating so that it forever cycles from baby to adult back to baby again.

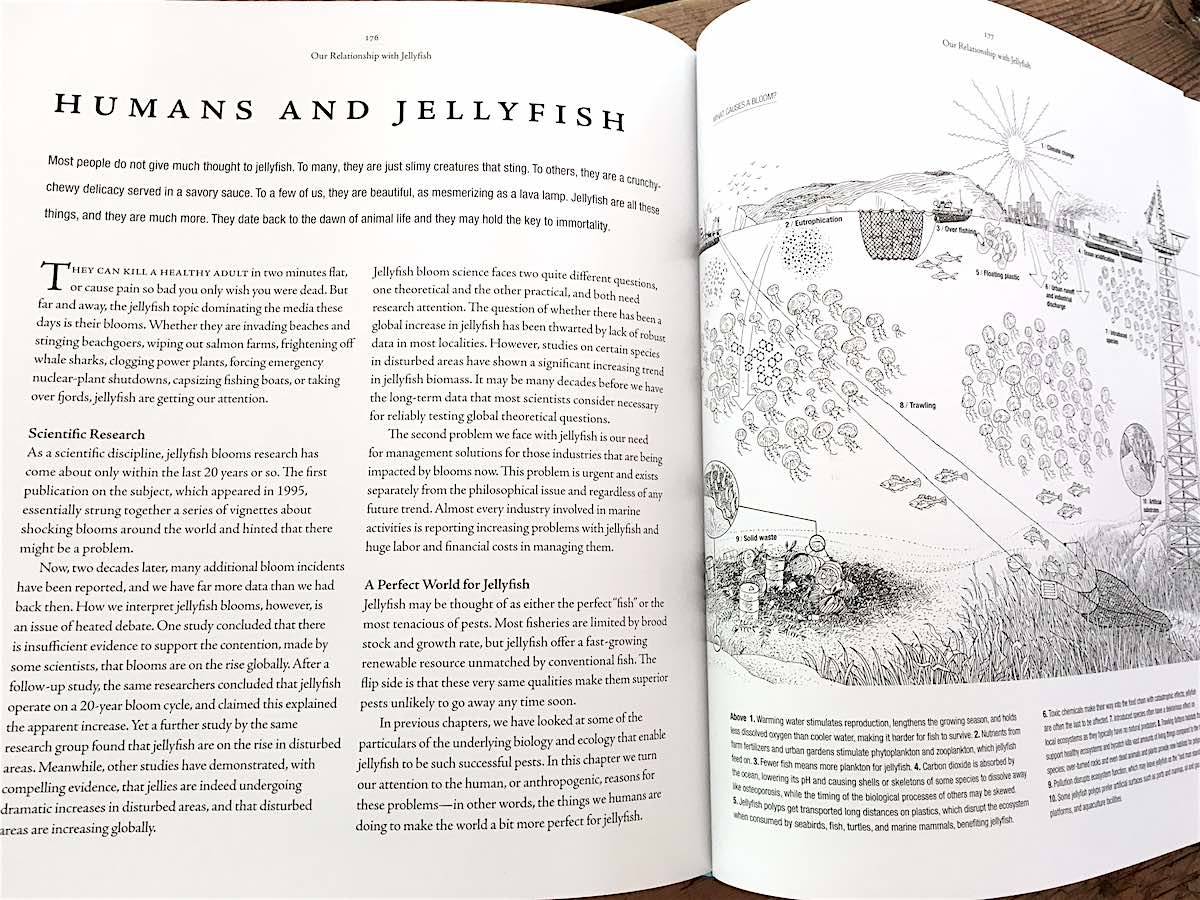

3. Recently, jellyfish blooms – or swarms – have become denser, are covering much larger areas than ever before, and are “lasting far longer than normal,” due to climate change.

4. Jellyfish can clone themselves, but the replica is so different from the original that it ends up being classified as a separate animal.

