technology

Social Media Consumption: Extrapolations

ASK

Extrapolate to 2050:

Individual daily consumption of all media (web-based and traditional)

Individual daily consumption of social media

All Media

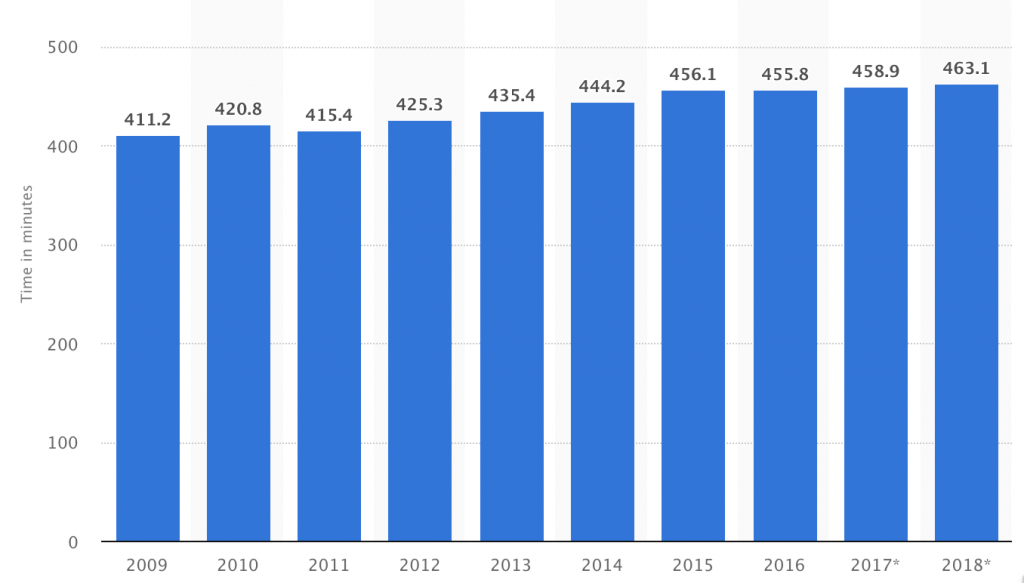

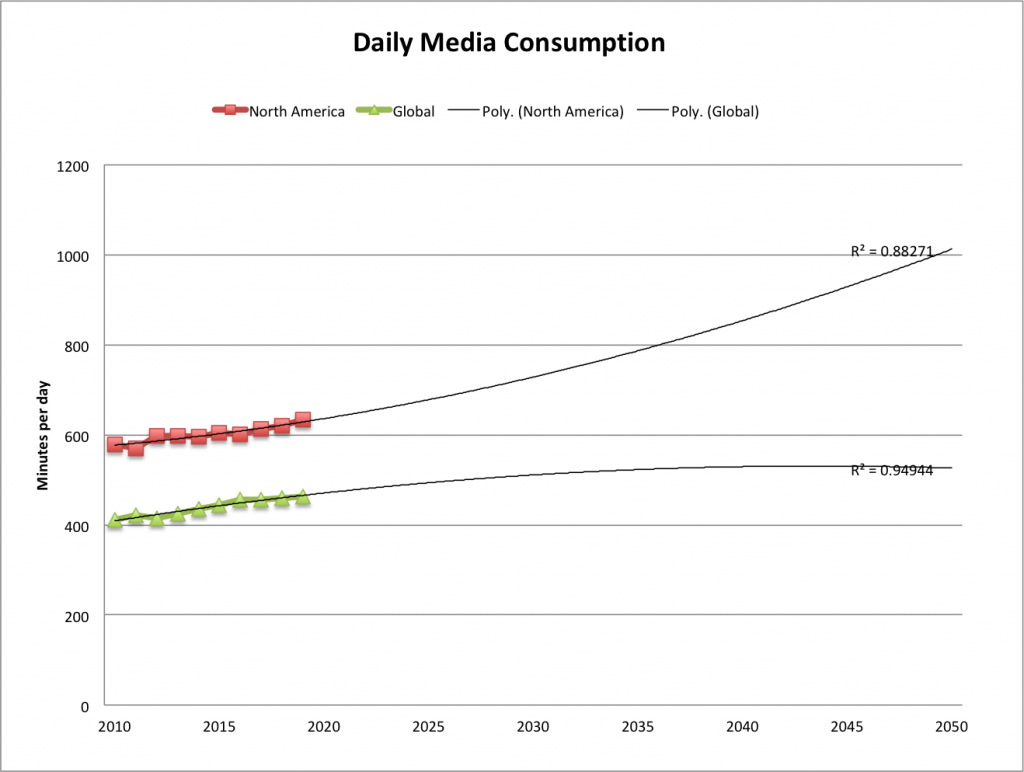

Zenith (a media agency) tracks this info on a global scale (I’ve not found other sources). They’ve only been publishing reports for the last four years, but I found a Recode article that interviews the head of forecasting at Zenith (Jonathan Barnard). This article provides historic data back to 2010, and forecasts to 2019, contrasting North America with the global average. The article was published in May 2017, and Zenith published a new report in 2018 with slightly different data for the last few years and looking forward, but the most recent report does not provide the context of the previous 10 years. For consistency of methodology, I’ve just used the data quoted by Recode for the following extrapolation.

[Excerpts from all four published Zenith reports are below, showing the yearly revision to their data. In summary, the estimates become more conservative with each subsequent report up until the latest report, which shows a jump again.]

[This and all extrapolations in this post in my file media-consump-forecast.xlsx]

src:

Recode, May 2017

“People consumed more media than ever last year — but growth is slowing”

figure: Average individual daily media consumption in minutes

citing Zenith (appears to be from their 2017 report, including historic data available not freely accessible).

*

Here are excerpts from the press releases for the annual “Media Consumption Forecasts” by Zenith.

From the 2018 Report:

2018: 479 minutes per day consuming media

12% more than in 2011

2020: 492 min/day

From the 2017 report:

2019: less than 1% growth

2017: same as 2016

2016: 456 min/day

2010: 411 min/day

From the 2016 report:

2018F:448 min/day

2015: 435 min/day

2010: 403 min/day

From the 2015 report:

2017F:506 min/day

2015: 492 min/day

2014: 485.3 min/day

2010: 461.8 min/day

***

Social Media

eMarketer and Statista both provide estimates of daily social media consumption. The eMarketer figures cover the US, and the Statista figures are global.

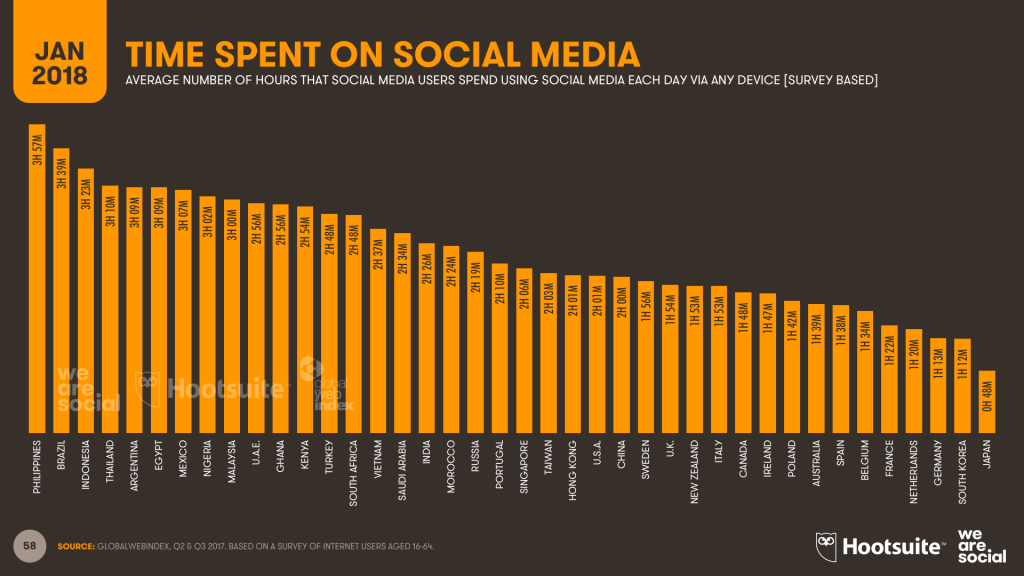

Upon first inspection of the data, the Statista figures seem to be roughly 3X higher than eMarketer’s figures, a disparity that does not agree with my understanding of the variation by country (see We Are Social chart below). I’m quite confident that Statista’s data actually comes from marketing firm Global Web Index, and their recent report (which does not include all the historic info available at Statista) makes frequent passing reference to the increasing amount of time users are watching video on social platforms. In reading various qualitative discussions of social media use, I find many sources group YouTube and Facebook minutes of use together under the social category.

When eMarketer’s social and video minutes are combined, they come in closer range to Statista’s figures, so I believe this is a good rough approximation.

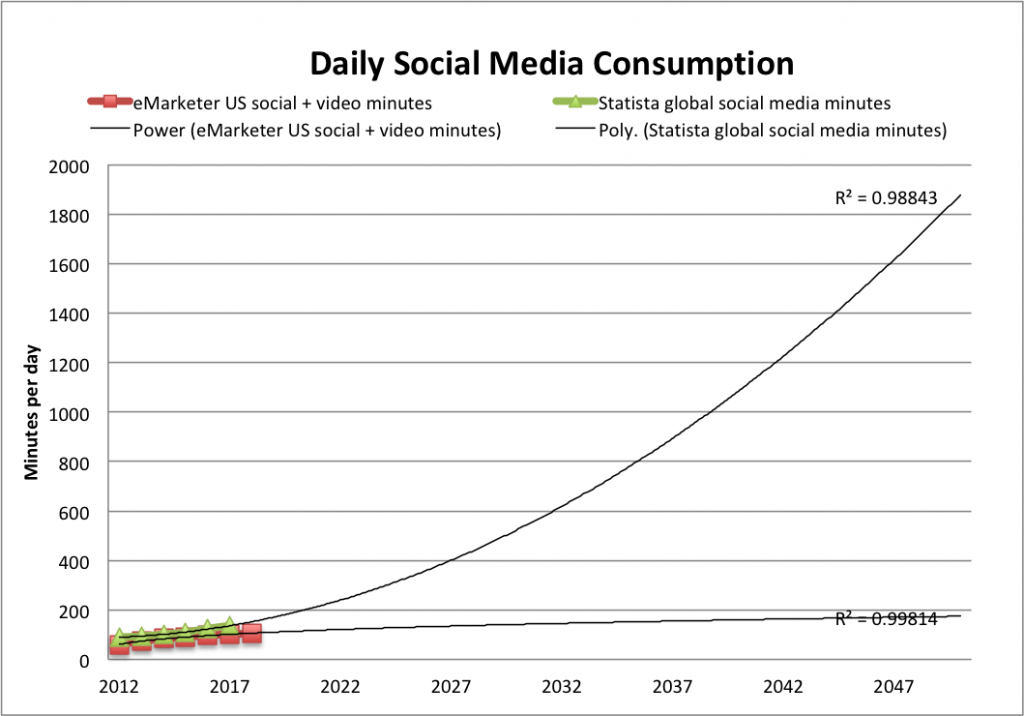

Here’s the extrapolation for both eMarketer (combined social and video) and Statista:

Note: The trendline of best fit for most of our extrapolations doesn’t fit the eMarketer data very well, so instead I’ve used a power trendline. The polynomial(2) trendline we often use does fit the Statista data pretty well, however. (You see both in the figure above)

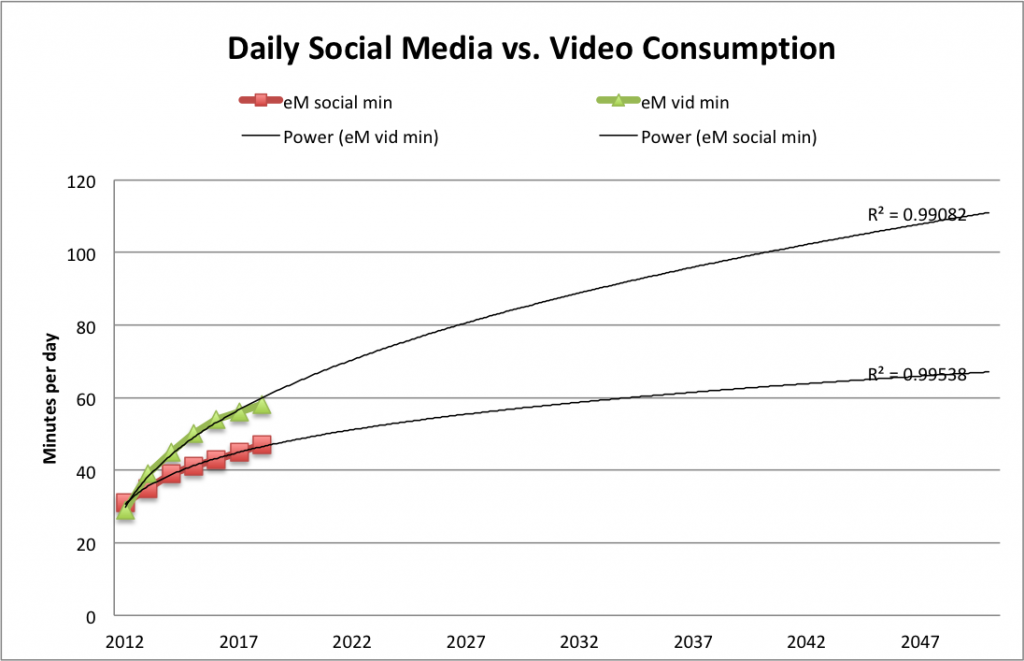

I also noticed in reading qualitative discussions that Facebook and YouTube’s average daily minutes are very similar, with video getting a bit more time, and this is also the shown in eMarketer’s data, with the gap slowly widening in video’s favor. I’ve extrapolated eMarketer’s social and video figures separately to show how that divergence might take shape (again, the power trendline seemed to fit best).

No surprise to see video pulling ahead of social, and I’m certain that marketing research focused on the growth of online video would suggest a much steeper curve.

