17 July 2025

Travel Gear Deals/Avoiding Bug Bites/Bad Behavior Fines

Nomadico issue #163

Cheaper Gear at Amazon

As I’m sure you’ve heard, we’re in the midst of Prime “Day” at Amazon, a sale event that’s going on for 72 hours this time. A few items we’ve recommended before are marked down quite a bit, like the 10-inch Kindle Fire tablet (56% off), the JBL Go 3 travel Bluetooth speaker (30% off), and the Lifestraw backcountry water filter (43% off). This is a great time to pick up earbuds or headphones, like the folding Beats Solo 4 headphones at 51% off.

What Really Works Against Mosquitoes

This Lifehacker article on how to avoid mosquito bites when you’re enjoying the summer weather on your deck is refreshingly concise. I’d add treated Insect Shield clothing to the list for an extra layer of protection, but it’s easy to remember a breeze and the right sprays. “DEET really works, and so do picaridin and oil of lemon eucalyptus. If a mosquito repellent spray (especially a ‘natural’ one) doesn’t have one of these ingredients, it’s probably no good.” I usually go for a higher percentage of DEET than they recommend, which you can find online or at sporting goods stores.

Bad Behavior Fines in Europe

I’ve frequently discussed new travel fees popping up all over, but this article showing all the things you can be fined for in Europe was about five times longer than I expected. You may think Europe is more laid-back about showing skin, but you’d better not walk around in swimwear in parts of Spain, Portugal, Italy, France, or Croatia, with some fines exceeding $1,500. Unruly behavior, smoking in public, eating next to a cultural monument, or even taking a selfie in the wrong place could hit your wallet hard. And don’t pull out a dashcam for your rental car in Austria: it’s illegal there.

How Many Passports?

Now that AI is answering our questions, sometimes even giving the right answer, you don’t see many articles like this answering a single search query like “How Many Passports Can You Have?” The answer, according to this Travel + Leisure article, seems to be “plenty” if you want to go to the effort. There are even circumstances where you could have two for your home country.

A weekly newsletter with four quick bites, edited by Tim Leffel, author of A Better Life for Half the Price and The World’s Cheapest Destinations. See past editions here, where your like-minded friends can subscribe and join you.

07/17/2515 July 2025

Mooncop / Super Graphic

Issue No. 75

MOONCOP – A STORY WITH EXISTENTIAL PATHOS THAT WE EARTH-DWELLERS CAN RELATE TO. RELEASED TODAY!