5. The giant heart jelly can grow to 165 feet, longer than a blue whale.

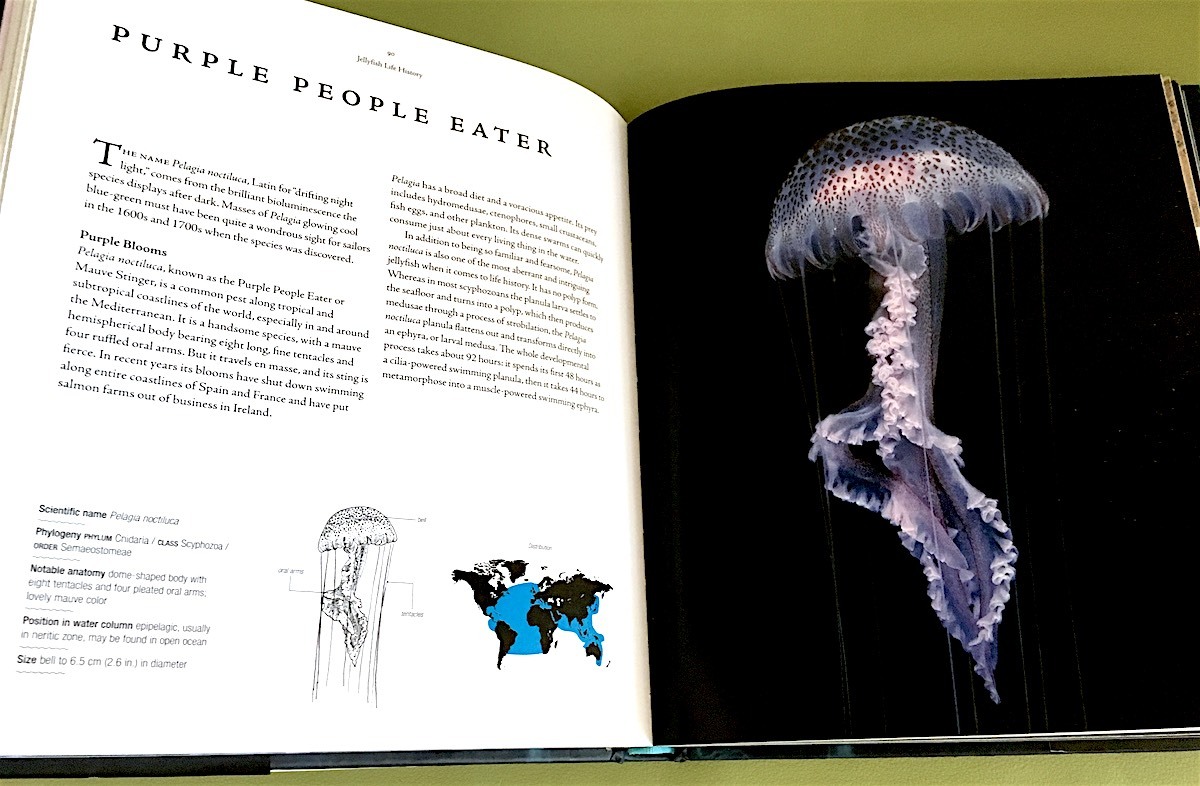

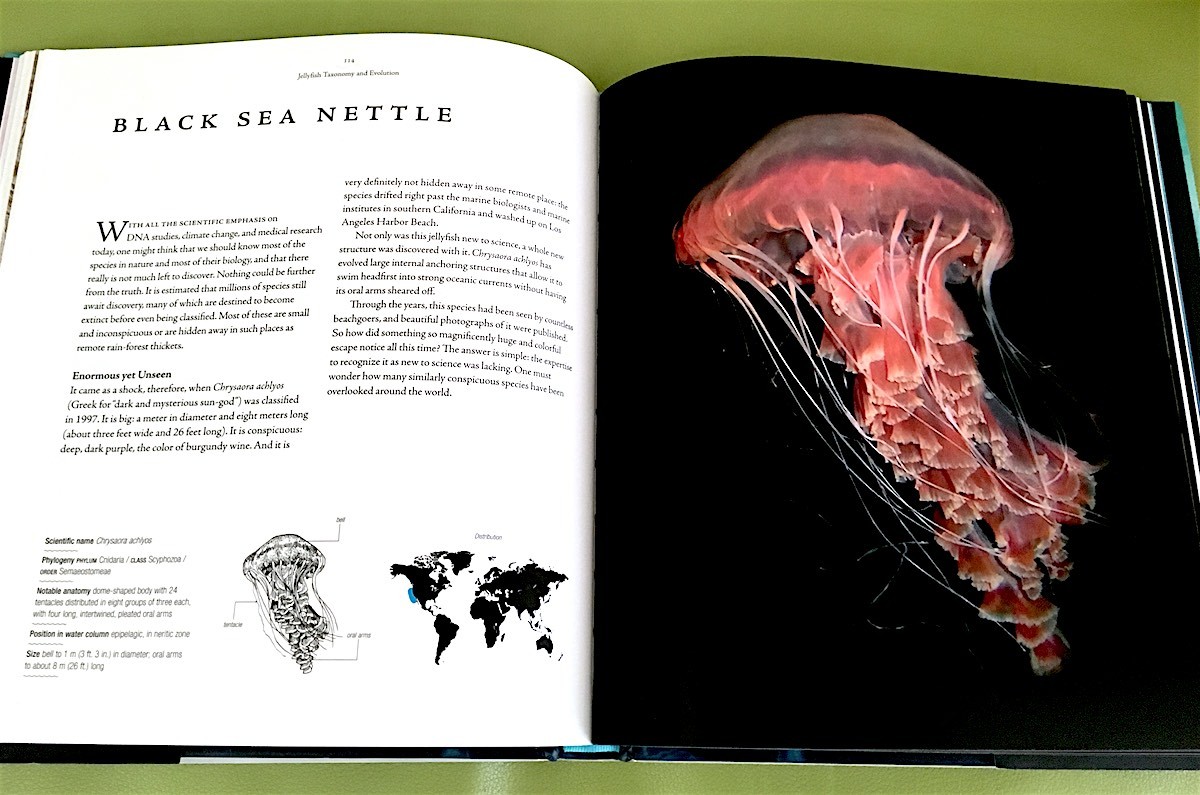

And this is nothing. Every page of text in Jellyfish has facts as fascinating as these, woven into a thorough coverage of jellyfish history, biology and ecology. Author Lisa-ann Gershwin, a marine biologist who has discovered over 200 new species of jellyfish, does an excellent job of combining a compelling narrative of 50 different jellyfish with luscious, I-can’t-believe-they’re-real photos. Put this book on your coffee table with caution – you might lose your guests as they submerge themselves into a book that’s as exotic as it is absorbing. – Carla Sinclair

Books That Belong On Paper first appeared on the web as Wink Books and was edited by Carla Sinclair. Sign up here to get the issues a week early in your inbox.