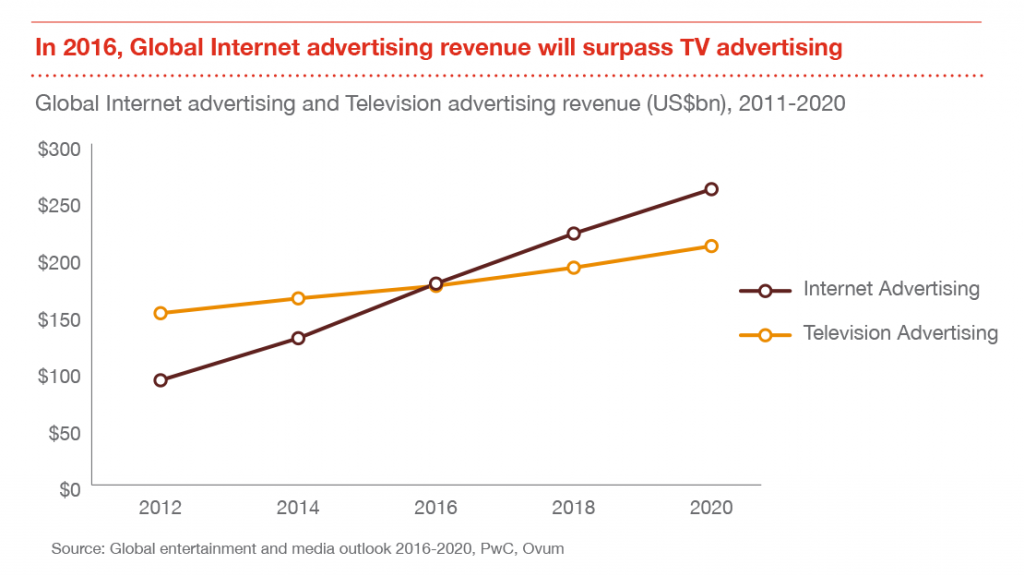

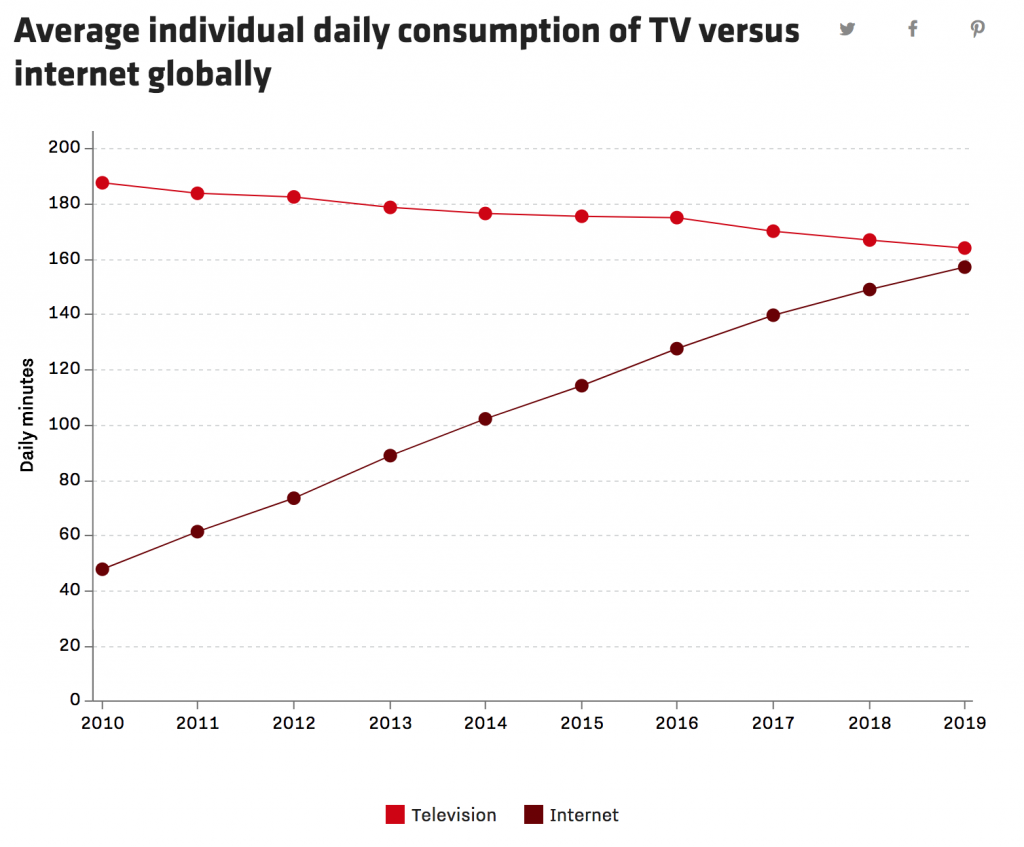

Meanwhile, and also no surprise, here’s a chart (from Recode, citing Zenith) showing that Internet consumption is overtaking traditional TV consumption (from the same source as the Global/N.American overall media consumption figures above).

[Click through to the great interactive version at Recode.]

Another ad media firm, GroupM, also predicts online time overtaking traditional TV this year.

In line with that, this year (2018), globally, advertisers are expected to spend more online than on television for the first time. Interestingly, social media ad spending is expected to rise 21% to $58 billion while video ad spending is rising 19% to $32. (Recode citing Zenith)

Here’s a snapshot from We Are Social showing how social media consumption varies from one country to another in 2017.

srcs:

eMarketer, June 2016

“Growth in Time Spent with Media Is Slowing”

Note:

eMarketer aggregates data from various research firms and they don’t offer much detail (at least, not to unpaid customers). I don’t know if these figures are based on consumer surveys or if they are based on data provided by service providers.

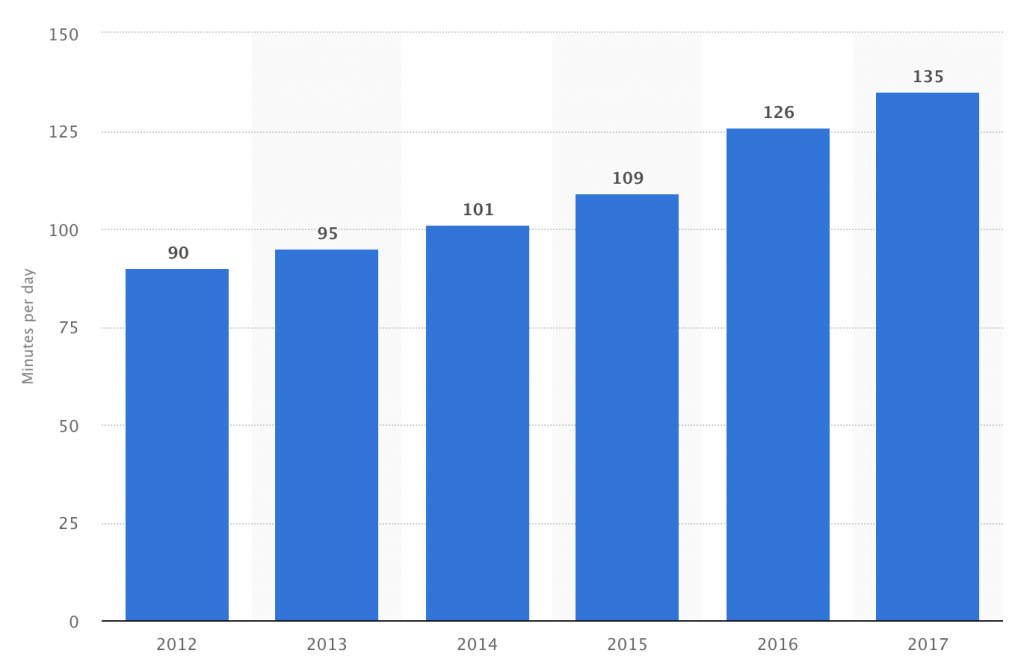

Statista (citing ??, 2017), 2018

“Daily time spent on social networking by internet users worldwide from 2012 to 2017”

Note:

Statista does not give the name of the original source (to unpaid customers), but they do specify that this data is based on worldwide, online consumer surveys of adults aged 16-64. Statista also reports that the survey question asks, “Roughly how many hours do you spend engaging with/connected to social networks or services during a typical day?” The source must be GlobalWebIndex, which conducts web-based surveys. Their latest report (2018) estimates current social media time exactly as reported by Statista. Their press release here describes the same survey question, and the same survey audience (16-64 year olds).

Entrepreneur, in Jan 2018 (date established via InternetArchive), published the following comparative daily consumption figures:

youtube: 40min/day

facebook: 35min/day

Snapchat: 25min/day

Instagram: 15min/day

Twitter: 1min/day

Media/Internet Time Allotment

Overall Media Allotment

src:

Statista, accessed May 2018

citing: info not available (likely eMarketer)

*

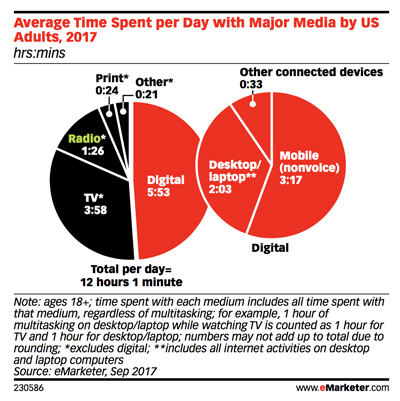

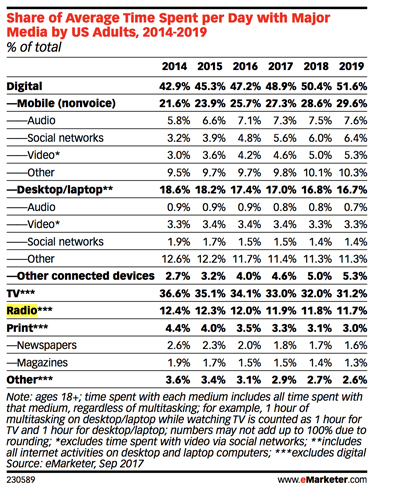

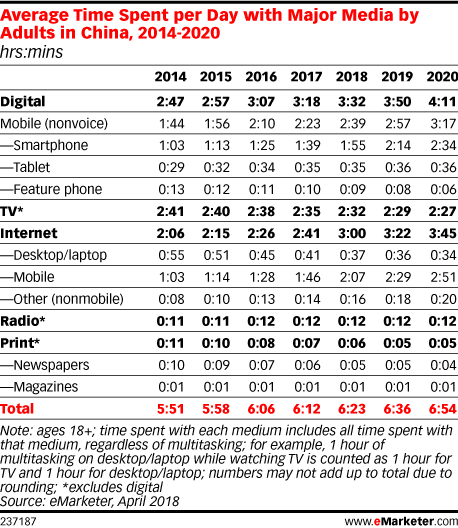

CC’s Note: eMarketer tracks the way people spend their time with media, showing comparison between desk/laptops, mobiles, non-streaming TV, radio, print

src: eMarketer, Sep 2017

via InsideRadio, Oct 2017

“EMarketer: Adults Spend Half Of Daily Media Usage On Digital”

*

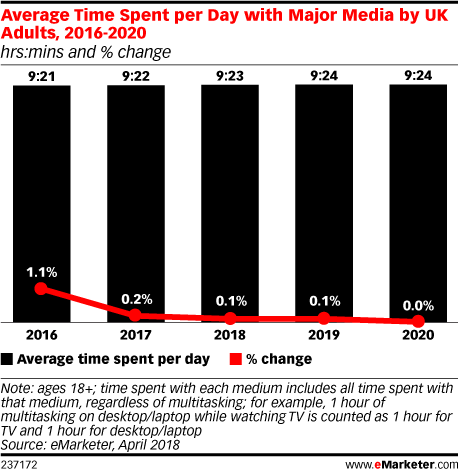

UK Adults’ media time has plateaued

“The way that people consume media will continue to change,” said eMarketer’s UK analyst, Bill Fisher. “Many traditional habits are simply transitioning over to digital devices and platforms, while digital-only habits continue to proliferate. However, what’s apparent from this forecast is that UK adults have reached a plateau. While the media mix may ebb and flow, and it will increasingly flow toward mobile, adults’ media consumption capacity has reached its peak.”

*

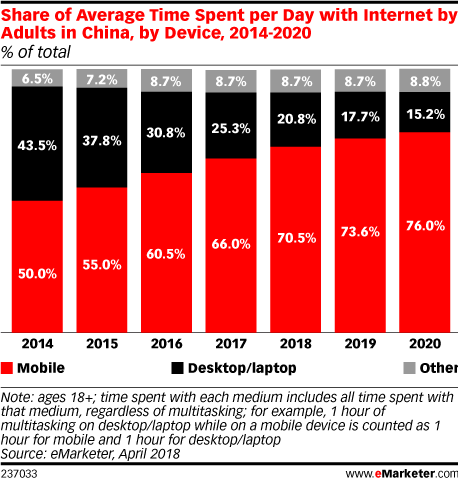

src: eMarketer

small thumbnails retrieved 5/14/18

permalinks (data restricted by paywall)

Average time spent per day with internet by adults in China by Device 2014-2020

Average time spent per day with major media by adults in China 2014-2020

*

In 2017, daily time spent with digital media among adults will top 3 hours in Japan (3 hours 5 minutes) and South Korea (3 hours 26 minutes). Those in India will average less than half that time (1 hour 18 minutes), with digital accounting for just under one-third of total daily time spent with media.

src:

eMarketer, June 2017

*

Daily time spent on social networking by internet users worldwide from 2012 to 2017 (in minutes)

src:

Statista, accessed May 2018

citing: untracked

*******

Mobile Time Allotment

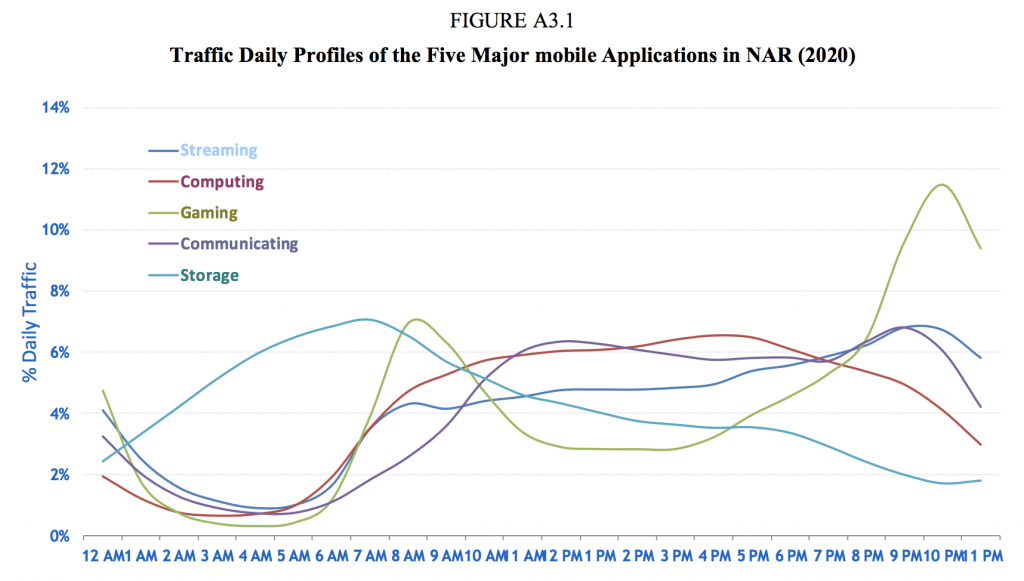

FIGURE A3.1

Traffic Daily Profiles of the Five Major mobile Applications in North America (2020)

Figure A3.1 shows the daily profiles of the five major mobile applications in North American Region (NAR), namely, streaming (audio and video), computing (cloud processing, office productivity, other mobile applications), storage (media sharing, backup and device synchronisation), gaming (casual, interactive or emerging applications), and communicating (voice, video, e-mail and M2M). All these represent human behaviours and they are similar across geographies.

src:

International Telecommunication Union, July 2015

“Rep. ITU-R M.2370-0: IMT traffic estimates for the years 2020 to 2030”

P.40-41

citing:

Source: Bell-Labs, Alcatel-Lucent, 2015.