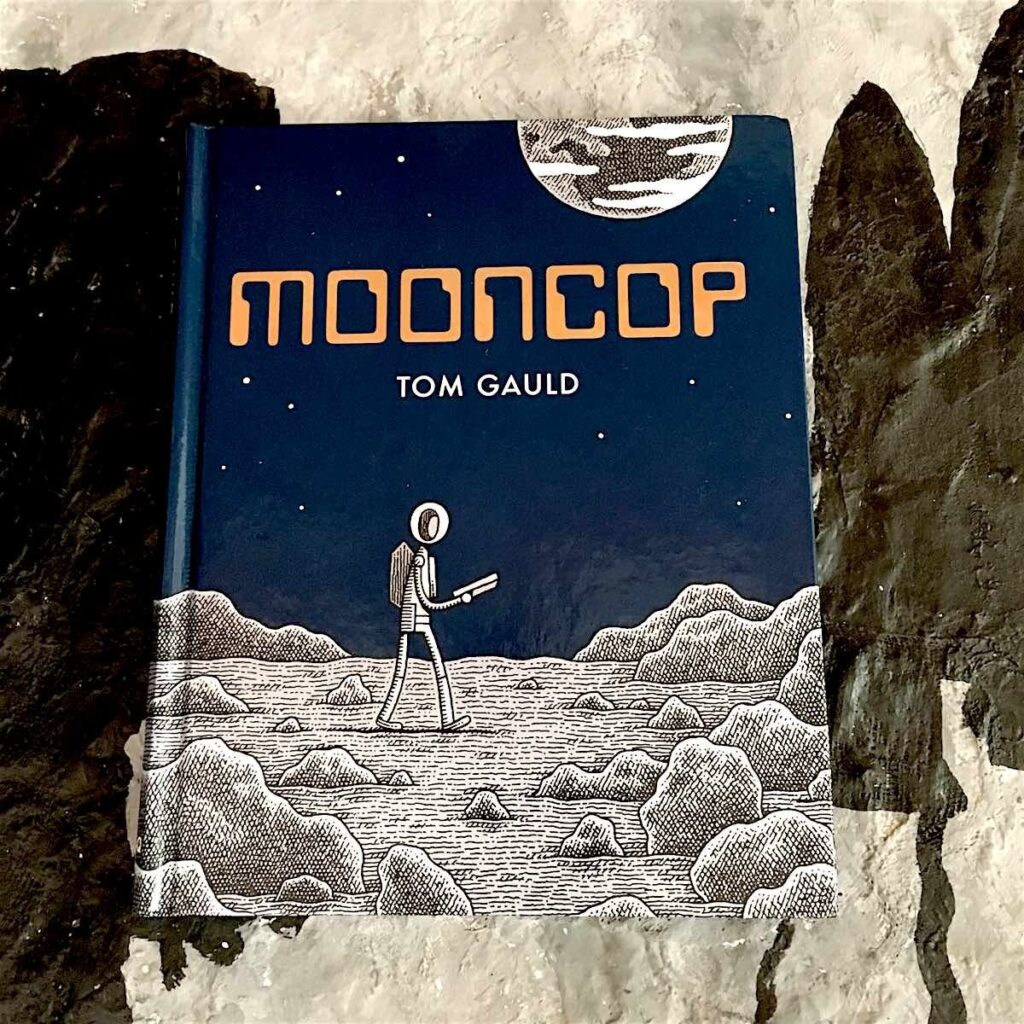

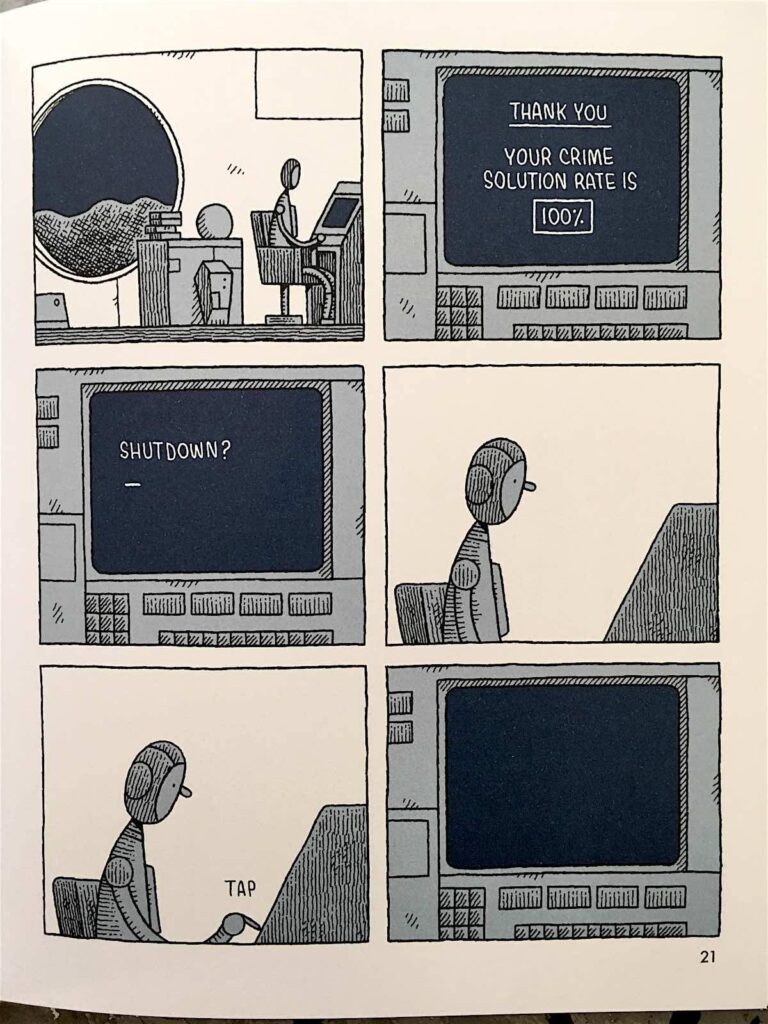

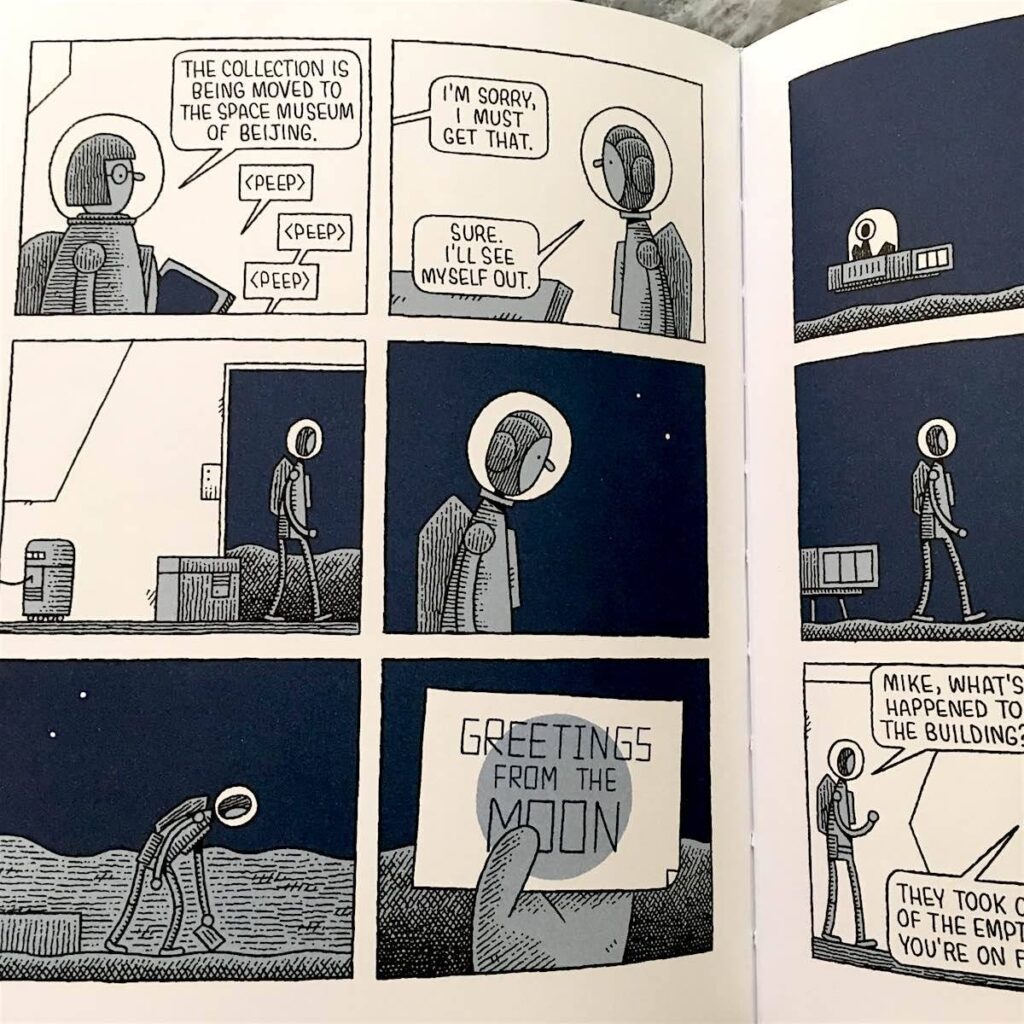

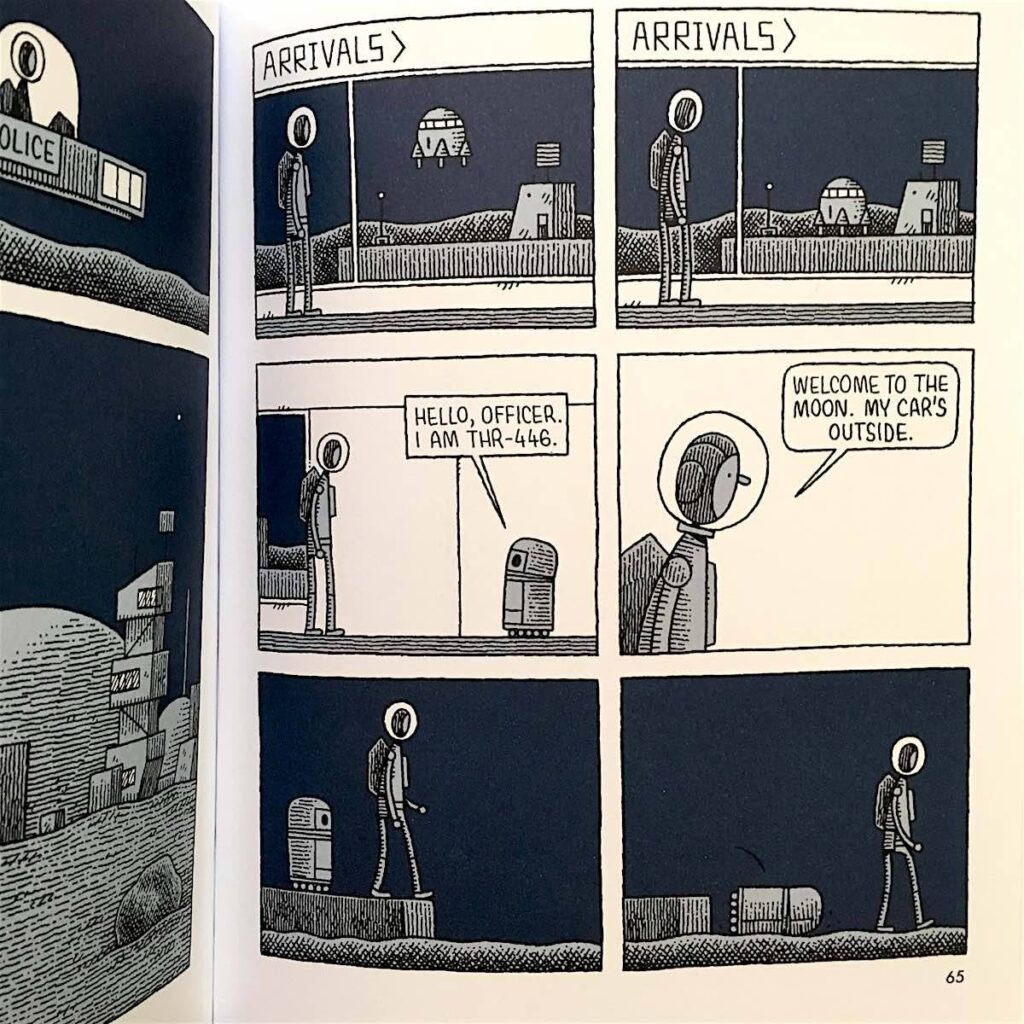

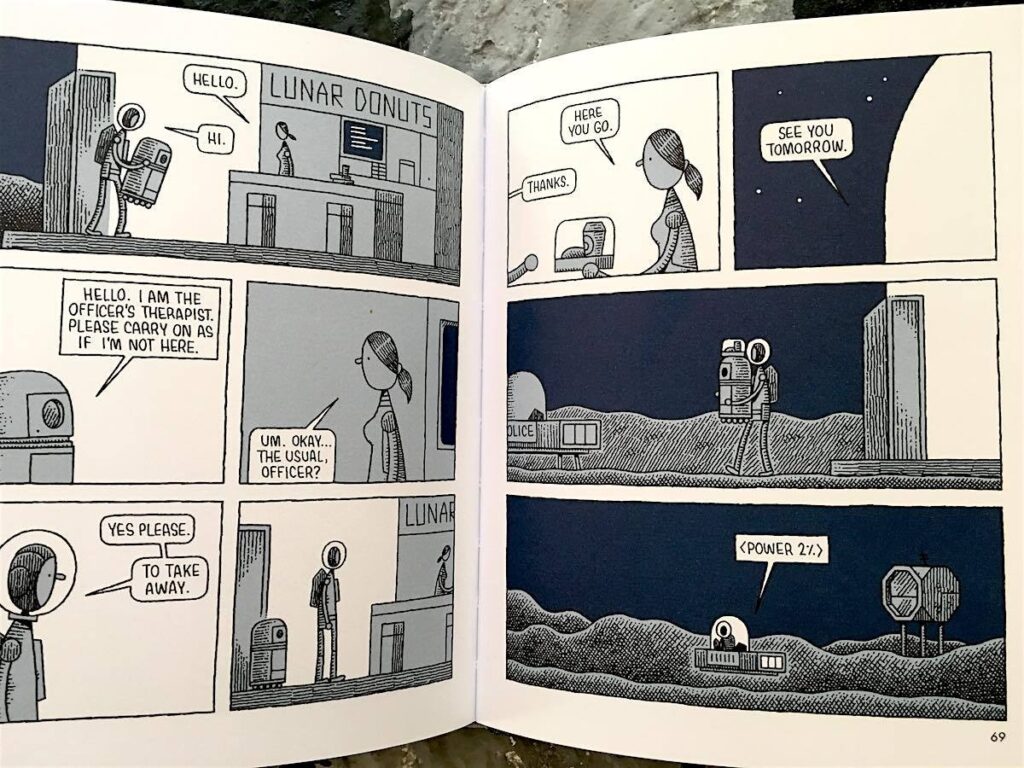

Mooncop

by Tom Gauld

Drawn and Quarterly

2016, 96 pages, 6.6 x 8.1 x 0.6 inches (hardcover)

The great Moon colonization project was a failure. The few diehards who remain in their prefab pod-like houses are going back to Earth. That leaves the unnamed lunar police officer with barely anything to do as operations wind down. Author/illustrator Tom Gauld is in top form with his just-released Mooncop, telling a simple story with a deep layer of existential pathos that even we Earth-dwellers can relate to. – Mark Frauenfelder

