A cool tool can be any book, gadget, software, video, map, hardware, material, or website that is tried and true. All reviews on this site are written by readers who have actually used the tool and others like it. Items can be either old or new as long as they are wonderful. We post things we like and ignore the rest. Suggestions for tools much better than what is recommended here are always wanted.

Tell us what you love.Categories

- Announcements

- Aural

- Autonomous Motion

- Backpacking

- Big Systems

- Clothing

- Communications

- Community

- Computers

- Consumptivity

- Craft

- Culture

- Dead Tools

- Deals

- Design

- Destinations

- Dwelling

- Edibles

- Every Day Carry

- Family

- Gardens

- Gareth's Tips

- General Purpose Tools

- Health

- Homestead

- Inner Space

- Just 1 Question

- Kitchen

- Learning

- Life on Earth

- Livelihood

- Living on the Road

- Maker Tools

- Maker Update

- Materials

- Media Tools

- Multiple Product Reviews

- No Stream

- Nomadico

- Paper World

- Photography

- Play

- Podcast

- Prove Us Wrong

- Readers' Gifts

- Recomendo

- Related Stuff

- Science Method

- Somatics

- Source Wanted

- Tips

- Tool Chest

- Tools for Possibilities

- Uncategorized

- Vehicles

- Videos

- Visual Media

- What's in My Bag

- Workplace

- Workshop

10 Great Tool Gift Ideas

I love it when smart and talented makers that I follow give their annual tool recommendations. Case-in-point is Chris Notap’s tool gift guide for 2025. Every one of these is a winner, from the “I am totally ordering a bunch of these for presents” Olight iMini flashlight to the “I also have and highly recommend” DeWalt Oscillating Tool. Besides being a great tool, it will always have a soft spot in my heart ‘cause it’s the last tool my dear ol’ dad gave to me before he died. Other standouts include the Knipex 12” pliers wrench, which looks amazing, the Apple AirTag battery life extender, and the BlueDriver Bluetooth car scan tool.

Tips & Tricks for Using JB Weld

David Riddle’s video on J-B Weld (and J-B Kwik) is one of those tutorials that instantly upgrades your knowledge and approach to a material or process. His whole philosophy for using J-B Weld boils down to: Preparation is everything. Sand until you’ve got some adequate tooth, clean with acetone, mix on something non-absorbent (don’t use paper, card, etc.), spread a thin, even film (he uses a plastic knife like it was a tiny mason’s trowel), and warm the epoxy so it flows into the tooth instead of sitting on the bonding surface. No heavy clamping, no cardboard mixing trays, no wishing. Just clean surfaces, good texture, and slow-cure J-B Weld doing what it does best.

Some Practical 3D Printed Tools

As you likely know, there’s such a profusion of 3D printable tools out there (with many of them less than adequate as serious tool replacements) that the whole category of videos about them are easy to ignore. In this video, Peter Brown prints and tests five actually useful tools. The big aha for me here was the hex-key handles. I hate futzing with hex-keys, especially went you can’t bring proper torque to bear. These handsome little handles solve for that. Other stand-out prints include a snappy one-handed broom hook, a router bits organizer (from Zack Freedman’s Gridfinity system), and a rare earth magnet dispenser.

The History of the Allen Hex Key Wrench

We are all intimately familiar with that little L-shaped tool that carries a dude’s name. The Allen hex key wrench is so ordinary it’s basically shop and household wallpaper. Yet its impact on manufacturing and domestic life are undeniable. This episode of History of Simple Things (a channel I just discovered) explores how a small Hartford company, and an engineer named William G. Allen, helped de-thrown the slippery, injury-prone slotted screw and reshape modern manufacturing in the process. It’s a century-long tale of safety, standardization, and one odd bit of branding that stuck like Velcro and Kleenex. The video is a reminder that even the homeliest of tools have hidden lineages worth appreciating, especially the ones rattling around the bottoms of your kitchen junk drawers.