[CC’s note: Haven’t been able to track this down]

*

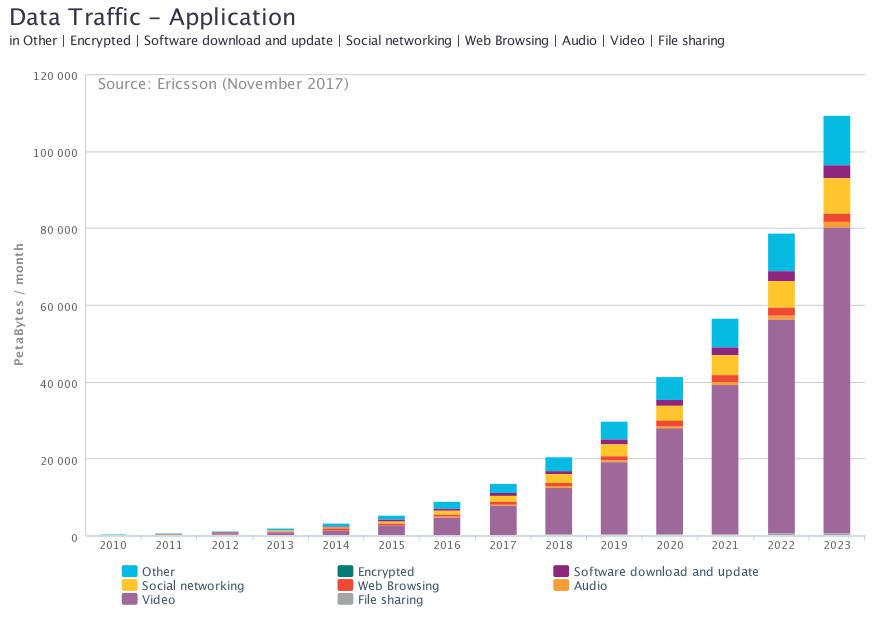

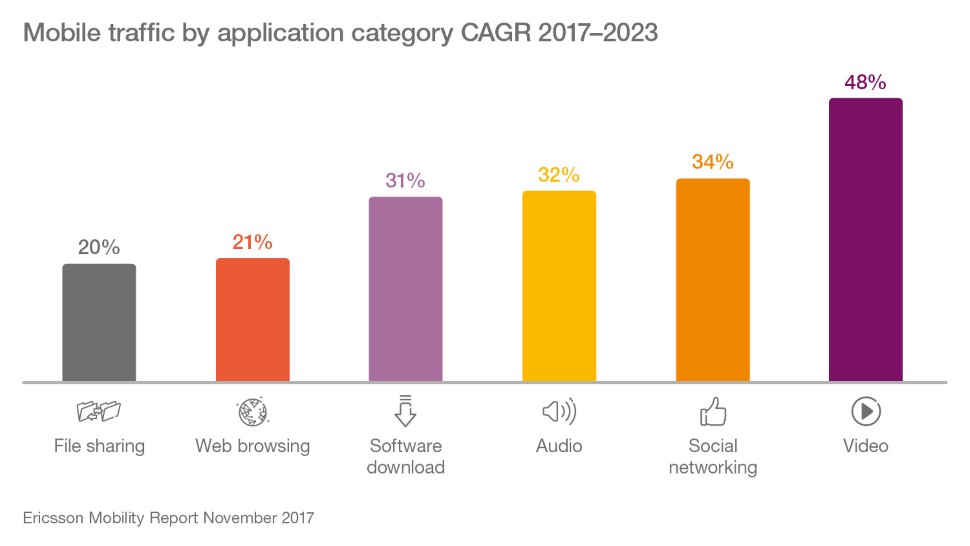

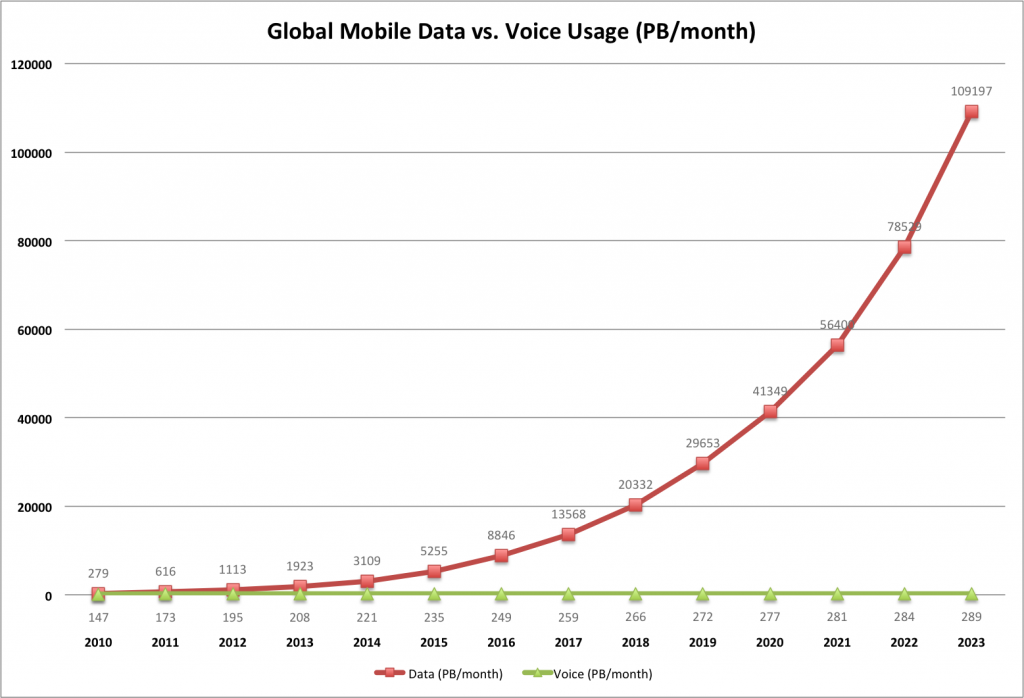

Mobile traffic distribution over different applications

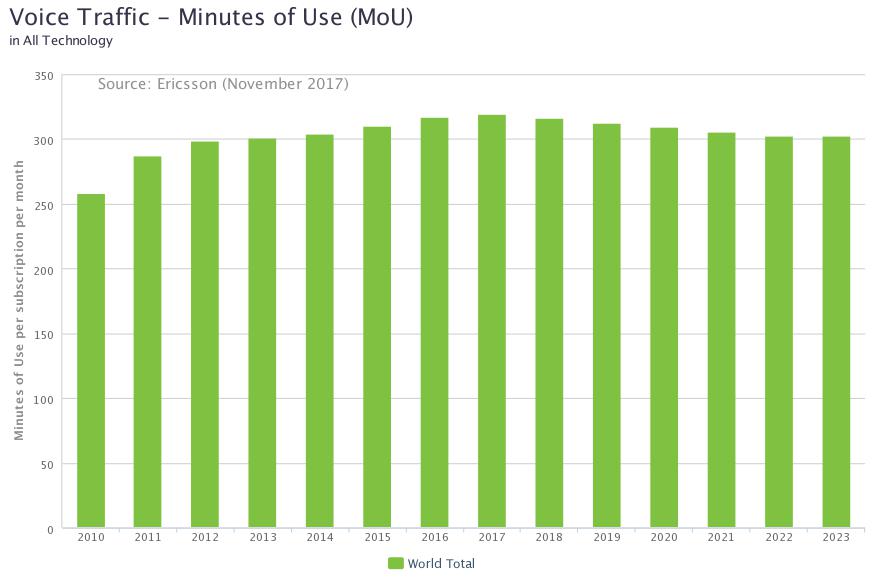

Contrast with voice usage

[Data here: Ericsson-Minutes-of-voice-monthly-2010-2023.xls]

src:

Ericsson, Accessed May 2018

Traffic Exploration [interactive data tool]

*

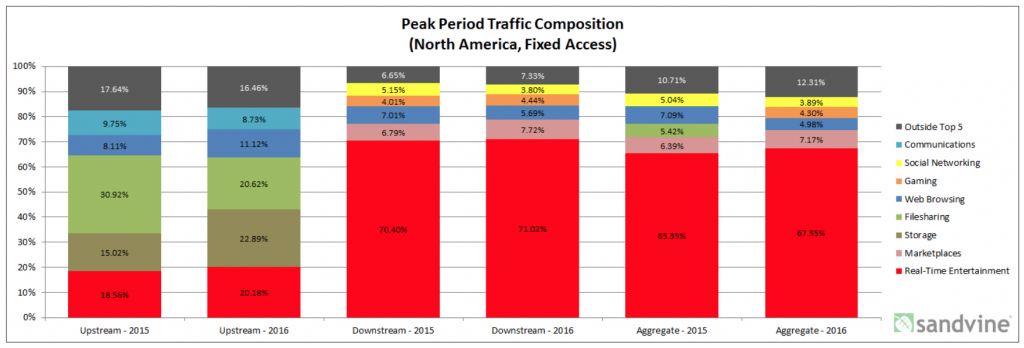

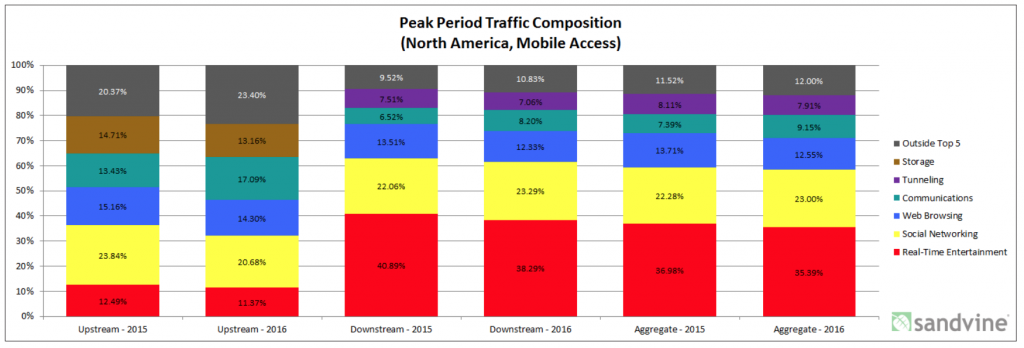

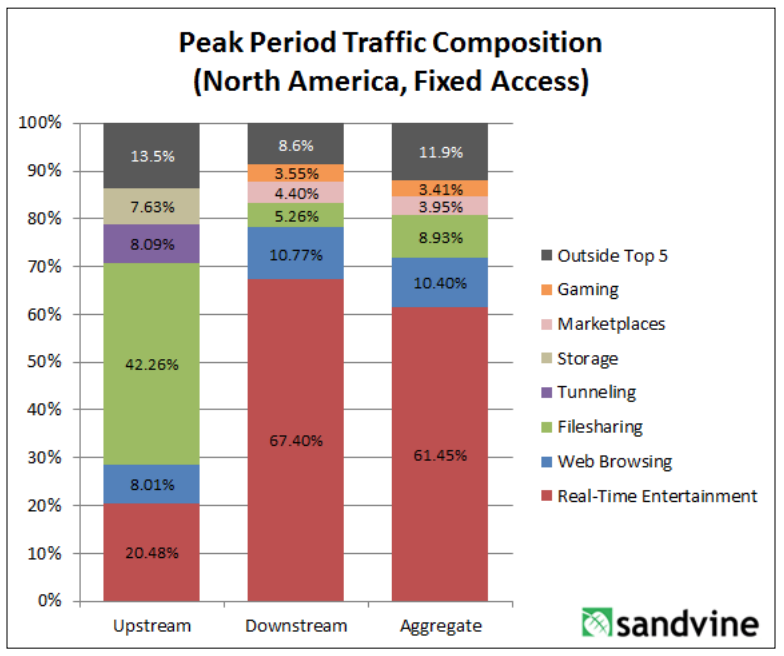

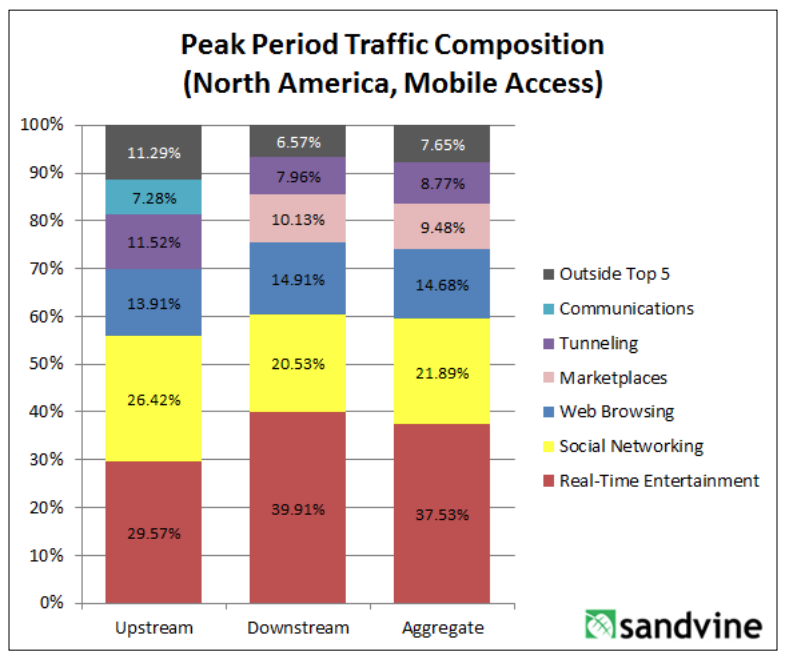

Sandvine, a Canadian network intelligence firm, tracks traffic composition. They’ve published a few reports with the current and previous year’s data, but I haven’t found anything more longitudinal. The reports describe peak period traffic composition across the following categories: real-time entertainment, marketplaces, storage, filesharing, web browsing, gaming, social networking, communications, and other. There are separate charts for mobile and fixed access.

from

“2016 Global Internet Phenomena: Latin America and North America”

from

“Global Internet Phenomena Report: 2H 2013”

CC’s Note: I’ve not been able to find a more recent version of the report. Sandvine was acquired recently, although the report author is still with the company. Could contact him to ask. Dan Deeth: ddeeth@sandvine.com

*

Comscore is tracking differences between desktop and mobile internet usage.

CC’s note: Not sure if historic data are aggregated, but here’s a sample of recent statistics (covering US, Canada, France, Germany, Italy, Spain, UK, Argentina, Brazil, Mexico, India, Indonesia and Malaysia)

Smartphones are the dominant platform in terms of total digital minutes, in every region Comscore examined.

Most pronounced in India – 89% total minutes

Least noticeable in Canada – 43% of total minutes (42% desktop, 15% tablet)

US: 60% (30% desktop, 10% tablet)

Mobile minutes are overwhelmingly spent with apps – over 80%

Top apps (everywhere, in various rankings) include:

Google Search, Whats App, Facebook, YouTube, Google Play, FB Messenger

Three largest categories where digital time is spent:

Multimedia (includes several large video streaming services), Social Networking, Instant Messengers

Looking specifically at mobile digital time, the top four categories are:

Entertainment, Social Media, Instant Messaging, and Games

On average, Social Media has the largest average share of mobile minutes, but Entertainment is larger in the US and Canada.