SUPER GRAPHIC: A VISUAL GUIDE TO THE COMIC BOOK UNIVERSE

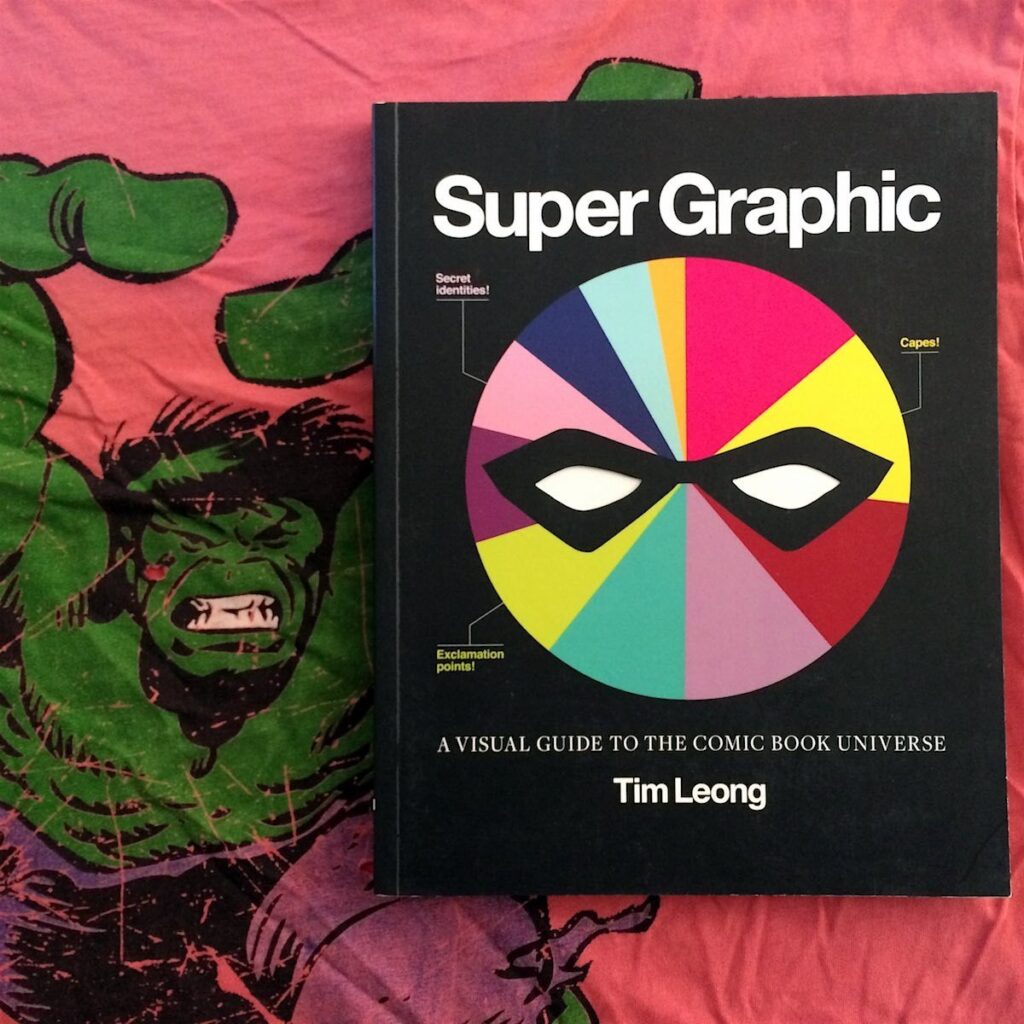

Super Graphic: A Visual Guide to the Comic Book Universe

by Tim Leong

Chronicle Books

2013, 196 pages, 7.4 x 9.4 x 0.6 inches (softcover)