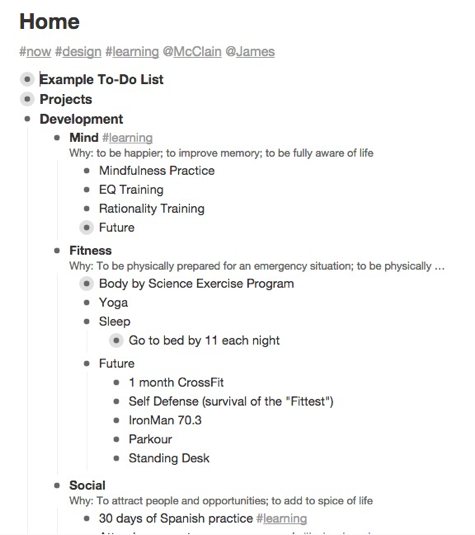

Regularly Rethinking Your Org

I’m not the most organized person in the world. I’m not terrible—I have my moments of clarity and tidy thinking, but I’m not obsessive or even particularly consistent about it. An example: For years I’ve had a 5-drawer wooden rolly cart by my workbench. I have most of my day-to-day tools on or around the bench, and this cart has additional tools and drawers organized by different activities: small supplies, painting, sanding, etc. Only the top drawer is tool-devoted, and over the years, it has become crammed with tools. Yesterday, I realized that the top drawer includes tools I use on a regular basis mixed in with tools I rarely use. This while some drawers in the cart are filled with materials I might only use once or twice a year. So, I moved those materials to shelves and created two tool drawers: one for everyday tools, one for special-use tools. I can already tell what a difference this will make as I quickly reach for a tool and don’t have to spend 5-minutes shifting and untangling stuff to get it in hand. The takeaway for me is that I’m going to start re-organizational thinking on a regular cadence (every quarter?). Pick some area of my shop and ask myself: Is this really the right system? How am I actually using the space and the tools, supplies, and materials within it? What can I improve?” I don’t do this type of thinking nearly enough. Do you?

Maker’s Muse

Some real eye-opening and inspiring ideas here for gates, doors, windows, skylights, pool covers, and more.

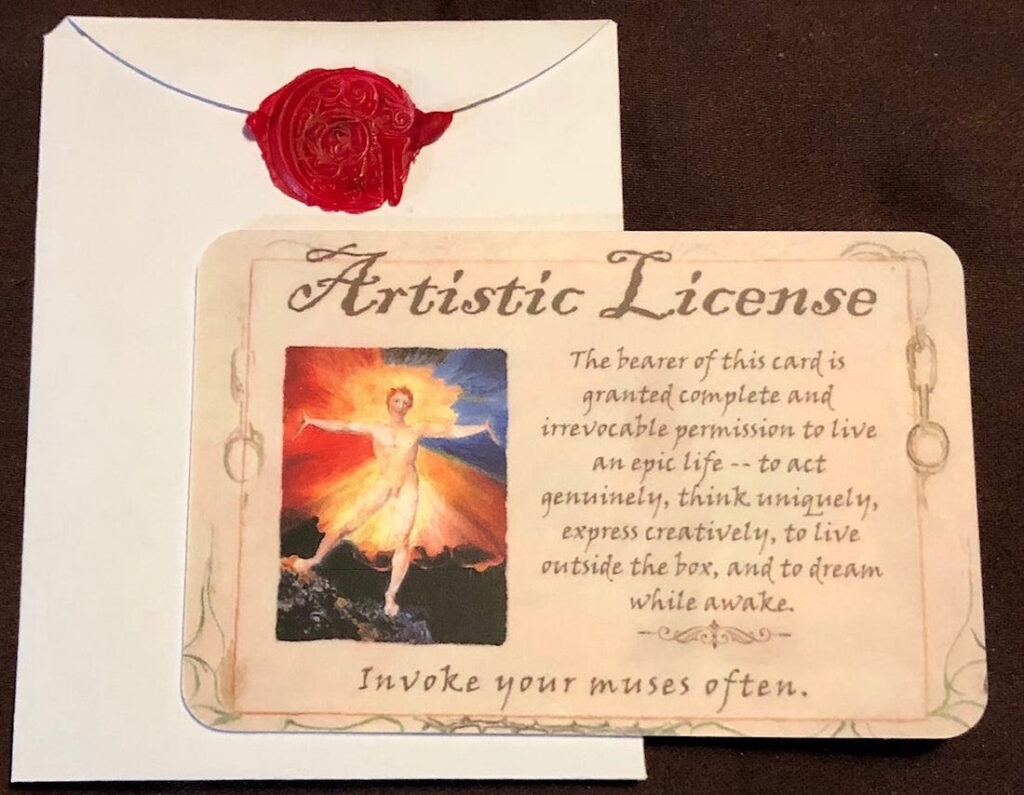

Do You Need an Artistic License?

I created this Artistic License years ago and have been selling them every holiday season. I hear from people all the time that they still have theirs in their wallet and get a kick out of it when they encounter it. Come on, admit it, we all want to feel like we have artistic license. I sell them for $5 each, postpaid, or 5 for $20 (pp). Foreign orders require the exact shipping cost. Message me at garethbranwyn@mac.com if interested.

Your Chance to Win a Flashlight!

I was so intrigued by the Olight iMini flashlight that Chris Notap recommended above that I immediately bought one, and man, is it a cool little bit o’ kit. It’s everything he says and more. Every keychain (and home, car, boat, shop) needs one. So, I decided to give three of them to newsletter readers!

Here’s how it works:

- Every existing newsletter subscriber will get one entry in the drawing. Paid subscribers will bet two entries.

- For everyone who brings on a new subscriber, you’ll get one drawing entry for each new signee (just email me the addresses they used to sign up).

- For everyone that upgrades to a paid subscription, you will get three entries.

I will do the drawing on Dec 16th and have the lights direct-shipped immediately. I can only mail to US subscribers. If you are out of the country and you win, I will send you a PDF copy of my book Tips and Tales from the Workshop, Vol. 2.