Among Social Media apps, Facebook, totally dominates, followed by Instagram, then Snapchat, then Twitter (Twitter’s share is tiny).

Among Messaging apps, WhatsApp totally dominates, then Facebook Messenger (less than half), then WeChat (very small share).

The report includes visualization of platform preferences for certain categories. Business/Finance (which includes banking) shows the most even split between mobile and desktop reach. In the majority of markets, retail is heavily biased toward mobile. News/Information is overwhelmingly biased toward mobile.

(shown for UK and India – both show a fairly even split between desktop and mobile for banking minutes).

The report also includes visualization of subtle seasonality in certain categories of content (shown for UK and Brazil).

src:

Comscore, 2018

“Global Digital Future in Focus”

Mobile Data vs. Voice Usage

ASK: Looking for a visualization of mobile voice/text usage compared with data usage.

CC’s chart

data via Ericsson’s interactive Traffic Exploration tool

Google Drawing shared with KK

*

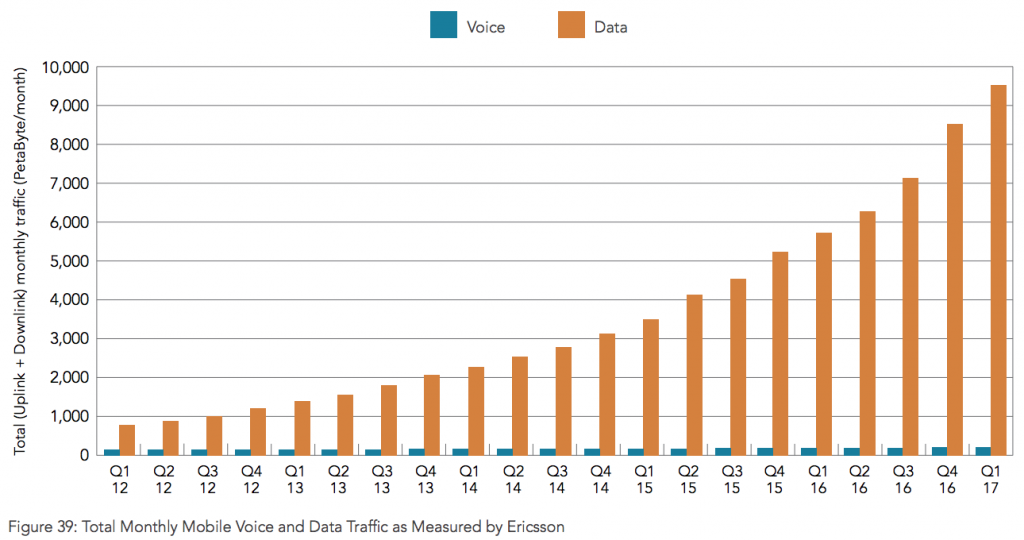

Akamai offers the following commentary on essentially the same historic data, also from Ericsson (emphasis mine):

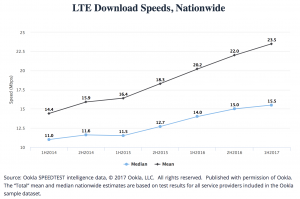

Mobile data traffic has continued to grow, and Figure 39 shows total global monthly data and voice traffic from the first quarter of 2012 to the first quarter of 2017. It depicts a continued strong increase in data traffic, with voice traffic growth having diminished to the low single digits per year. The growth in data traffic is being driven both by increased smartphone subscriptions and a continued increase in average data volume per subscription, fueled primarily by increased viewing of video content. In the first quarter of 2017, data traffic grew nearly 12% quarter-over-quarter and nearly 70% year-over-year. Looking at the full five-year period shown in Figure 39, cumulative voice traffic growth was 28%, while cumulative data traffic growth was more than 1,200%.

referring to:

Figure 39: Total Monthly Mobile Voice and Data Traffic as Measured by Ericsson

Q1 2012 – Q1 2017

src:

Akamai, 2017

“The State of the Internet / Q1 2017”

p.46

citing Ericsson

*

Ericsson survey results and commentary on the expectations for 5G enabling VR/AR mobile applications:

Video now accounts for over 50 percent of all mobile traffic – a figure that is expected to increase to over 75 percent by the end of 2023.

A recent survey* of consumers aware of VR in 8 countries suggested that 7 out of 10 early adopters expect VR/AR to fundamentally change everyday life. These early adopters expect 5G to play a significant role in enriching the shared VR experience by providing lower latencies, haptic feedback and higher resolutions.

In its current forms, AR may be much more suited than VR to mobile applications. However, the line between the two is already dissolving, with merged reality (MR), stereoscopic six degrees of freedom (6DoF) and holographic video on the horizon.

* Ericsson ConsumerLab, Merged Reality (June 2017) Base: 9,200 consumers aged 15–69 in France, Germany, Italy, Japan, South Korea, Spain, the UK and the US

src:

Ericsson, Nov 2017

“Millennials Expectations for 5G”

Social Media Users

Hootsuite and We Are Social publish an annual report detailing internet use and social media growth. In their 2018 report, they list the most active social platforms (slide 59), led by Facebook (2,167B MAUs), with WeChat at #5 (980M MAUs). Because Facebook is still not used in China (not broadly), we have added the Facebook and WeChat user figures to roughly approximate the number of people using social media. At 3.147B, this comes very close to the report’s estimate of active social media users (3.196B).

src:

We Are Social/Hootsuite, Jan 2018

“2018 Global Digital”

full set of slides

I tallied historic MAU data from Facebook (Q3 2008 – Q4 2017) and WeChat (Q2 2011 – Q2 2017)

src:

Facebook via Statista, Jan 2018

“Number of monthly active Facebook users worldwide as of 4th quarter 2017 (in millions)”

src:

Tencent via Statista, Aug 2017

“Number of monthly active WeChat users from 2nd quarter 2010 to 2nd quarter 2017 (in millions)”

I calculated this tally as a percentage of global population, to be compared against the percent of global internet users (reported by the Internet Telecommunications Union).

global population src:

United Nations, Department of Economic and Social Affairs, Population Division. World Population Prospects: The 2017 Revision. (Medium-fertility variant).

via Worldometers

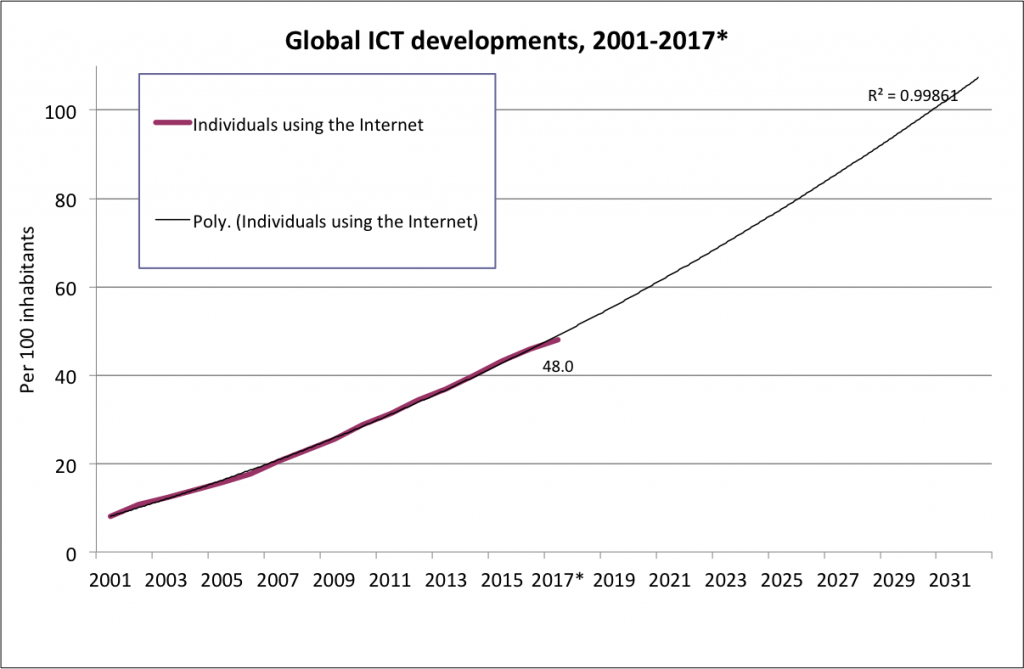

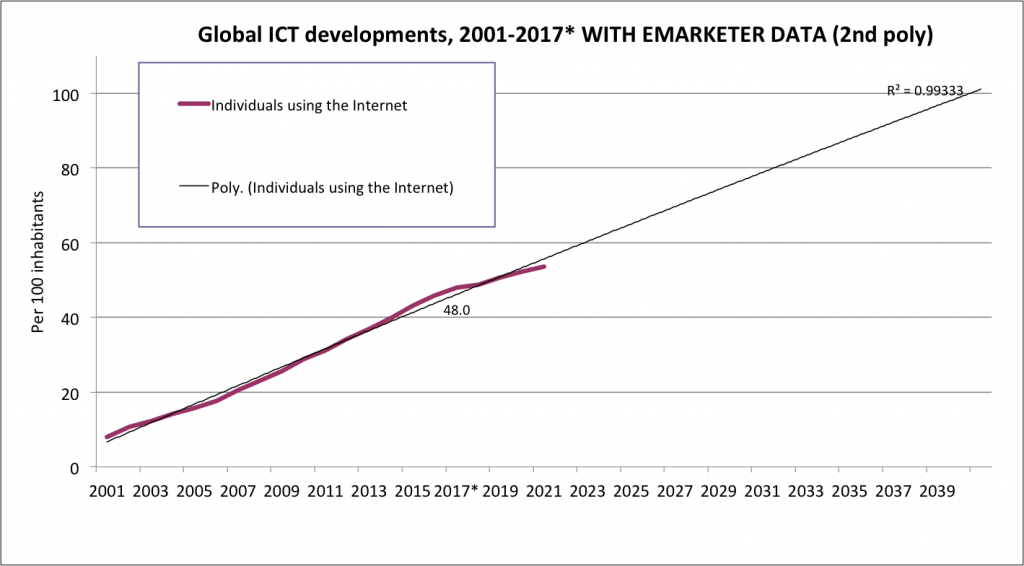

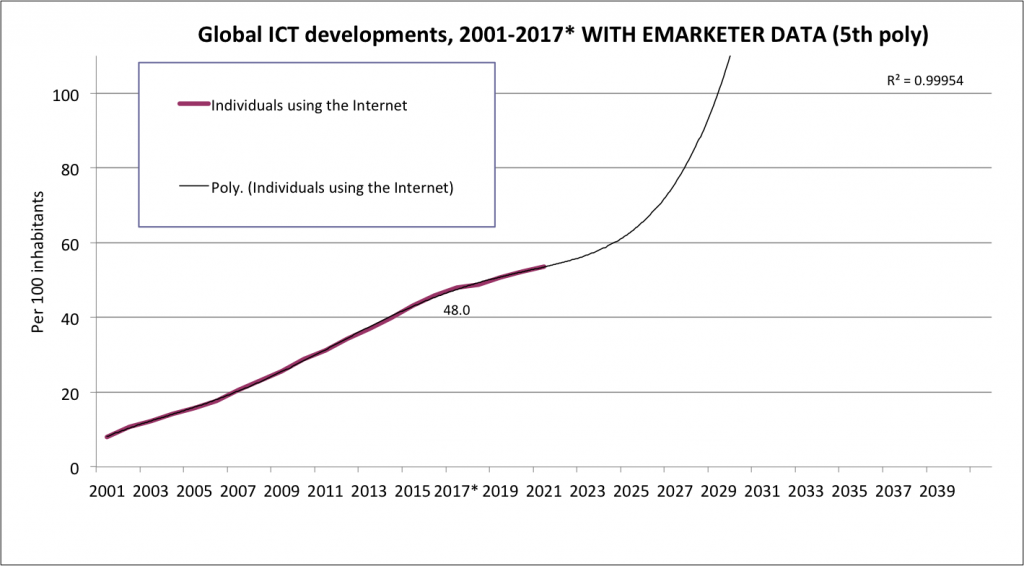

I used Excel to create trend lines (2deg polynomial) showing when each set (internet users and social media users) might reach 100% saturation.

The data are collected in the following Excel file:

global-internet-users-ITU-2001-2017-extrap-to-2030

And a simplified Google Drawing is here:

https://docs.google.com/drawings/d/1qbYyLORAMPYAtwZkrZxN0-VTfjUpPLoZL-SV-z-IB9E/edit?usp=sharing

Other bits of interest:

Dragon Social, Oct 2017

“10 Most Popular Social Media Sites in China”

eMarketer, June 2017

“Percent of Internet users who use a social network at least 1x/month”

2016-2021

Business Insider, Sep 2016

“Messaging apps are now bigger than social networks”

[crossing chart]

2011-2017

100% Internet Penetration

ASK: Forecasts for global 100% internet users?

FINDINGS:

eMarketer publishes a ~5-year forecast of internet penetration every year. It’s most recent publicly accessible forecast showed a downward revision from the previous year’s forecast.

As of June 2016

2014 41.1%

2015 44.3%

2016 46.8%

2017 49.0%

2018 51.1%

2019 53.0%

2020 54.6%

src: eMarketer, June 2016

Revised, as of April 2017

2016 44.6%

2017 46.8%

2018 48.8%

2019 50.6%

2020 52.2%

2021 53.6%

This is the only significant forecast I’ve found for this indicator.