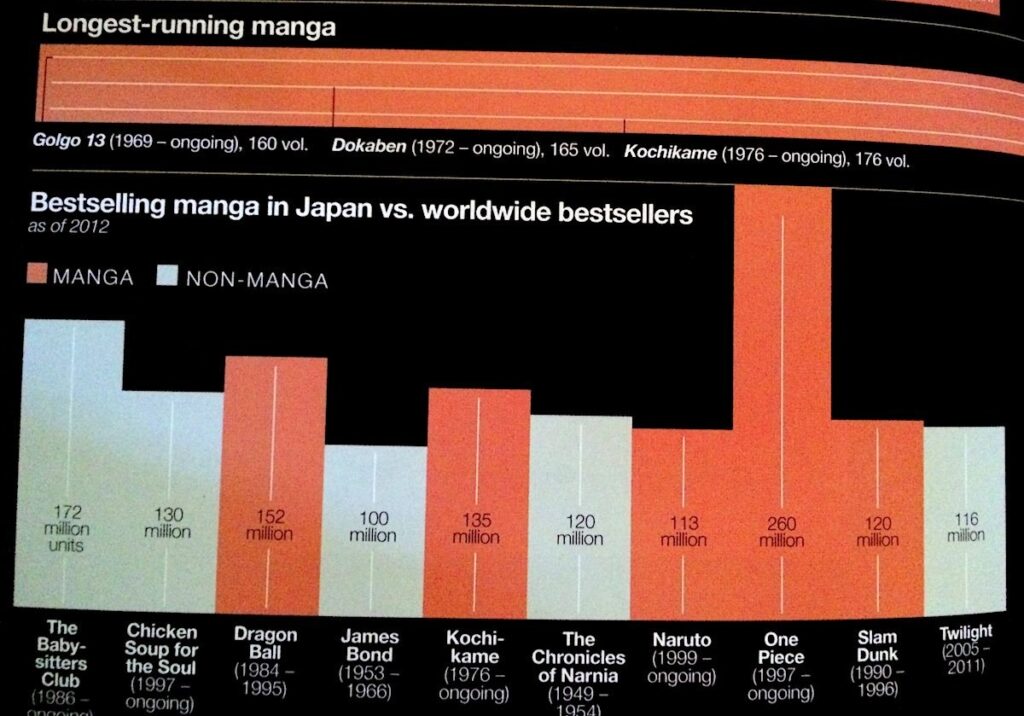

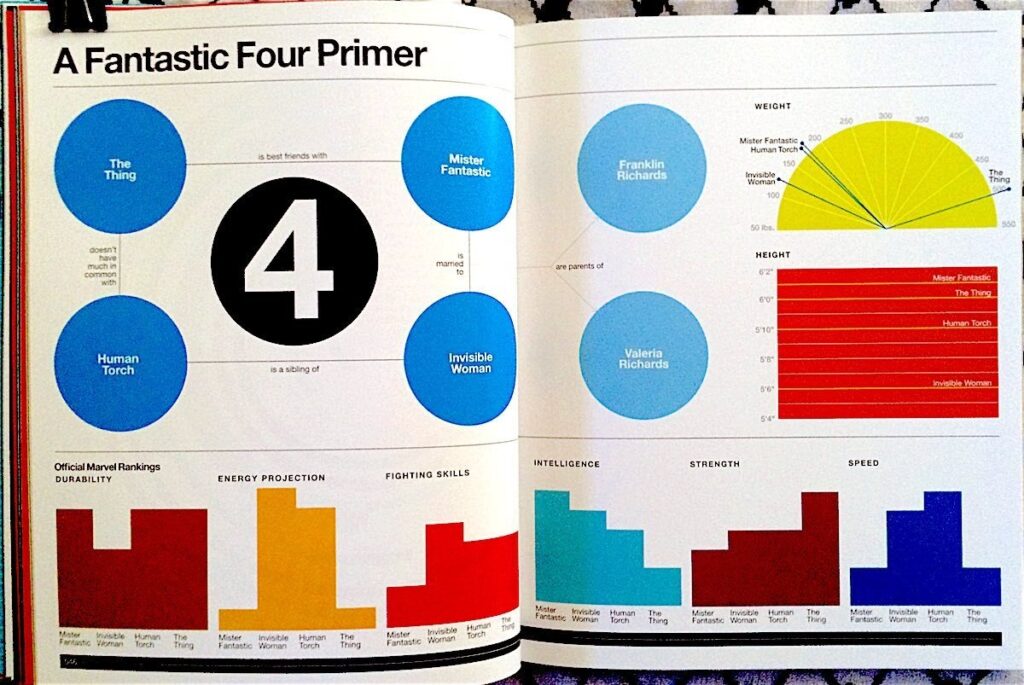

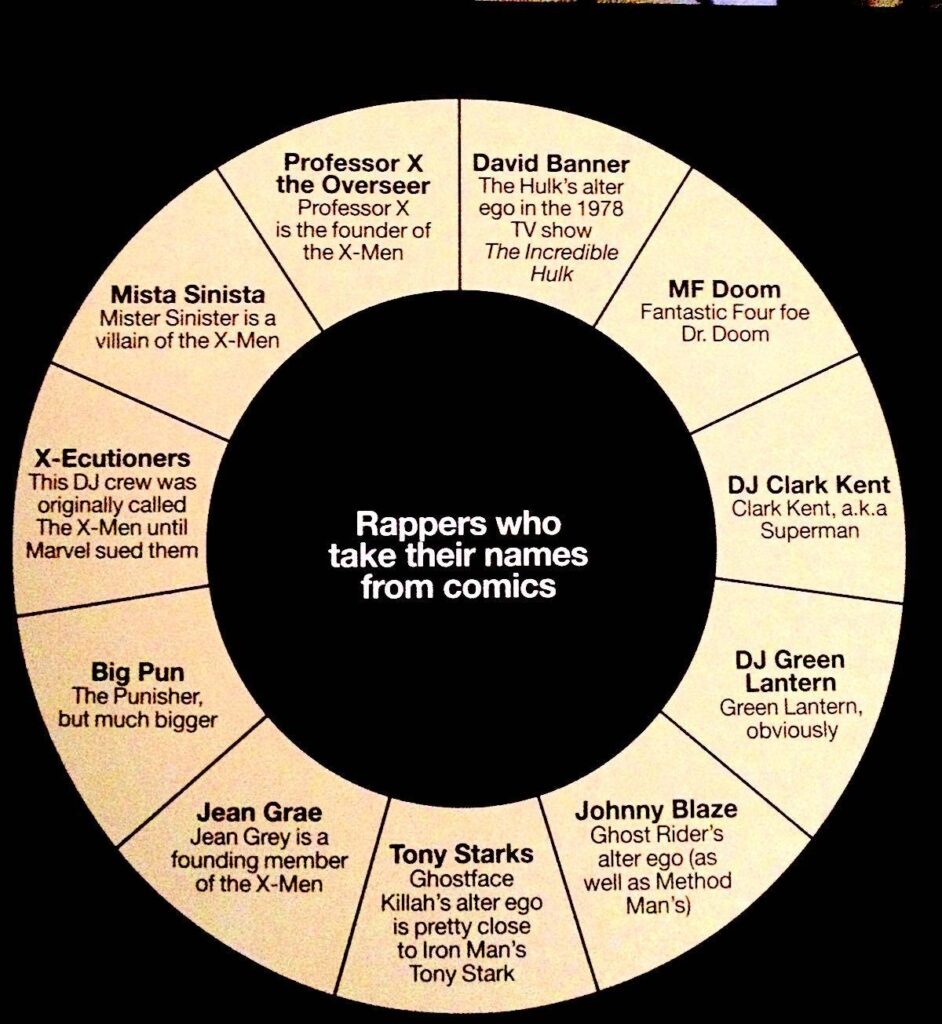

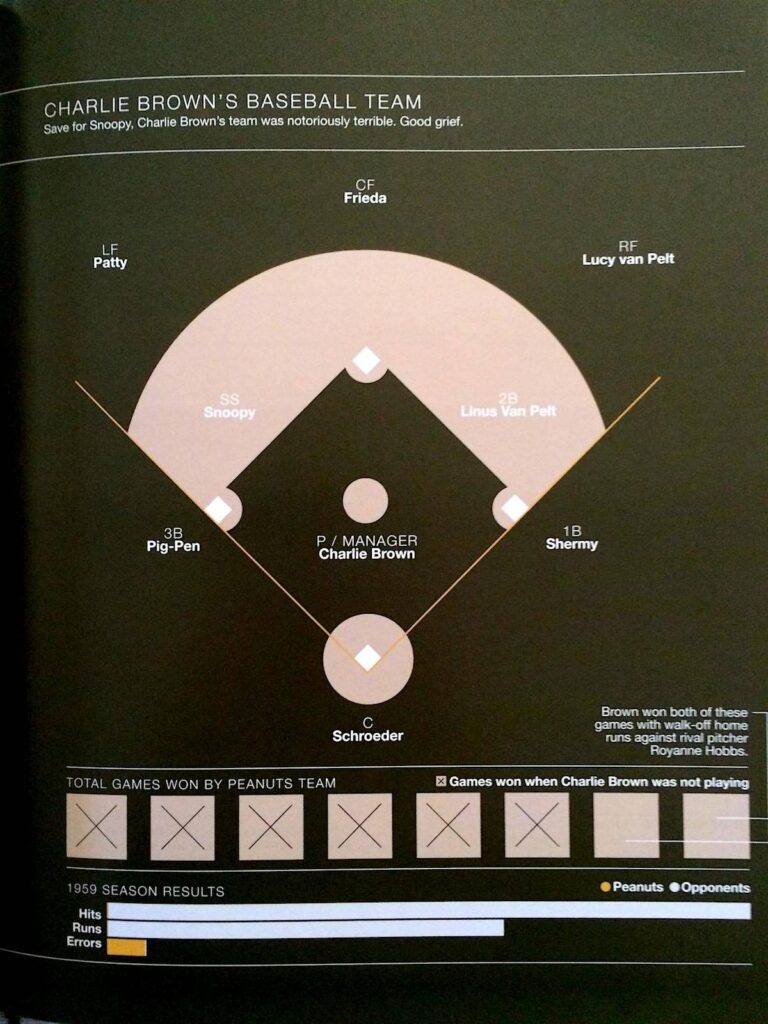

How has Superman’s logo changed shape since it was first created in 1938? How long do comic book characters tend to stay dead? How do the populations of fictional cities compare to New York City or London? Tim Leong’s Super Graphic: A Visual Guide to the Comic Book Universe uses bright maps, word webs, graphs, and flowcharts to answer questions like these and illustrate correlations among different comic book characters. Most of his information comes from the usual Marvel and DC superhero comic books, but he also analyzes information from such classics as Tin-Tin, Peanuts, and Archie comics.

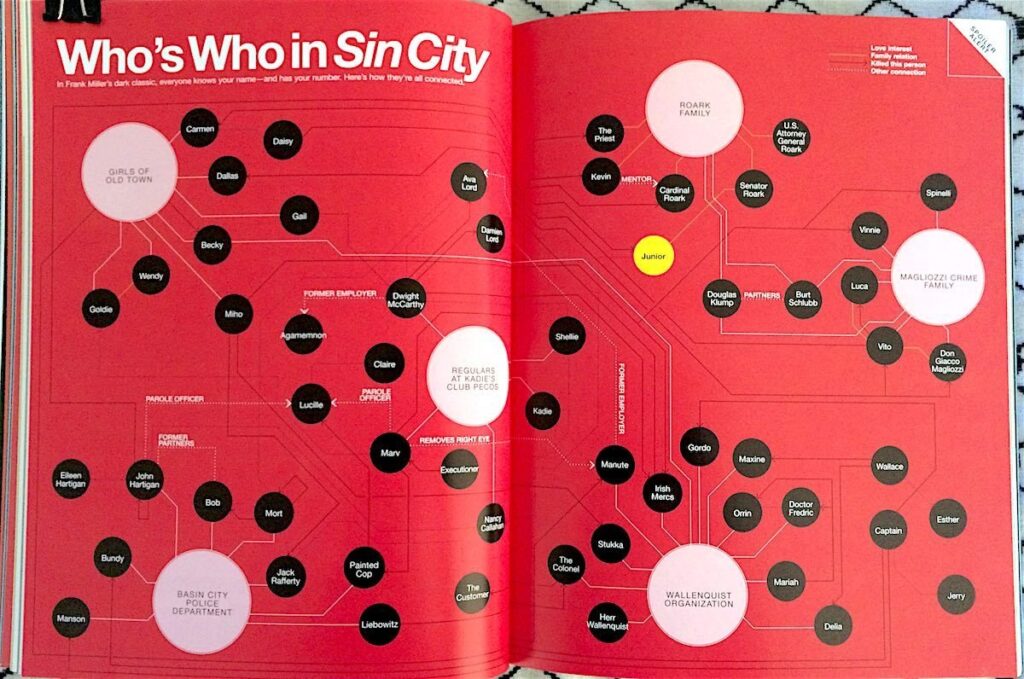

The smartest graphs show Leong’s skill for bringing together information into succinct visuals, such as the charts showing that superheroes tend to wear primary colors while supervillains tend to wear secondary colors. Other spreads draw information from the comic book business or affiliated merchandise. For example, some infographics discuss which demographics reads comic books, which characters won most often in Marvel Universe Trading Card Series, and which comic book writers are the most prolific. Still other pages use the graphs to make sight-gags without providing any insight or trivia. These pages, such as the graph entitled “A Personal History of Saying ‘Good Grief’” which is drawn as the pattern on Charlie Brown’s shirt, are briefly amusing