*

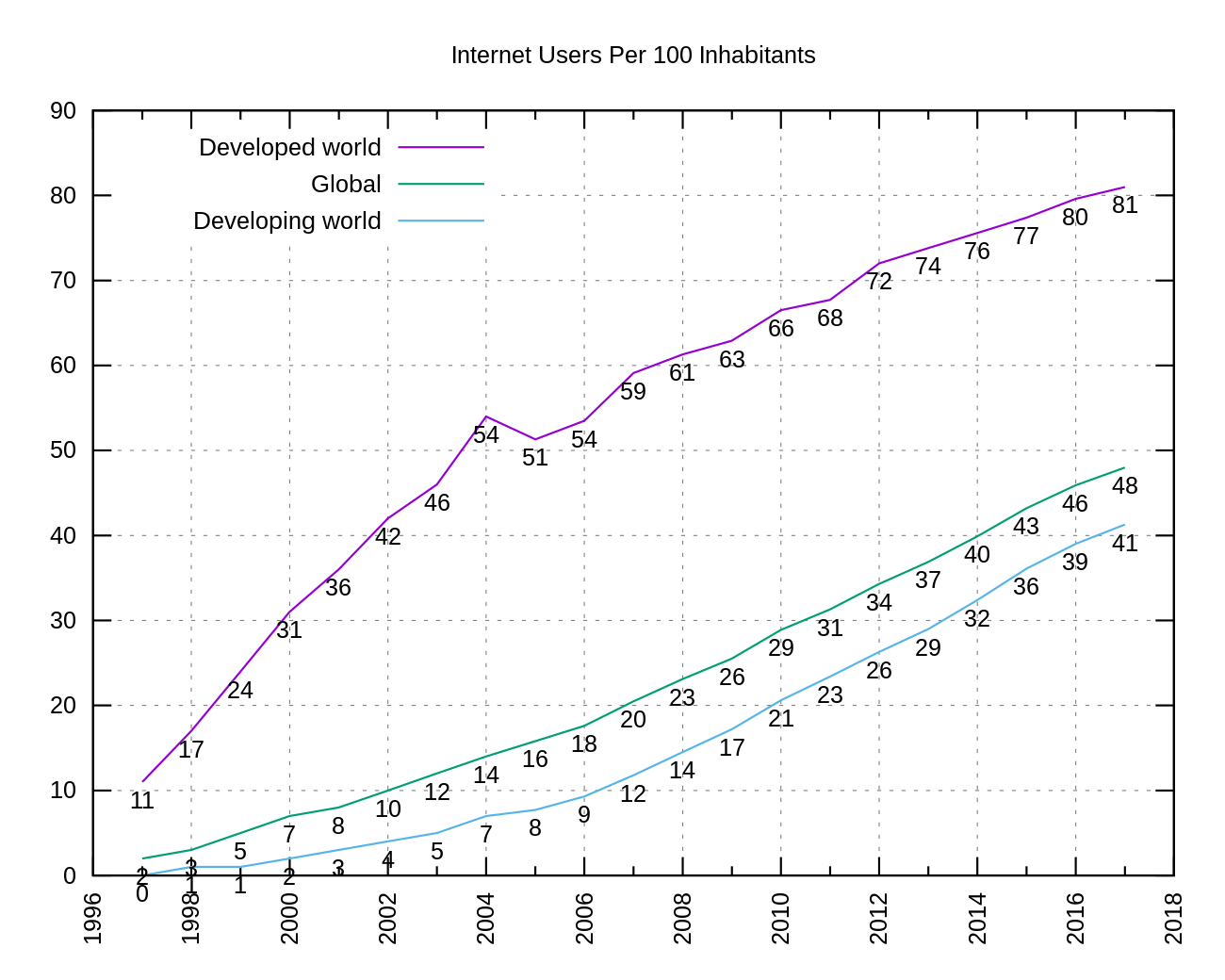

The International Telecommunications Union tracks internet users as a percentage of the global population. Historic data is available back to the mid 1990s.

I’ve added a trendline projection, which suggests ~2030 as a possible saturation date.

However, when eMarketer’s most recent forecast figures are added, the trendline wiggles. The same type of trendline (2nd order polynomial) then delays saturation until 2040.

Adjusting the trendline type (to a 5th order polynomial) gives a better R-squared value, and again brings saturation back to ~2030.

[Black and yellow simplified chart here]

src:

International Telecommunications Union, 2017

“Global ICT developments, 2001-2017*” [XLS file]

Here’s a tidy chart, showing data points, of basically the same data (1997-2017) aggregated at Wikipedia, with separate lines for global, developed world, and developing world:

src: Wikipedia citing Internet Telecommunications Union

*

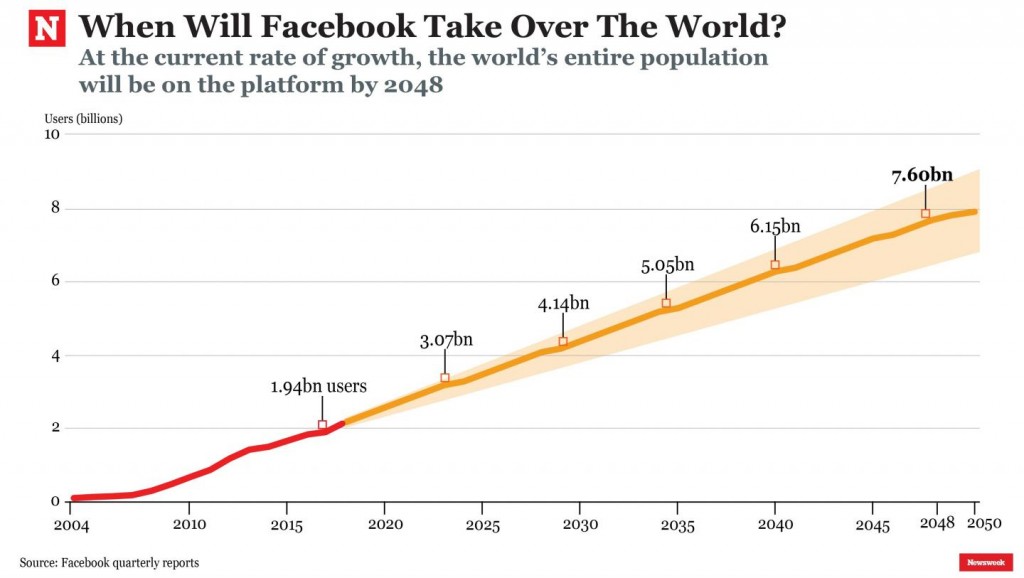

Newsweek projection of when the number of active Facebook users will equal the current (2017) population of the world (7.6B) — 2048

Newsweek’s fine print: The forecast has been calculated only using the annual figures provided by Facebook’s reports since 2004, and does not take into consideration technological progress or demographic changes.

CC’s NOTE: In 2048, the UN medium fertility variant projection for world population is 9.7 billion. At 7.6 billion users, that would be about 78% of the projected 2048 population. That would be a big jump from the 26% of global population FB users accounted for in 2017, but still not literally everyone.

src:

Newsweek, May 2017

“How Long Until Facebook Takes Over The World?”

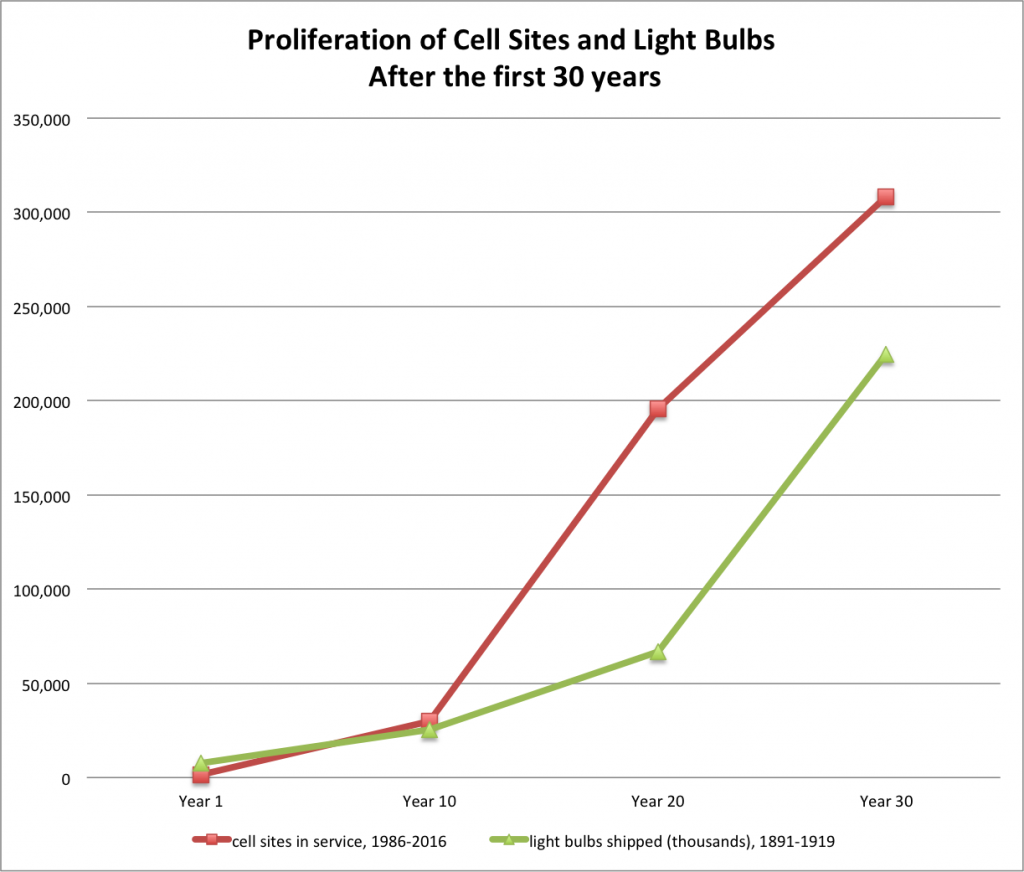

Proliferation of cell sites and light bulbs

NOTE:

This chart reflects production of large incandescent lamps, which include the ordinary electric-light bulbs for residential, commercial, and industrial use. This category excludes miniature lamps such as those for motor vehicles, flashlights, and Christmas trees. (Bright, p.5, Note 2). Production of other types of lamps (miniatures, photofloods, etc) seem to’ve been fairly low in the first three decades of lamp production (1891-1919), but began to ramp up soon thereafter, certainly by 1939 (figures reported in Bright, p. 10), and by 1945 these other categories of lamps accounted for about 36% of total lamp production (calculated based on figures reported by the FTC in 1980, p.34).

DATA

Cell sites in service

1986 1,531

1996 30,045

2006 195,613

2016 308,334

src:

CTIA, 2017

“Wireless Snapshot 2017”

Light bulbs shipped (thousands)

1891 7,500

1899 25,320

1909 66,776

1919 224,713

src:

MIT Studies of Innovation, 1949

Arthur A. Bright

“The Electric-Lamp Industry: Technological Change and Economic Development from 1800 to 1947”

p.4, Table I: The Production Of Large Incandescent Lamps In The United States 1879-1945

NOTE:

Data from these two sources is aggregated in CC’s Excel file: cell-sites-vs-light-bulbs.xls, which includes additional years of data (through 1945) for the light bulb industry, as well as calculated rates of growth.

*

Additional source for light bulb production

Federal Trade Commission, February 1980

“Staff Report on the Development and Structure of the U.S. Electric Lamp Industry”

Excerpts:

Total volume of light bulb industry

1912 90.8 million

1926 478.9 million (527% increase from 1912)

p.103

| Comparison of 1945 and 1974 Shipments of Various Types of Electric Lamps [thousands of units] |

|||

| Type of Lamp | 1945 shipments | 1974 shipments | Percentage change |

| Photographic | 36,447 | 2,406,332 | 6,502.3 |

| Large incan. | 794,402 | 1,532,039 | 92.9 |

| Miniature* | 337,325 | 964,016 | 185.8 |

| Fluorescent | 42,781 | 284,529 | 561.1 |

| Total | 1,250,689 | 5,395,942 | 331.4 |

p.34

*Of the 964,016 Miniature lamps shipped in 1974, 665,208 were used in automotive applications. (p.43)

citing:

U.S. Department of Commerce,_c: Bureau of the Census, Current Industrial Report: Series MQ-36B(74)-5, Electric Lamps, 1975; and U.S. Department of Commerce, Bureau of the Census, Facts for Industry: Electric Lamps, 1946.

Table 111-1 shows the U.S. value of shipments, exports, and imports in SIC 3641 for the years 1967 to 1973. During that time; imports never accounted for more than 6.79 percent of total domestic value of shipments while exports never accounted for more than 5.21 percent. When imports are added to value of shipments and exports subtracted from the whole, consumption can be found. Between 1967 and 1973, 93 percent of the total lamps consumed in the United States were manufactured in the U.S. In the same seven-year period, 94.8 percent of the lamps manufactured in the United States were used in the U.S.

p.38-40

***

OTHER BITS OF POSSIBLE INTEREST…

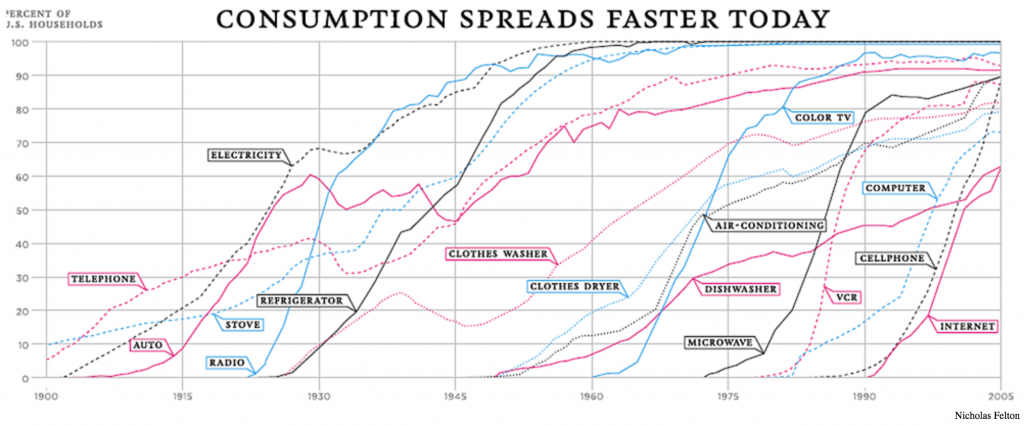

“Consumption Spreads Faster Today”

Chart shows historic penetration rates for new technologies – accelerating over time.

Includes electricity.

Other interesting excerpt:

At the average wage, a VCR fell from 365 hours in 1972 to a mere two hours today. A cellphone dropped from 456 hours in 1984 to four hours. A personal computer, jazzed up with thousands of times the computing power of the 1984 I.B.M., declined from 435 hours to 25 hours. Even cars are taking a smaller toll on our bank accounts: in the past decade, the work-time price of a mid-size Ford sedan declined by 6 percent.

src:

New York Times, February 2008

graphic src:

Nicholas Felton (not sure about data src, although many other version of this chart exist, so it must be widely available data)

And here’s an older version of the chart (1998), different illustrator, additional detail.

And another version, through 2010, which really emphasizes the acceleration of penetration rates.

*

U.S. Housholds by Type of Phone, 1900-2011

src:

Harvard Business Review, Nov 2013

graphic by:

Michael Degusta, MIT Technology Review

using data from Forrester, Knowledge Networks, Net York times, PEW, US Census

*

The History of the Light Bulb – US Department of Energy

Interactive timeline of light bulb technology

Light – Our World in Data

Price (1300 to current, UK), consumption (1700 to current, UK), and access (current, global) to lighting

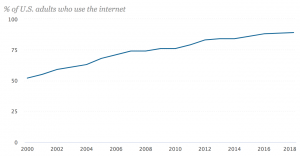

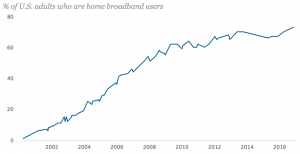

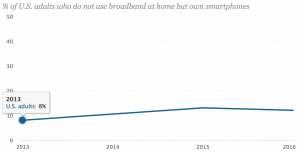

Internet Connectivity and Infrastructure

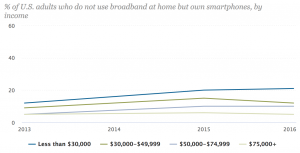

Pew Internet/Broadband Fact Sheet

src:

Pew Research Center, Feb 2018

“Pew Internet/Broadband Fact Sheet”

*

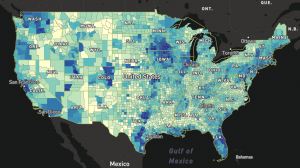

FCC Fixed Broadband Deployment Map

See the source link for an interactive version of the map.

src:

FCC Fixed Broadband Deployment

Accessed April 2018

Note: Discussion of the FCC map and it’s latest version is available here. The latest map is based on 2016 data. FCC does not have an equivalent map for mobile broadband, although it does publish an annual report on mobile wireless competition.