but not the pages to study. Instead, take your time exploring Scrooge McDuck’s family tree, the character web of Sin City, and the pie charts of every weird pizza the Teenage Mutant Ninja Turtles have eaten. You never know when that information might be useful. – Megan Hippler

Books That Belong On Paper first appeared on the web as Wink Books and was edited by Carla Sinclair. Sign up here to get the issues a week early in your inbox.

07/15/2514 July 2025

Big History

Tools for Possibilities: issue no. 146

Compact timeline of global history

Not a map really, but a 5-foot-high chart showing in one glance 4,000 years of human history on a global scale. Thirty years ago I saw this on the wall of someone’s dorm room and it flipped me out then, and every time I’ve seen it since. Its beauty is how Mr. Sparks divies up world power (somewhat crudely) into its main factions graphed in each increment of fifty years since 2000 B.C.E. Different civilizations are color-coded so one can easily trace the flow and ebb of culture over the centuries.

It has three uses for me: whenever I am reading about some historical event I can instantly see what else was going on in the world at that time (for instance, what was happening in France during the Ming Dynasty). I also get a very intuitive sense of the rises and falls of civilizations, a pattern that no other chart or book has been able to give me. And hanging on the wall, it never fails to elicit gaps of shock when visitors recognize our modern place in the chart. At ten bucks, it’s a bargain education.— KK

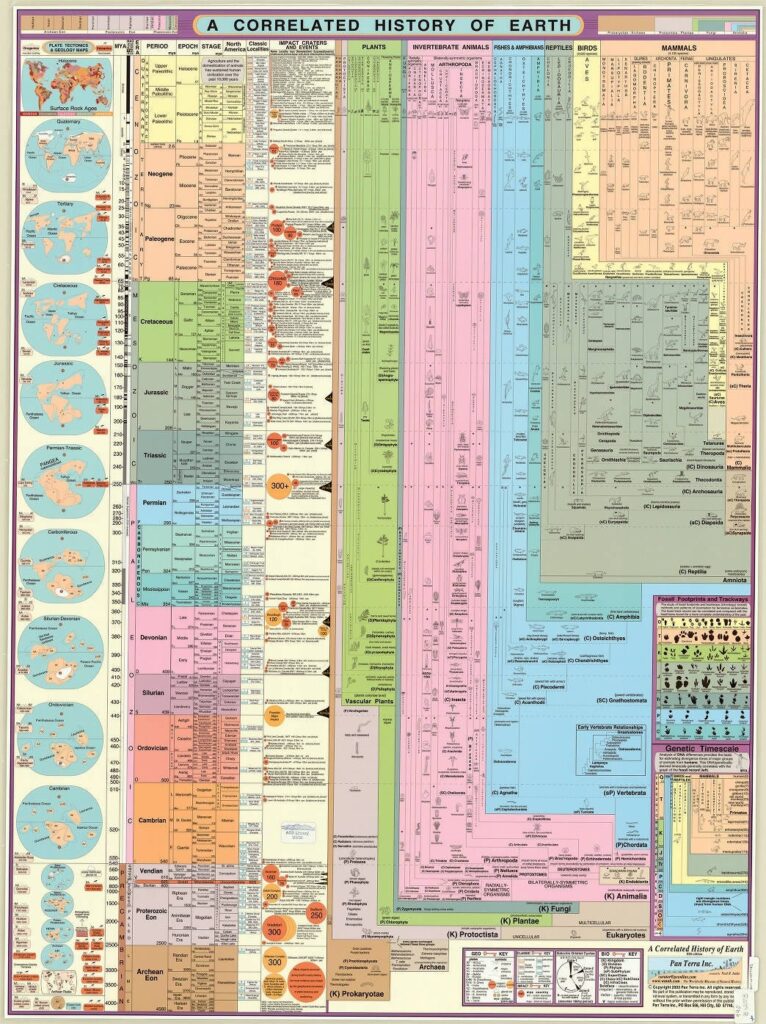

Understanding geological and biological time

The long view. Or rather, views. Geological time and biological time run at such different paces that the two perspectives are not easily brought together. This crisp chart joins them with extraordinary clarity. It lays out the chronologies of continents skittering around the globe, of comet and asteroid impacts, and of life’s increasingly diverse groups of living creatures and how they fit into geological time. And more. Ordinarily, combining such staggering amounts of information would yield mush and muddle. But this exquisitely printed, laminated poster manages to present 4.5 billion years of geology and biology as the unified whole that it is. Like a good map it teaches something at two feet away, or you can get out a magnifying glass and read down for details. — KK

- From the chart’s Web site:

“Included are plate tectonic maps, mountain building events (orogenies), major volcanic episodes, glacial epochs, all known craters from asteroid and comet impacts, over 100 classic fossil localities from around the world, fossil ranges of plants, invertebrates and vertebrate life forms, and major extinction events as revealed by the fossil record. Also evident on this chart are the “Cambrian explosion” of animal phyla and the juxtaposition of reptiles and mammals across the Cretaceous/Tertiary (K/T) boundary. Hundreds of illustrations add a striking visual dimension to the data.”

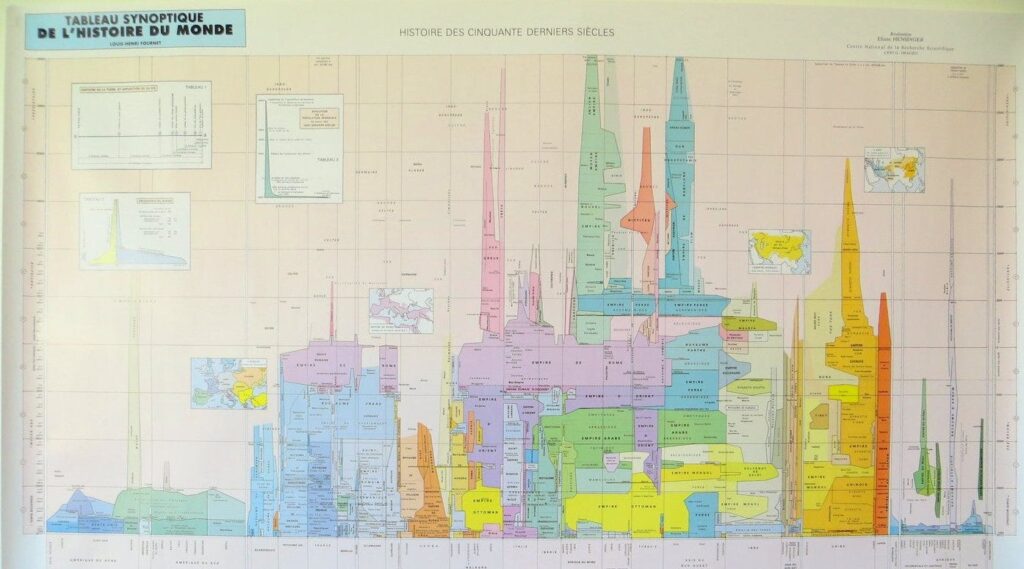

5,000 years of history in one square meter

Diagrammatic Chart of World History

Simply the best overview of the — long now — I am aware of. Displays with utmost intelligence 50 centuries of civilization, as revealed in the complex rise and fall of ancient powers. Because it is not as linear as the famous, previously-reviewed Histomap, it is not as handy for quickly locating a fact in time, but its extra dimensions make this diagram the one I keep returning to to grok the past 5,000 years.— KK

Once a week we’ll send out a page from Cool Tools: A Catalog of Possibilities. The tools might be outdated or obsolete, and the links to them may or may not work. We present these vintage recommendations as is because the possibilities they inspire are new. Sign up here to get Tools for Possibilities a week early in your inbox.

07/14/2513 July 2025

Retro Recomendo: Household Tips

Recomendo - issue #470

Our subscriber base has grown so much since we first started nine years ago, that most of you have missed all our earliest recommendations. The best of these are still valid and useful, so we’re trying out something new — Retro Recomendo. Once every 6 weeks, we’ll send out a throwback issue of evergreen recommendations focused on one theme from the past 9 years.