*

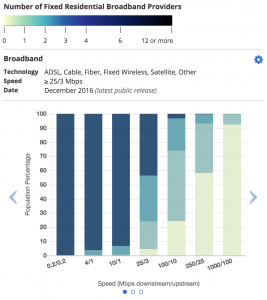

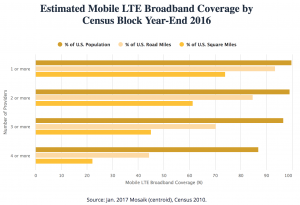

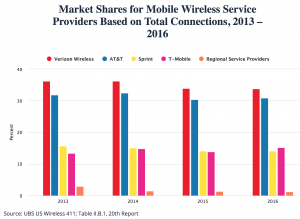

20th Mobile Wireless Competition Report Quick Facts

src:

FCC, September 2017

20th Mobile Wireless Competition Report Quick Facts

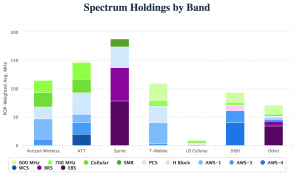

A couple more interesting bits from the full report…

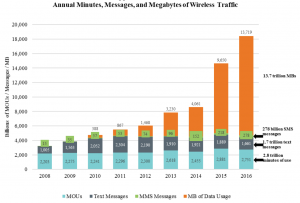

NOTE: MOU = minutes of voice use

[p.72]

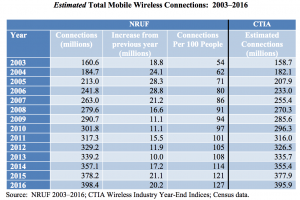

Note: A “connection” is a paid subscription, equivalent to the number of ‘lines’ when discussing landline phone service.

[p.73]

[p.74]

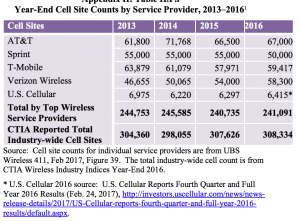

Note: According to CTIA, there has been an approximate 57 percent growth in the number of cell sites over the last ten years (in 1986, there were 1,531 cell sites in service).

The report notes that, according to CTIA, the number of cell sites will significantly increase as the mobile wireless industry densifies and prepares for 5G. Also, because multiple cell sites can be co-located in the same “tower” site, the reported cell sites should not be equated with “towers.” The reported cell sites include repeaters

and other cell-extending devices (e.g., femtocells or distributed antenna systems).

A specialized communications tower industry has developed to provide and manage the

support structures for the cell sites. Today, there are more than 120 tower and DAS operators in the United States, and a majority of towers are now owned or operated by independent companies rather than by mobile wireless service providers.142 Independent tower operators own, operate and lease shared wireless communications and broadcasting towers, manage other tall structure sites (such as rooftops and water towers), and to a lesser extent, own and operate neutral facilities to host small cells and DAS networks for mobile service providers. [p.32]

src:

FCC, Sep 2017

“Implementation of Section 6002(b) of the Omnibus Budget Reconciliation Act of 1993, Annual Report and Analysis of Competitive Market Conditions with Respect to Mobile Wireless, Including Commercial Mobile Services”

*

[In the U.S.] Expected arrival time-frame for 5G roll out with decent coverage and availability in handsets:

early 2020s

(Although 2019 phones will be advertising capacity, even if there’s no network to connect to right away.)

“I believe that eventually consumers will pay for just one broadband connection, fixed and mobile. When I say 50M or more homes, I mean wireless substitution. I think you can draw a parallel with local telephone service and long distance. The long distance business evaporated. Similarly, today’s fixed and mobile broadband services will collapse into one. The cellular operators today are better positioned to take that market.” Peter Rysavy (wireless technologies consultant)

src:

Forbes, Sep 2017

“The Dawn Of 5G: Will Wireless Kill the Broadband Star?”

Ericsson (Nov 2017) has the same prediction for 5G, anticipating coverage for more than 20% of the global population (1 billion) by the end of 2023. First deployments are expected in 2019.

*

Submarine Cable Capacity

src:

Submarine Telecoms Industry Report 2017

[p.17]

*

Network World, Mar 2018

“Submarine cable boom fueled by new tech, soaring demand”

Excerpts:

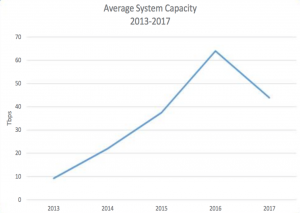

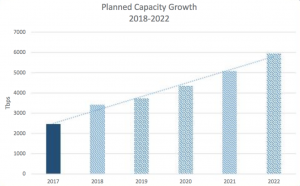

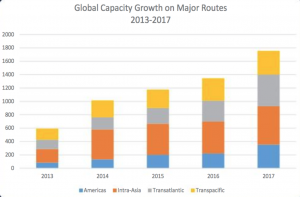

Between 2013 and 2017, the subsea cable industry has added an average of 32 percent of capacity annually on major submarine cable routes.

SubTel Forum projects global submarine cable capacity will increase up to 143 percent between 2017 to 2022, and it also notes that a construction boom is already underway. Last year, 62,000 miles of submarine cable was added globally. This, after global averages didn’t crack 19,000 miles of added cable between 2013 to 2016.

According to TeleGeography, the international capacity deployed by companies such as Google, Facebook, Microsoft, and Amazon rose 14-fold between 2012 to 2016. … By investing in them, these mega-companies get them built faster. They also get a level of control over construction, maintenance and operation that’s ultimately more economical than becoming a paying customer on a telecom’s cable.

[It’s now cheaper to build systems with greater bandwidth. In 2013, new systems averaged 9 terabits per second (Tbps) — multiple systems planned for 2018 and 2019 will have capacities of 60 Tbsp. Tech advances are also eliminating costly and complex infrastructure layers, such as regen equipment. In addition, new cables can land directly inside multi-tenant data centers, rather than a traditional cable landing station (CLS) on the beach.]

*

Telegeography, Nov 2017

“A Complete List of Content Providers’ Submarine Cable Holdings”

This article lists cables owned or strongly supported by Amazon, Facebook, Google, and Microsoft.

Excerpt:

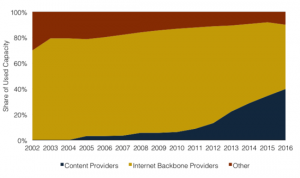

The amount of capacity deployed by content providers has outpaced all other customers of international bandwidth in recent years. Between 2012 and 2016 the amount of international capacity deployed by companies like Google, Facebook, Microsoft, and Amazon has risen 13-fold to 179 Tbps. (In contrast, international capacity deployed by all other operators only rose threefold, to 272 Tbps).

Content providers prioritize some submarine cable routes more than others in their network deployments. Between 2012 and 2016, content provider demand was the strongest across the Atlantic where capacity rose at a compound annual rate of 66 percent to 42 Tbps.

And as such, the largest content providers have built U.S.-centric network architectures. Their investments on systems directly connecting Europe to Asia are almost non-existent, in comparison. In the Atlantic and Pacific, content providers accounted for over half of total demand in 2016. In contrast, content providers represented only a small share of capacity usage on routes connected to the Middle East and Africa.

Used International Bandwidth by Source, 2002-2016

*

Submarine Telecoms Industry Report 2017

Excerpts:

Submarine fiber systems ownership

2013-2017: 61% private, 39% consortium

2018 and beyond: 83% private, 17% consortium

A recent trend towards private ownership has been observed compared to historical trends of primarily consortia ownership. Business cases for smaller systems have been prevalent, and the demand driving these systems has differed from years past. Globe-spanning infrastructure cables that require consortium ownership have fallen out of favor, contributing to this trend shift.

The boom of private ownership will continue to extend well into the future, as more niche and point-to-point systems are implemented. Much of this is driven by intra-regional needs — typically for smaller nations looking to get connected. However, a growing number of systems are being driven by factors not previously seen in the submarine fiber industry.

[p.22]

*

Norway Telecom Trends

The Norwegian Communications Authority prepares a twice annual report of statistics showing developments in electronic communications services, including fixed telephony, mobile telephony and services, broadband and TV transmissions.

See especially Chapter 2, Development Trends, stating on page 11

src:

Norwegian Communications Authority, May 2016

“The Norwegian Electronic Communications Service Market 2015”

Media

Summary

This collection of data includes the following indicators, dates, and sources:

GLOBAL

ownership vs. access ($ millions), 2009-2019, McKinsey

total media consumption CAGR, 2010-2015, Zenith

total media consumption min/day, 2010/2015-2018, Zenith

total internet consump min/day, 2015/2018, Zenith

mobile internet consump min/day, 2016, Zenith

all other (besides mobile internet) media consump % change, 2016, Zenith

desktop internet consump min/day, 2010/2014/2016, Zenith

traditional cinema consump % change, 2016, Zenith

traditional outdoor consump % change, 2016, Zenith

traditional television consump min/day, % of consump, % change, 2015/2016/2018, Zenith

traditional radio consump % change, 2016, Zenith

Traditional newspapers consump, % change, 2016, Zenith

traditional magazines consump % change, 2016, Zenith

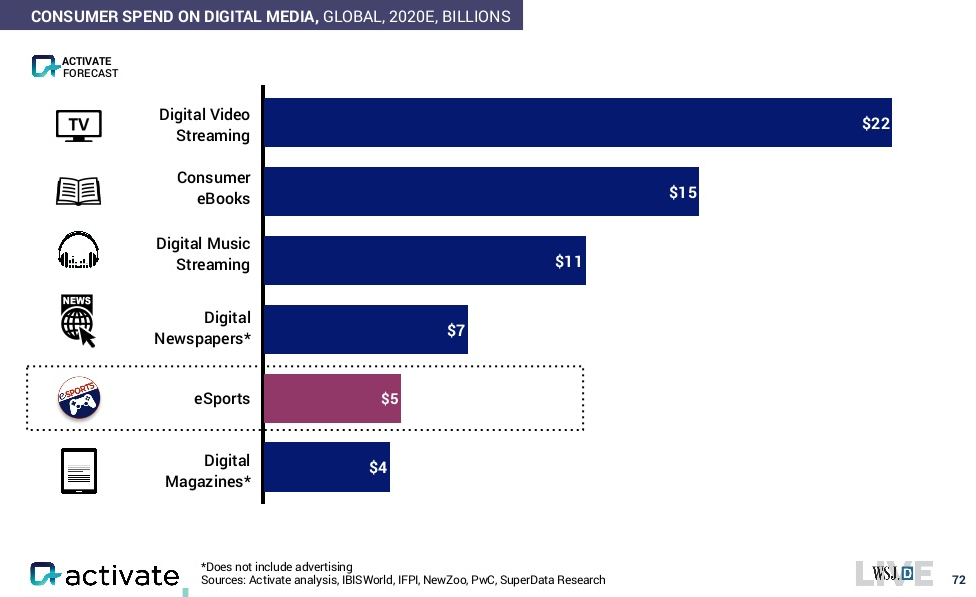

consumer spending, billions, 2020, Activate

digital video streaming

consumer ebooks

digital music streaming

digital newspapers

esports

digital magazines

UNITED STATES PER ADULT

all digital media time/day, 2012-2018, eMarketer

all mobile (nonvoice) media time/day, 2012-2018, eMarketer

mobile radio time/day, 2012-2018, eMarketer

mobile social networks time/day, 2012-2018, eMarketer

mobile video time/day, 2012-2018, eMarketer

mobile other media time/day, 2012-2018, eMarketer

all desk/lap-top media time/day, 2012-2018, eMarketer

desk/lap-top video time/day, 2012-2018, eMarketer

desk/lap-top social media time/day, 2012-2018, eMarketer

desk/lap-top radio time/day, 2012-2018, eMarketer

desk/lap-top other media time/day, 2012-2018, eMarketer

other connected devices time/day, 2012-2018, eMarketer

non-digital TV time/day, 2012-2018, eMarketer

non-digital radio time/day, 2012-2018, eMarketer

non-digital print media time/day, 2012-2018, eMarketer

non-digital newspapers time/day, 2012-2018, eMarketer

non-digital other media time/day, 2012-2018, eMarketer

all digital and non-digital media total time/day, 2012-2018, eMarketer

UNITED STATES, TOTAL AMONG ALL USERS

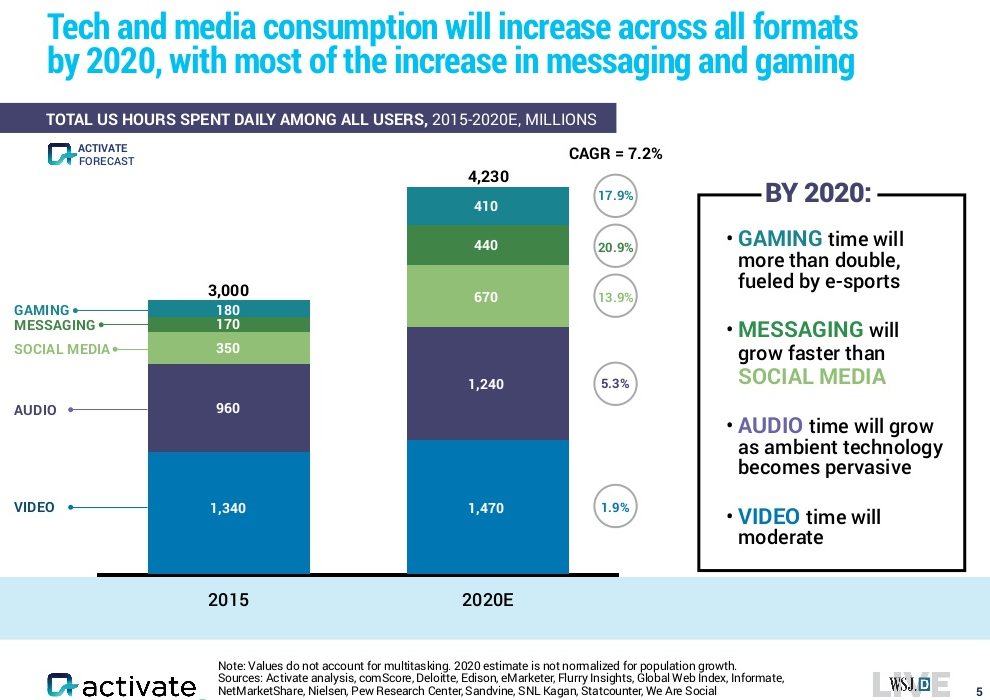

gaming hours/day and CAGR, 2015/2020, Activate

messaging hours/day and CAGR, 2015/2020, Activate

social media hours/day and CAGR, 2015/2020, Activate

audio hours/day and CAGR, 2015/2020, Activate

video hours/day and CAGR, 2015/2020, Activate

UNITED STATES

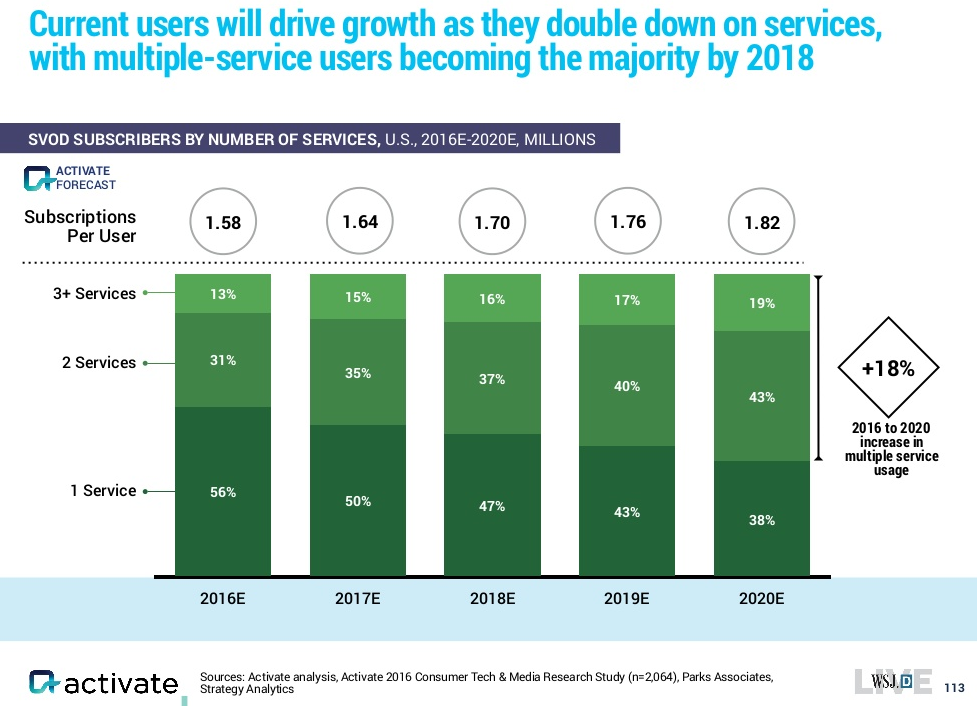

subscription video on demand, subscribers by number of services, 2016-2020, Activate

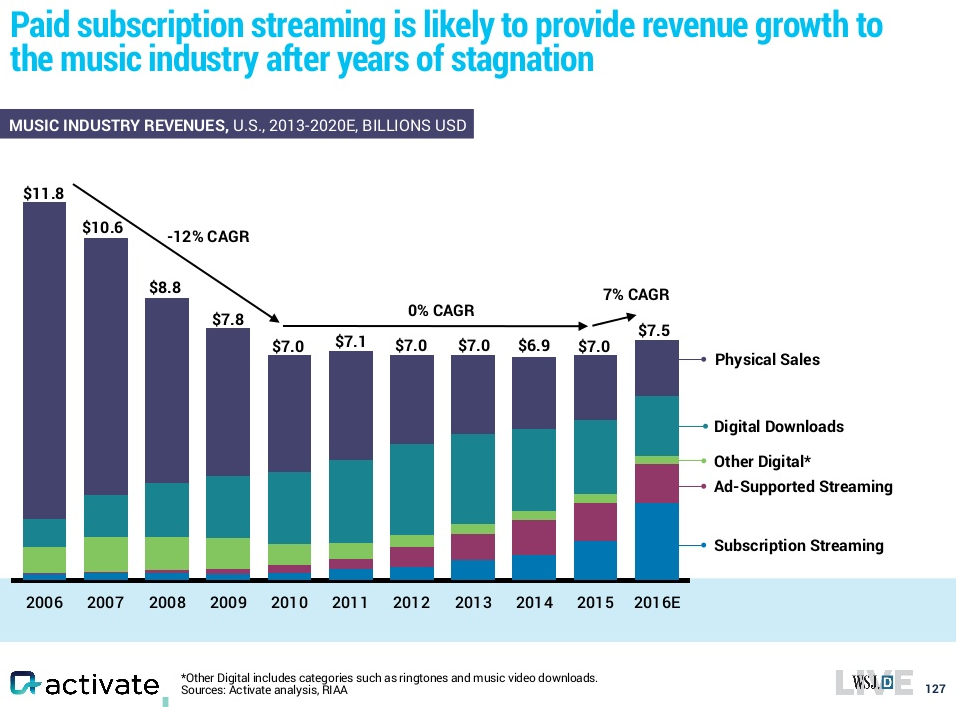

music revenues by sale type, $ and CAGR, 2006-2016, Activate

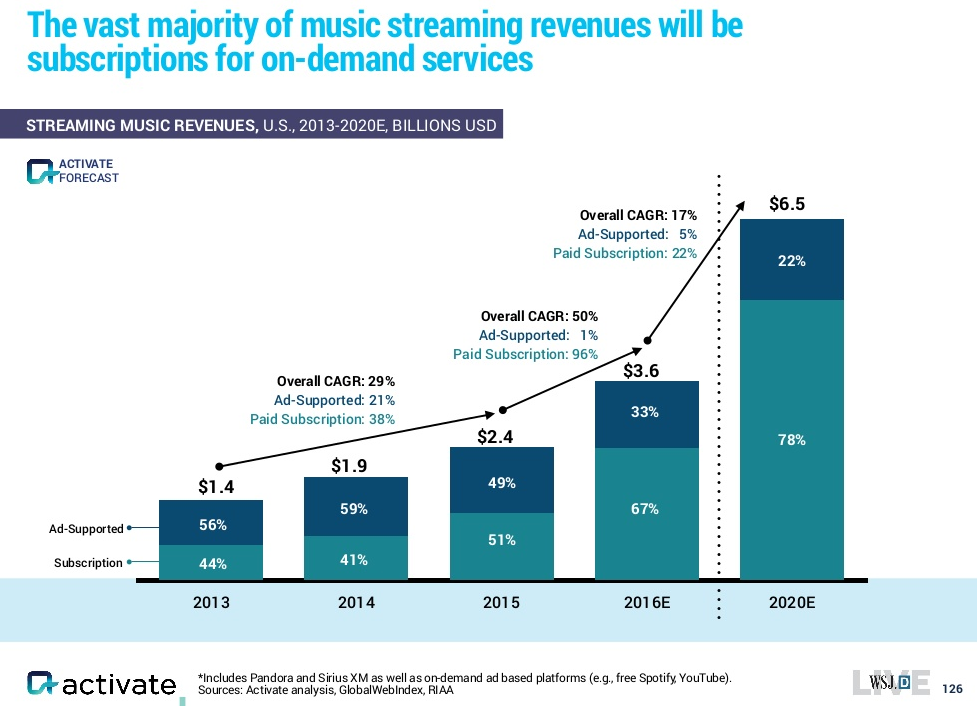

music streaming revenue, ads vs. paid subscriptions, 2013-2020, Activate

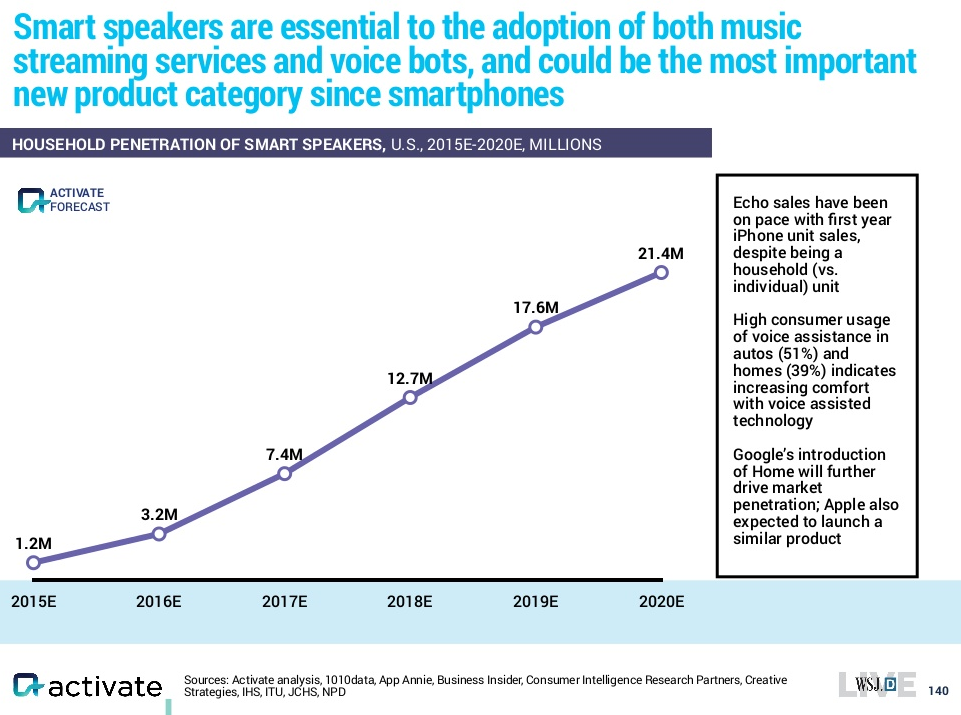

smart speakers household penetration, millions, 2015-2020, Activate

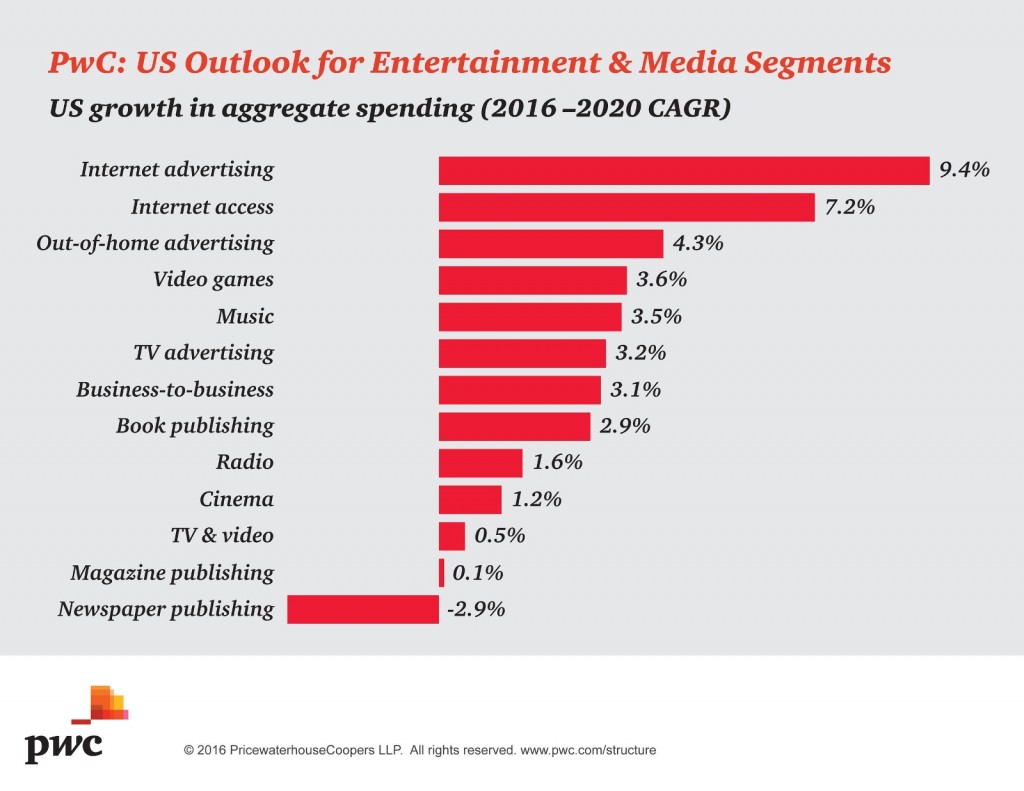

aggregate media spending CAGR, 2016-2020, Activate

internet advertising

internet access

out-of-home advertising

video games

music

tv advertising

business-to-business

book publishing

radio

cinema

tv & video

magazine publishing

newspaper publishing

internet users % of population, 2000-2014, ITU

broadband subscriptions, 2000-2015, ITU

wired-line vs. wireless users, 2000-2014, Activate

In addition to these data sets, I’ve also noted a large set of VR predictions by Jesse Schell.

Findings

General Media Consumption

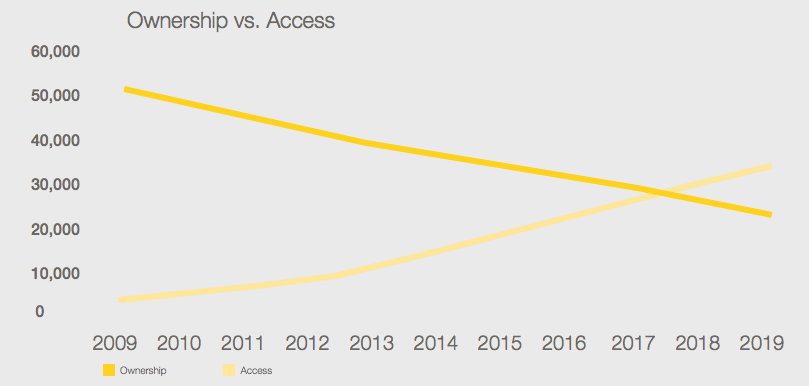

McKinsey publishes an annual global media spending/revenues report examining the last five years of historic data and forecasting trends for the next five years. The most recent report includes the following ownership vs. access chart:

Note: Ownership consists of home video physical sales, physical recorded music sales and recorded music digital downloads. Access consists of OTT digital

video, recorded music digital subscriptions and recorded music ad-supported digital streaming.

Src:

McKinsey&Company. July 2016.

“Global Media Report 2015: Global Industry Overview.” P.21.

Citing:

McKinsey & Company, Wilkofsky Gruen Associates

Older McKinsey reports are available, which offer some older, historic data points. For example, the 2014-2018 Outlook includes some historic data going back to 2013.

*

Zenith (part of Publicis Media) is a marking consulting firm. It’s annual, global survey (two years running), “Media Consumption Forecasts,” estimates recent, current, and near-term media consumption patterns. The current report forecasts general media consumption trends two years out, to 2018. The report estimates time spent reading newspapers and magazines, watching television, listening to the radio, visiting the cinema, using the internet, and viewing outdoor advertising while out of the home. 71 countries are covered, and regional estimates are available (although the freely available excerpts below are global).