Unclog sewer drains

We live in an old house and the sewer pipes get clogged a lot. I got tired of paying a plumber $150 to clear the pipe every time it clogged, so I bought this $27 hose attachment, called a Drain King. It’s a rubber bladder that you insert into the sewer line opening. When you turn the hose on, the bladder expands, forcing the water to push the clog out. It has never failed me. Read the glowing testimonials on Amazon for this thing. — MF

Bathroom phone shelf

You are sitting on the toilet but there is no place to park your phone safely. This is an everywhere-in-the-world problem, with a first-world solution: this hefty, heavy solid metal, toilet roll shelf. The shelf is flat, dry, and stable. The roll holder underneath is easy to use. It can also store books, wet wipes, etc. As a courtesy I replaced our guest bathroom roll holder with this, and I like it so much I may do the rest of the bathrooms. — KK

Smudge-free surfaces

I bought a 10-pack of these extra-large microfiber cloths ($12), and now I keep them everywhere—home drawers, office, car, purse. They leave every surface spotless in seconds. I spend at least 10 hours a day staring at a screen or wearing glasses. I never knew I needed something so much in my life. — CD

This vacuum cleaner really sucks

The Bissell Zing Canister (model 2156A) was only $50 and it exceeded my expectations. It is bagless, quieter than any other vacuum cleaner I’ve owned, and has powerful suction. It’s great for hardwood floors (I don’t know how well it works on carpeting since we don’t have any). — MF

Best stain remover

Tipped off by the comprehensive research at America’s Test Kitchen, I’ve found that the best — really the only — stain remover for laundry that really works is sodium percarbonate, which is a powder you need to mix in water before each use. (No liquid spray works nearly as well.) You then soak garments for 6 hours and wash. It completely removes just about any food stain, even stale ones. There are generic versions available but a proven brand of percarbonate is OxiClean Versatile Stain Remover. — KK

Simple strategy for cleaning

The next time you have a big mess to clean up, try the “pile method.” Gather everything that needs to be put away into one giant pile, then sort the items—like with like—into smaller piles. Put those piles away one by one. This way, you avoid getting sidetracked as you put things away. At first, it felt counterintuitive to make one big mess, but it really does speed up the process, and it’s so satisfying to be efficient and tidy. — CD

Sign up here to get Recomendo a week early in your inbox.

07/13/2510 July 2025

Free Bag Checks/San Miguel de Allende/Travel Gear Sales

Nomadico issue #162

Which Credit Cards Score Free Bag Checks?

My flight on Southwest last week may be my last one for a while since they’re heading downhill to join the rest at the bottom, but as long as I keep paying the annual fee for their credit card, one bag will still fly free. While the Chase Sapphire and Amex cards with Membership Rewards are popular for their multi-program transfer options, you need a branded airline card if you fly a U.S. carrier frequently and want to get around baggage charges. The United Explorer, Alaska Airlines, Southwest, and JetBlue cards are the best since the bag fee is waived for all flights, but you’ll get a domestic checked bag included if you pay for one with a card from Delta or American. The annual fee on these is $150 or less and for JetBlue and Alaska, the bag perk extends to companions on the same reservation.

The Complicated Story of San Miguel de Allende

My base in Mexico is an hour and a half from San Miguel de Allende and I’ve probably been there at least 20 times now. I’m usually ready to leave after a couple of days, but there’s a reason it has been named best city or best small city in the world in glossy travel magazines’ polls: it’s a gorgeous place. But what about all those gringos taking over? I like this article about the city for its balanced look at the rising prices, Airbnb boom, and gentrification. They rightly point out that the city gets more domestic visitors than foreigners and many of those expensive mansions are vacation homes for Mexico City residents. (Via the Travel Wire from Nomadic Notes.)

Holiday Gear Sales

Friday is Independence Day in the USA, which provides a good excuse for companies to bombard you with e-mails to implore you to buy something. This is a good weekend to find travel gear and clothing on sale though since the online retailers want to get the slow summer sellers moving and clear out more of the items from past seasons. I gather a bunch of these discount links in once place a few times a year when the markdowns are deepest and you can see the current version that went out yesterday at this link.

The Life of Chuck Movie

I often judge a movie by a) how much it surprises me and b) how long I keep thinking about it in the days after. The Life of Chuck may not be tearing up the summer box office amidst all the reboots and sequels for teens, but it’s getting mostly good reviews from critics and viewers. This pairing of two creators best known for horror (Mike Flanagan and Stephen King) is a trippy, heart-warming tale with lots of twists and turns. Worth seeing in a theater, but it should work on small screens too when it makes its way to airplanes and streaming later.

07/10/2509 July 2025

Book Freak 185: Die with Zero

An approach to personal finance that emphasize maximizing life experiences over wealth accumulation.

This approach to personal finance focuses on maximizing life experiences rather than wealth accumulation. Perkins challenges conventional wisdom about saving and retirement, showing how delaying gratification too long leads to wasted life energy and missed opportunities for meaningful experiences. Die With Zero provides a framework for balancing present enjoyment with future needs.

Core Principles

Strategic Timing of Experiences

Certain life experiences have optimal timing windows based on your health, wealth, and time availability. Rather than indefinitely delaying gratification, invest in peak experiences when you have the physical ability and mental capacity to fully enjoy them.

Memory Dividend

Experiences provide both immediate enjoyment and ongoing returns through memories that can be relived and shared. Unlike material possessions, positive experiences appreciate in value over time through the “memory dividend” of recollection and storytelling.

Peak Net Worth Planning

Rather than maximizing wealth until death, identify your optimal “net worth peak” —s the point when you should start spending down assets to maximize lifetime fulfillment. This typically occurs between ages 45-60 when you still have good health to enjoy experiences.

Try It Now

- Calculate your annual baseline cost of living to determine your minimum survival needs

- List key experiences you want to have and map them to specific time periods in your life

- Take an inventory of your health, time and money to identify your current optimal balance between earning and spending

- Start tracking your “fulfillment curve” by rating experiences on a numerical scale

Quotes

“The business of life is the acquisition of memories. In the end that’s all there is.”

“If you spend hours and hours of your life acquiring money and then die without spending all of that money, then you’ve needlessly wasted too many precious hours of your life.”

07/9/25

ALL REVIEWS

EDITOR'S FAVORITES

COOL TOOLS SHOW PODCAST

WHAT'S IN MY BAG?

02 July 2025

ABOUT COOL TOOLS

Cool Tools is a web site which recommends the best/cheapest tools available. Tools are defined broadly as anything that can be useful. This includes hand tools, machines, books, software, gadgets, websites, maps, and even ideas. All reviews are positive raves written by real users. We don’t bother with negative reviews because our intent is to only offer the best.

One new tool is posted each weekday. Cool Tools does NOT sell anything. The site provides prices and convenient sources for readers to purchase items.

When Amazon.com is listed as a source (which it often is because of its prices and convenience) Cool Tools receives a fractional fee from Amazon if items are purchased at Amazon on that visit. Cool Tools also earns revenue from Google ads, although we have no foreknowledge nor much control of which ads will appear.

We recently posted a short history of Cool Tools which included current stats as of April 2008. This explains both the genesis of this site, and the tools we use to operate it.