Excerpts:

Total media consumption

2010-2015: +7.9% (driven by internet consump), avg +1.5% per year

2010: 403 min/day

2015: 435 min/day

2016: +1.4%

2017: +1.2%

2018: 448 min/day, +0.4% (mobile consump levels off)

Total internet consumption

2015: 110 min/day

2018: 31% global media consumption

Mobile internet consumption

2016: +27.7%, 86 min/day, accounting for 71% of internet consump

Overall media consumption

2016: +1.4%

All other media consumption (besides mobile internet)

2016: -3.4%

Desktop internet consumption

2010: 36 min/day

2014: 52 min/day

2016: 36 min/day

Traditional cinema consumption

2016: -0.5%

Traditional outdoor consumption

2016: -0.8%

Traditional television consumption

[declining, but still the most popular medium]

2015: 177 min/day, 41% of media consumption

2016: -1.5%

2018: 38% of media consumption

Traditional radio consumption

2016: -2.4%

Traditional newspapers consumption

2016: -5.6%

Traditional magazines consumption

2016: -6.7%

Note: [The traditional media] figures only refer to time spent with these media in their traditional forms – with printed publications and broadcast television channels and radio stations. Much of the time that consumers spend on the internet is devoted to consuming content that has been produced by traditional publishers and broadcasters.

Src:

Zenith. June 2016.

“Media Consumption Forecasts.”

Via:

Contact:

Jonathan Barnard, Head of Forecasting, jbarnard1@publicisgroupe.net

Tim Collison, Global Communications Director, tcolliso@publicisgroupe.net

*

eMarketer has been publishing short-term forecasts of general media consumption longer than Zenith. It’s latest forecasts to 2018 show similar trends, although the total time consumed estimates are quite different.

Excerpts:

While mobile devices enable people to consume media content anywhere at any time, the numbers suggest a saturation point is near—and that increased time spent with one medium will tend to come at the expense of time spent with another, as explored in a new eMarketer report, “US Time Spent with Media: eMarketer’s Updated Estimates for Spring 2016.”

Src:

eMarketer. June 2016.

“Growth in Time Spent with Media Is Slowing.”

*

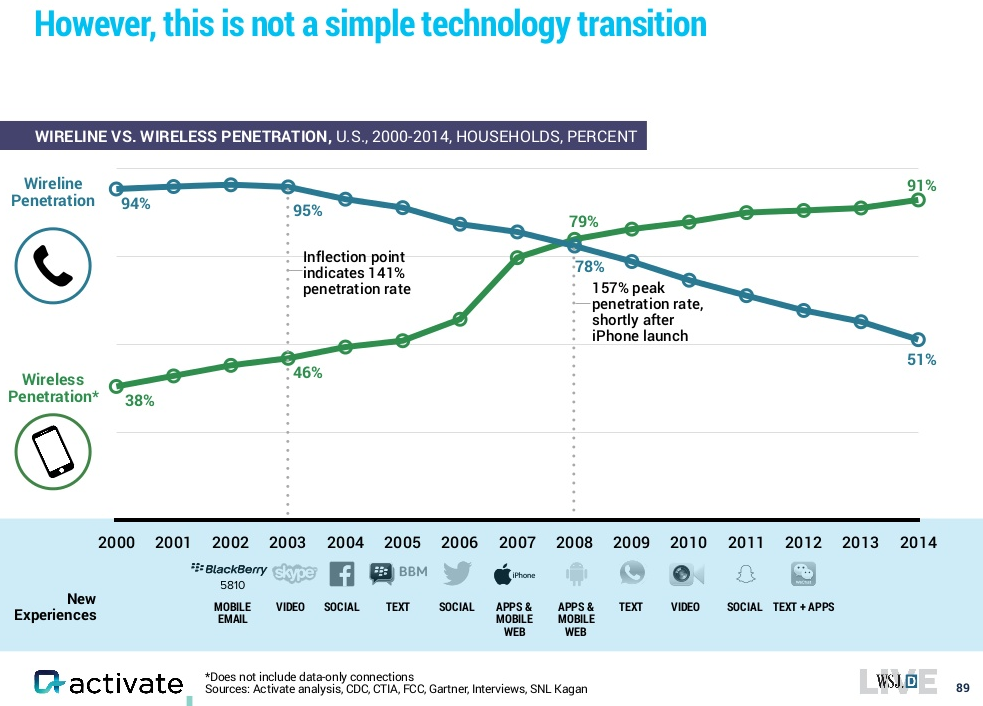

Technology strategist Michael Wolf, of Activate, recently presented a number of media forecasts at WSJDLive, The Wall Street Jounral’s global tech conference.

Here are excerpts:

Src:

Activate. October 2016.

“Tech and Media Outlook 2017.”

*

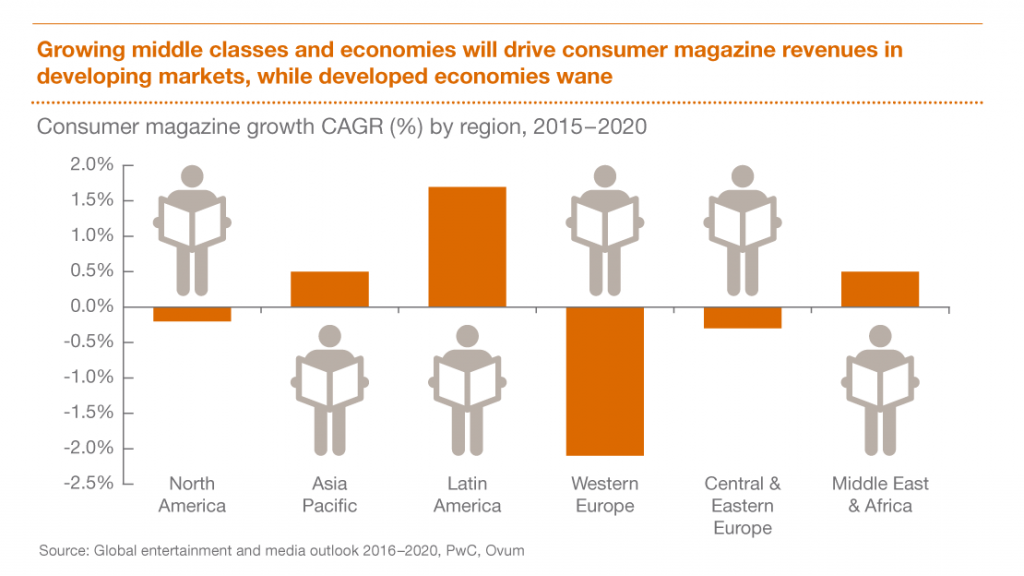

PwC produces an annual 5-year outlook for the entertainment and media industry which includes forecasts of consumer spending and advertising revenues.

Here are forecasts for US aggregate media spending for 2016-2020:

Src:

PRNewswire. June 2016.

“PwC’s Entertainment & Media Outlook Forecasts U.S. Industry Spending to Reach $720 Billion by 2020.”

citing:

PwC. June 2016.

“PwC Global Media and Entertainment Outlook: 2016-2020.”

*

PwC’s Chris Lederer, Partner, PwC’s Strategy&, Entertainment & Media practice, gave the following generalizations and examples from the latest report:

“At the highest level our annual Global entertainment and Media Outlook shows a mature media industry with slowing growth prospects.”

“The countries with large populations under 35 are faster growers than countries with larger aged populations,” Lederer observes.

More specifically, PwC’s analysis found that “on average, E&M spending in the 10 youngest markets is growing three times as rapidly as in the 10 oldest markets.”

2016 is the year when global Internet advertising revenue will surpass TV advertising

src:

Damian Radcliffe. August 2016.

“PwC’s global media outlook 2016-2020: six key trends.”

The Media Briefing.

***

Internet Users

ITU publishes an annual estimate of the percentage of internet users in each country.

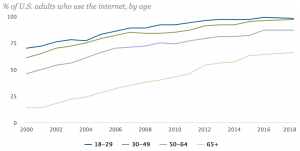

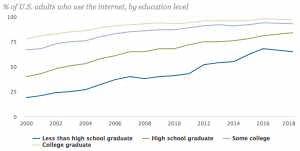

United States, 2000-2014

Src:

ITU. 2016.

“Percentage of Individuals using the Internet (excel).”

[ICT Statistics]

***

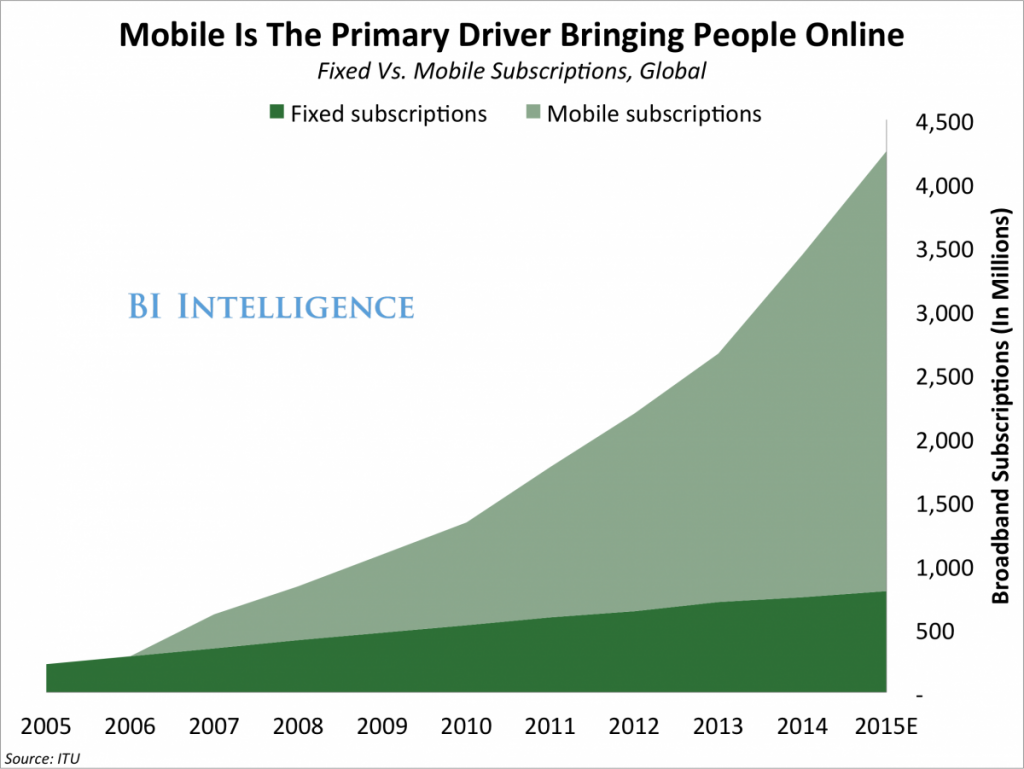

Broadband Subscriptions

Src:

Andrew Meola. Jun 2016.

“All media consumption is declining – with one exception.”

Business Insider.

Citing: ITU

ITU data is here:

Src:

ITU. 2016.

“Key ICT indicators for developed and developing countries and the world (totals and penetration rates).” [XLS]

[ICT Statistics]

***

Wired-Line Vs. Wireless Users

Src:

Activate. October 2016.

“Tech and Media Outlook 2017.”

***

VR Predictions

Game Designer Jesse Schell has made a large set of 40 (mostly) falsifiable predictions for VR, looking out as far as 2025.

Src:

Jesse Schell. March 2016.

“40 VR/AR Predictions – GDC 2016”

Tech Research Firms’ Annual Predictions

NYT’s Bits blog covered the recently released annual prediction reports from IDC, Gartner, and Forrester. IDC and Gartner’s reports include several 35 year predictions. Forrester’s report focuses on 2016, but reinforces the predictions of the other firms.

Although we’re generally after forecasts that address the everyday life of the average American, the forecasts in this set have broad economic and employment implications that certainly will affect a large number of people, and certainly the technology tools we use every day.

IDC’s report features several predictions for the 20182020 period, meant to provide guidance for business and industry strategists in the coming year. Here are a few excerpts via Bits as well as the original report:

•By 2018, corporations pursuing digital transformation strategies would “more than double the size of their software development teams.”

•By 2018, the number of Internet of Things devices will more than double, prompting the development of 200,000 new apps. By 2020, devices will triple and apps will exceed 250,000.

•By 2018, 65% of all IT assets used by companies will be housed offsite in collocation, hosting, and cloud data centers and one third of IT “staff” will actually be employees of organizations’ third party managed service providers.

•By 2020, more than 30 percent of today’s tech suppliers will “not exist as we know them today,” having been acquired or failed.

•By 2020, spending on cloud services and related hardware and software will be more than $500 billion, three times the current level.

•By 2020, providers of underlying cloud infrastructure will significantly consolidate,” with “six or fewer cloud platform vendors” holding 80 percent or so of the market. Probably Amazon, Microsoft, Google, Salesforce, IBM, Alibaba and Tencent.

•By 2020, over 70% of 3rd Platform IT spending will be driven by doing entirely new things, rather than on using new technologies to do traditional things in a new way.

•By 2020, 50% or more of e-commerce transactions will be enabled or influenced by Facebook and other regional social network leaders (e.g., Tencent’s Weibo in China).

•By 2020, one of the more frenetic IoT segments, wearables, will consolidate, as over half of today’s players will exit the market.

Gartner issued a similar set of predictions to 20182020, including the following:

•By 2018, 20 percent of business content will be authored by machines (eg: shareholder reports, legal documents, market reports, press releases, articles and white papers).

•By 2018, six billion connected things will be requesting support.

•By 2018, more than 3 million workers globally will be supervised by a “robo-boss.”

•By year-end 2018, 20 percent of smart buildings will have suffered from digital vandalism.

•By 2018, 45 percent of the fastest growing companies will have fewer employees than instances of smart machines (eg: fully automated supermarket, drone-only surveillance services).

•By year-end 2018, customer digital assistant will recognize individuals by face and voice across channels and partners.

•By 2018, two million employees will be required to wear health and fitness tracking devices as a condition of employment (eg: emergency responders, pro athletes, political leaders, airline pilots, industrial workers, remote field workers).

•By 2020, autonomous software agents outside of human control will participate in five percent of all economic transactions (eg: banking, insurance, markets, exchanges, crowdfunding).

•By 2020, smart agents (virtual personal assistants) will facilitate 40 percent of mobile interactions, and the post-app era will begin to dominate.

•Through 2020, 95 percent of cloud security failures will be the customer’s fault.

Forrester’s report only looks out as far as 2016, and doesn’t offer as many numeric predictions, but the concepts are similar. Excerpts:

•Leaders will understand and anticipate individual needs to deliver personalized experiences, sharply increasing their lead in the market.

•We will see extraordinary leadership disruption as companies adapt to a customer-led market.

•Leaders will invest in culture to accelerate both the pace of change and their speed of business.

•Cutting-edge algorithms will give leaders a leg up over competitors drowning in data and using run-of-the-mill analytical tools.

•Privacy will move from a niche consideration to a value to which customers will respond.

Sources

Steve Lohr. November 4, 2015. “Digital Transformation Going Mainstream in 2016, IDC Predicts”. Bits. New York Times.

Frank Gens. November 2015. “IDC FutureScape: Worldwide IT Industry 2016 Predictions — Leading Digital Transformation to Scale.” IDC #259850.

October 6. “Gartner Reveals Top Predictions for IT Organizations and Users for 2016 and Beyond.” Gartner.

October 2015. “The 2016 Top 10 Critical Success Factors To Determine Who Wins And Who Fails In The Age Of The Customer.” Forrester.